FameEX Weekly Market Trend | October 10, 2024

2024-10-11 18:22:50

1. BTC Market Trend

From October 7 to October 10, the BTC spot price swung from $60,219.79 to $64,448.8, a 7.02% range.

In the last three days, important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On October 8, Fed’s Kashkari believed that the neutral rate is close to 3%. Moussalem indicated the likelihood of further rate cuts is high; his personal interest rate expectation is higher than the Fed’s median.

2) On October 8, Fed’s Kugler expressed his support for further rate cuts if inflation continues to ease.

3) On October 9, Fed Vice Chair Jefferson suggested that the risks to the Fed’s employment and inflation goals are currently nearly equal. When considering additional adjustments to the federal fund’s target range, he will assess new economic data and risk balance, making decisions on a meeting-by-meeting basis. Williams indicated that two more 25-basis-point rate cuts this year are a very good baseline scenario. Kugler said faster rate cuts may be necessary if downside risks to employment intensify. Atlanta Fed President Bostic revealed that the Fed must balance various competing risks when considering the pace of rate cuts in the coming months. If monthly job growth falls below 100,000, it will raise doubts about whether faster rate cuts should be considered. Boston Fed President Collins believed that policymakers should adopt a cautious, data-dependent approach when lowering rates to help maintain the strong momentum of the U.S. economy, with the 2% inflation target expected to be achieved by the end of next year. According to Logan, the economic outlook remains subject to “significant uncertainty”, and there is a notable risk that inflation could stay above 2%, favoring a “more gradual path” to return to normal rate levels. Fed meeting minutes showed that a sharp rate cut is not a signal of concern for the economy, nor is it an indication of rapid rate cuts.

4) On October 9, ECB Governing Council Member Villeroy indicated that a rate cut by the European Central Bank is “very likely”.

According to a report by Hong Kong’s Ming Pao, Dessislava Aubert, a senior research analyst at blockchain data company Kaiko, pointed out that since the end of September, the world’s largest USD-pegged stablecoin, USDT, has occasionally dropped below its basic exchange rate of 1 USD. Hashkey CEO Xiao Qi Ong stated that if traders are eager to convert funds back into fiat currency, it can be inferred that they are rushing to buy Chinese stocks. In addition to retail investors, some institutional investors are also increasing their holdings of Chinese stocks. Crypto hedge fund MNNC Group mentioned that some of its institutional investor clients are reallocating funds to Chinese stocks. On a leading crypto exchange platform, each USDT can be exchanged for between 6.78 and 6.98 Chinese yuan, while in the traditional currency market, the offshore yuan exchange rate against the dollar is around 7.09. Over the weekend, Goldman Sachs upgraded its investment rating of the Chinese stock market to “buy” and expects a 15% to 18% upside potential in Chinese stocks.

According to Coindesk, U.S. Delaware Bankruptcy Court Judge John Dorsey decided during a Monday hearing to approve FTX’s bankruptcy plan, which will fully repay cryptocurrency customers in cash with interest. Under the plan, 98% of creditors will receive at least 118% of their claim value in cash. FTX’s lawyer mentioned that they are still considering allocating stablecoins to creditors as an option and confirmed that they are in discussions with at least four companies to handle such distributions if necessary.

Following the news of the judge approving FTX’s bankruptcy plan, the price of FTT briefly surged past 3 USDT. FTX’s CEO announced that a professional agency will be hired to pursue debt recovery for global customers. K33 analysts noted that approximately $2.4 billion in compensation to FTX creditors could be reinjected into the cryptocurrency market.

According to Fortune, Elon Musk, in an interview with Tucker Carlson, stated that he is “fully committed” to supporting Donald Trump’s return to the White House and believes that if Trump loses to Kamala Harris in the November election, Musk himself could face serious consequences, including potential federal prosecution.

In the nearly two-hour interview, Musk admitted, “If he loses, I’m done. I’ve been attacking Kamala.” He said that if Harris wins, her political opponents might target the X platform (formerly Twitter), especially if the Democratic Party repeals Section 230, which would “immediately bankrupt X.”

Musk also claimed that he might face federal prosecution, though he believes any charges would be purely “legal warfare” with no substantial basis. He added, “They will try to sue the company, sue me.”

From October 10 to October 13, keep the sell orders for the ETH spot at $3,425 and $5,040, and the buy orders for bottom fishing at $1,730 and $2,040. For the BTC spot, keep the sell orders at $67,900, $79,870, and $96,820, and the buy orders for bottom fishing at $36,720 and $44,370. There is no need to cancel these orders.

2. CMC 7D Statistics Indicators

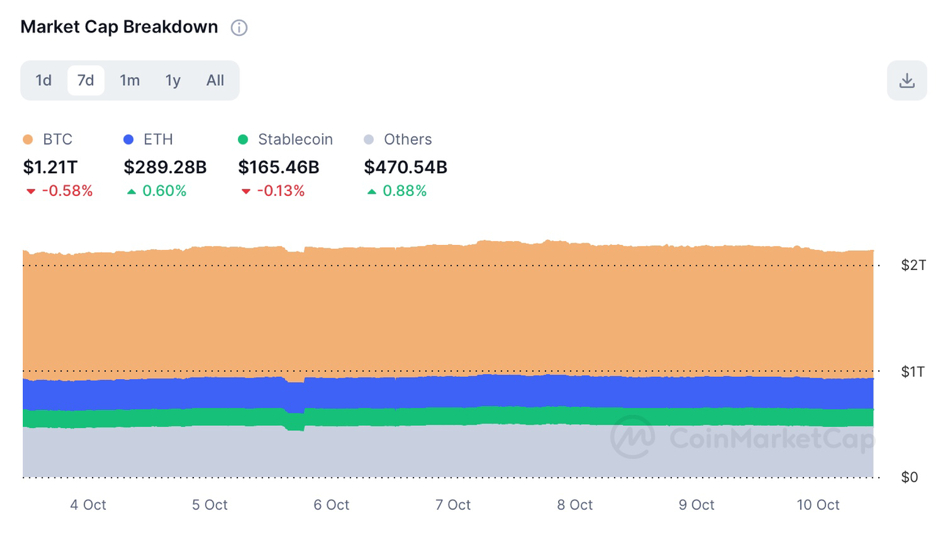

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

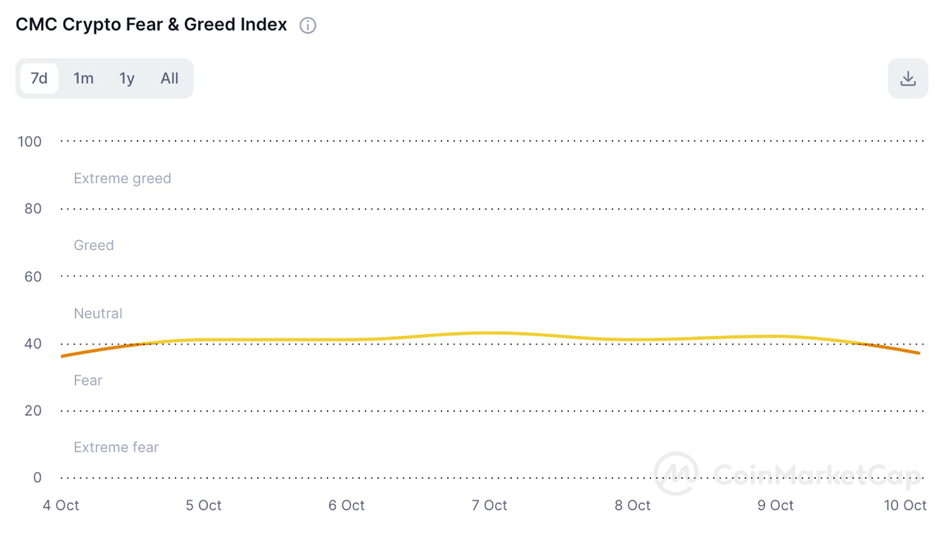

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

The 7-day cumulative funding rates for mainstream cryptocurrencies across major exchanges are generally positive, indicating that market consensus still views the current trend as a bull market.

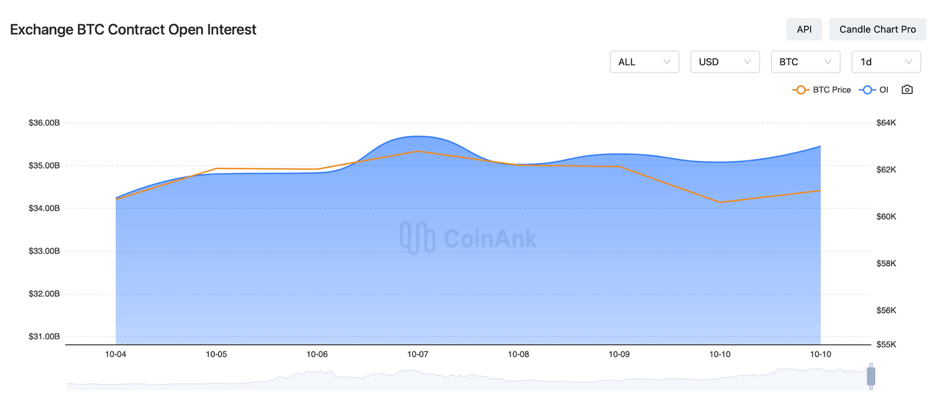

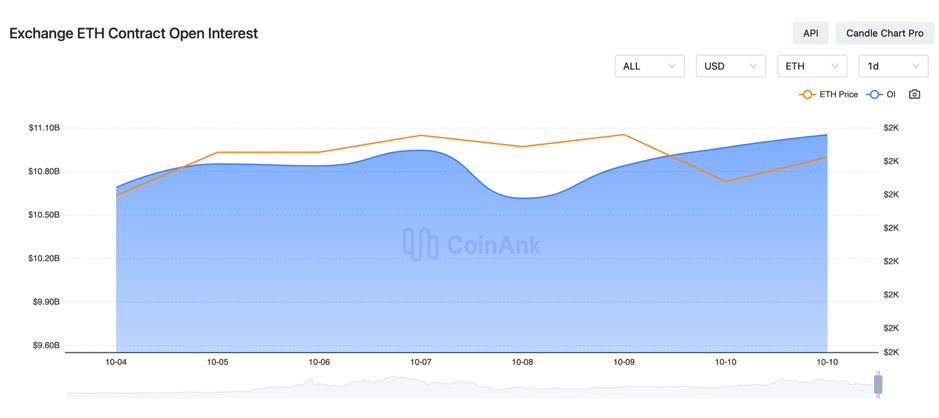

In the past three days, the open interest for BTC and ETH contracts hasn’t changed much.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) October 7: The U.S. SEC warned of the risks of cryptocurrency and emerging technology investment scams; the SEC supported the U.S. Supreme Court’s approval of a class action lawsuit accusing Nvidia of concealing crypto mining revenue; Crypto.com confirmed it had received a Wells Notice from the SEC and has filed a lawsuit against the SEC; U.S., U.K., and Australian law enforcement agencies jointly sanctioned key members of the Evil Corp organization.

2) On October 7, Hong Kong SFC CEO Julia Leung stated that 11 virtual asset platforms expected to receive licenses will be licensed in batches by the end of the year; she also said that completing the entire framework related to virtual assets would take at least until next year.

3) On October 7, the U.S. Department of Justice seized nearly $2.7 million in cryptocurrency linked to the North Korean hacker group Lazarus Group; the U.S. government filed a complaint seeking to confiscate assets from the group; the Department of Justice indicted 18 individuals and companies for widespread cryptocurrency fraud and market manipulation.

4) On October 7, 21Shares called on the European Securities and Markets Authority (ESMA) to unify cryptocurrency ETF regulations.

5) On October 7, the total settlement amount between crypto companies and U.S. regulators reached $32 billion; the U.S. Supreme Court declined to hear the Silk Road appeal case, and 69,370 BTC could be auctioned off; the Mayor of Rockdale, Texas, said Bitcoin mining has helped revitalize the local economy.

6) On October 7, the U.S. Department of Homeland Security thwarted over 500 crypto ransom attacks and seized $4.3 billion in cryptocurrency over the past three years; the U.S. HC3 reported that ransomware group Trinity has stolen sensitive data from healthcare organizations and demanded cryptocurrency ransoms; cryptocurrency promoted by rapper Cardi B has been traced back to a scam.

7) On October 7, New York Digital Investment Group (NYDIG) stated that despite a “seasonal slowdown” in Q3, Bitcoin remains the best-performing asset so far this year.

8) On October 8, a Matrixport report projected global cryptocurrency adoption to exceed 8% by 2025; a UN agency suggested that Southeast Asia criminalize unlicensed Virtual Asset Service Providers (VASPs) to combat online fraud.

9) On October 8, the Atlanta Fed’s GDPNow model raised its forecast for the U.S. Q3 GDP growth to 3.2%, up from a previous estimate of 2.5%.

10) On October 8, Bitcoin financial services company Fold submitted its S-4 filing, preparing for a Nasdaq listing.

11) On October 8, Elon Musk’s America PAC will offer a $47 reward to those who recommend signing petitions in swing states.

12) On October 8, top trader Eugene, after criticizing the declining quality of crypto content on X, listed what he considers high-quality crypto Twitter accounts, including Cold Blooded Shiller, Mercury, and huss.

13) On October 8, a Russian investigator was sentenced to 16 years in prison for accepting 1,032 BTC in bribes from hackers; over 20,000 investors were defrauded in an Argentine crypto scam project, with the first lawsuits to be filed this week; Irish police have yet to crack a drug dealer’s crypto wallet after four years, with the seized Bitcoin’s value soaring from $56 million to $378 million.

14) On October 8, a major crypto exchange requested FalconX to return 1.35 million SOL assets; crypto investment firm Canary Capital submitted a spot XRP ETF application to the SEC; VanEck launched a $30 million venture fund to support crypto and AI.

15) On October 8, Telegram’s founder announced that 10 new app features, including gifts and stickers, were launched in a single day; Midas, a physical asset platform, received European regulatory approval to open tokenized U.S. Treasury products to retail investors.

16) On October 8, it was reported that WeChat search now supports real-time Bitcoin prices; Google search has integrated ENS, allowing users to search for .eth domains and check balances; Samsung Pay integrated Alchemy Pay’s virtual card, enabling users to pay directly with cryptocurrency.

17) On October 8, a leaked HBO documentary video suggested Peter Todd may be Satoshi Nakamoto; Ethereum maintained a 45% market share in competition with Solana and Aptos.

18) On October 8, South Korean lawmakers called for a special investigation into the KOK cryptocurrency scam during a National Assembly audit; South Korea’s military disclosed 29 cases of crypto-related classified document leaks; South Korea plans to regulate cross-border stablecoin transactions.

19) On October 9, the Governor of India’s Central Bank said the Monetary Policy Committee had adjusted its policy stance to neutral; the National Bank of Bahrain launched the first Bitcoin-linked structured investment product.

20) On October 9, China’s financial regulators issued window guidance, strictly prohibiting bank credit funds from being illegally invested in the stock market; the People’s Bank of China refuted rumors about distributing digital asset dividends in digital yuan and warned the public to be wary of false information.

21) On October 9, the Chief Intelligence Officer of the UK’s MI5 revealed that since January 2022, the UK has thwarted 20 potentially deadly plots supported by Iran; North Korea’s military announced that it will completely cut off rail and road connections with South Korea starting from October 9.

22) On October 9, Japan’s Financial Services Agency excluded non-custodial wallet service providers from the crypto asset trading industry; Japan’s largest telecom company, NTT Digital, officially joined Injective as its latest validator. NTT, one of the world’s largest Fortune 500 companies, chose Injective as its key blockchain partner for expansion into Web3.

23) On October 9, according to tradesparadise.news, the UAE announced the cancellation of all crypto trading taxes, taking a significant step towards becoming a global crypto hub.

24) On October 9, it was reported that Taiwan’s Financial Supervisory Commission would launch a virtual asset custody business; Brazilian crypto giants teamed up to launch a stablecoin pegged to the Brazilian real; U.S. bank State Street is working on the tokenization of bond and money market funds.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.