Why Is The Price of Solana (SOL) Higher Today?

2024-02-08 17:38:55

Despite experiencing a network outage earlier this week, Solana's price demonstrates resilience as it rebounds.

Source: thevrsoldier.com

Following the five-hour disruption on Feb. 6, concerns arose among investors regarding a potential significant sell-off. However, Solana is currently witnessing a price recovery, with the latest 24-hour period showing a gain of 1.04%. Remarkably, SOL traders seem largely undeterred by the incident, indicating a level of confidence in the cryptocurrency's stability. It raises the question of whether Solana's strength is solely a reflection of broader market trends or if there are underlying factors specifically driving the altcoin's price upward.

The Size of The Global Cryptocurrency Market Is $1.65 Trillion

On February 7, many leading cryptocurrencies were showing positive price movements, contributing to a 0.45% increase in the total crypto market capitalization, which reached $1.6 trillion, as reported by CoinMarketCap. Bitcoin maintained its stability above $43,000, while Ether experienced a gain of 1.25%, reaching $2,371 in trading value. The crypto market's potential bullish catalysts include the upcoming Bitcoin halving event, growing optimism surrounding the approval of spot Ethereum ETFs in May, and the anticipated Dencun upgrade on the Ethereum network.

Week Inputs Into Solana Securities Totaled $13.4 Million

CoinShares' recent report highlights a notable increase in institutional investor interest in investment products based on Solana (SOL). Surpassing its competitors in the layer 1 token category like Ether and Avalanche, SOL-based investment products witnessed a significant influx of $13.4 million in inflows. In contrast, Ethereum experienced outflows of $6.4 million, while Avalanche saw outflows of $1.3 million during the same period. This trend underscores a growing preference for SOL among institutional investors seeking exposure to layer 1 blockchain projects.

The report from CoinShares highlights a significant development in the cryptocurrency market, with an influx of $707.8 million into cryptocurrency products recorded last week. This surge has notably bolstered global assets under management, reaching a total of $53 billion. The growing institutional interest in SOL-based investment products signals a changing sentiment towards Layer-1 tokens, positioning Solana as a preferred option for investors seeking to broaden their crypto portfolios.

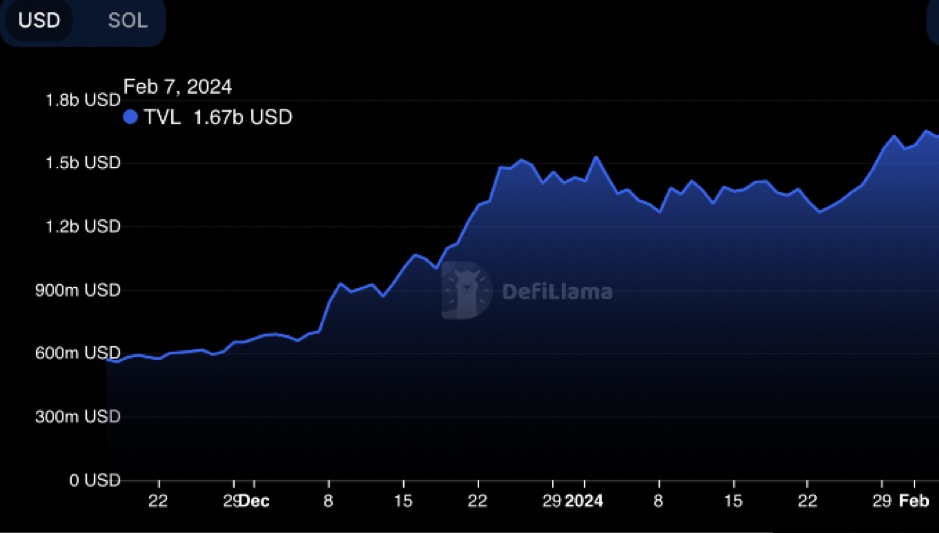

The Overall Value Lock Measure For Solana Shows The Activity of Traders

According to data from DefiLlama, Solana's Total Value Locked (TVL) surged to $1.65 billion as of February 7. Additionally, Solana's decentralized exchange (DEX) volume has maintained a strong position this week, with trading volumes reaching $6.25 million.

Solana total value locked by: DefiLlama

While Solana's DEX volume ranks second to Ethereum, which recorded $7.582 billion in volume over the same period, Solana's lower transaction costs continue to attract new users. Solana's transaction fees, as reported by Solscan, remain consistently low, ranging between $0.0001 and $0.0003. These minimal fees contrast sharply with the higher transaction costs typically associated with Ethereum, making Solana an appealing choice for users seeking cost-efficient transactions and exploring new airdrops.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.