FameEX Weekly Market Trend | June 24, 2024

2024-06-24 19:14:05

1. BTC Market Trend

From June 20 to June 23, the BTC price swung from $63,394.87 to $66,488.99, with a volatility of approximately 4.88%. The following are important recent statements from the Federal Reserve (Fed):

1) On June 21, Richmond Fed President Barkin stated that the Fed needs further clarity on the inflation path before it can cut rates.

2) On June 20, Fed President Kashkari mentioned that it might take one or two years to bring inflation back to 2%. He added that rate cuts could be considered if more positive inflation reports are seen.

3) On June 22, former Fed hawk Bullard said that while inflation data has sparked hopes for a rate cut in September, the pace of policy easing would still be slow.

In a blog post, BitMEX co-founder Arthur Hayes analyzed the recent announcement by Japan’s fifth-largest bank, Norinchukin Bank, to sell $63 billion worth of US and European bonds. Hayes suggested that this could lead other Japanese banks to follow suit, potentially selling up to $450 billion in US Treasuries. He noted that the sharp increase in the US-Japan interest rate differential has significantly raised the forex hedging costs of holding US bonds, leading to losses. During an election year, US Treasury Secretary Yellen might ask the Bank of Japan to use the Fed’s FIMA repo facility to absorb these sold bonds to prevent a sharp rise in Treasury yields and subsequent market turbulence. Hayes argued that if the Fed prints money on a large scale to repurchase the sold US bonds, it would inject new liquidity into the cryptocurrency market, potentially sparking a new bull market. He asserted that to maintain the current dollar-based financial system, the supply of dollars must increase, which would undoubtedly boost the prices of crypto assets, including Bitcoin.

On June 22, a well-known crypto co-founder wrote that the market rally in 2024 will be driven by the BTC ETF, with smart money flowing into high-profile projects and “yield farming” studios. These entities create impressive data, allowing project teams to raise more funds from venture capitalists. High-quality projects are receiving substantial valuations from large-scale VCs. Projects with strong financial backing and user bases are confident, leveraging various platforms for success. While trading platforms don’t control pricing, investors should focus on fundamentals and circulating supply rather than just market cap. The current market, with its professional players and advanced risk-hedging tools, is far different from previous cycles. The strategies that worked in 2017’s ICOs, 2021’s IEOs, or even 2023’s yield farming may no longer be suitable. Each cycle sees a few projects succeed through the bull and bear phases, while many high-profile projects fail. Success in both Web2 and Web3 ventures is rare, with only a few projects crossing the chasm and enduring through cycles.

On June 23, famous rapper Curtis James Jackson III, known as “50 Cent”, claimed that his X (formerly Twitter) account and website were hacked. The hacker launched a memecoin called GUNIT and used 50 Cent’s X account to promote it, luring fans to drive up the price. Eventually, the hacker stole $3 million from victims before executing a rug pull. 50 Cent stated that X quickly froze his account and that he had no connection to this cryptocurrency.

On June 25, the European Union will begin accession talks with Ukraine and Moldova.

From June 24 to June 26, the spot price of BTC might continue to decline along with the overall trend of global major assets. During this period, it is important to watch for short-term buying opportunities. Sell orders for ETH are set at $4,700, with buy orders for bargain hunting at $2,500. There is no need to cancel these orders. In the BTC spot market, sell orders at $72,500 and $77,500 are unlikely to be filled in these three days, but do not cancel them. This is to avoid missing out on selling opportunities in case of sudden positive news.

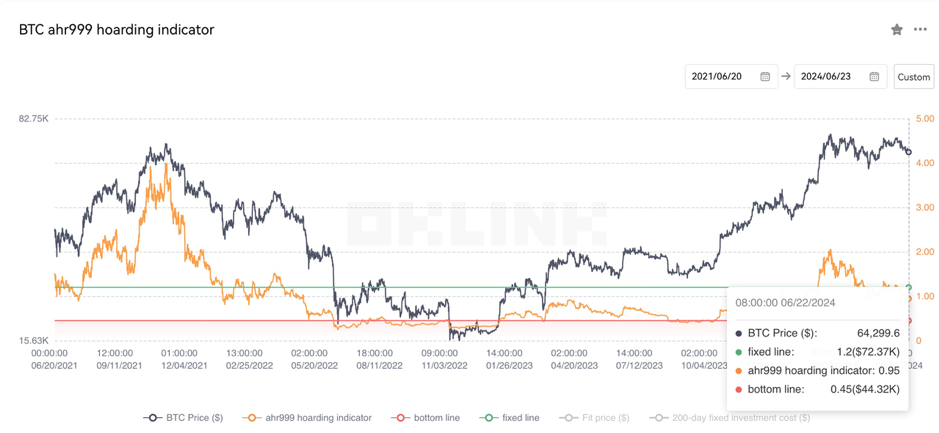

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 0.95, which is below the DCA level ($72,370) but above the buy-the-dip level ($44,320). Therefore, it is advisable to continue dollar-cost averaging into top cryptocurrencies.

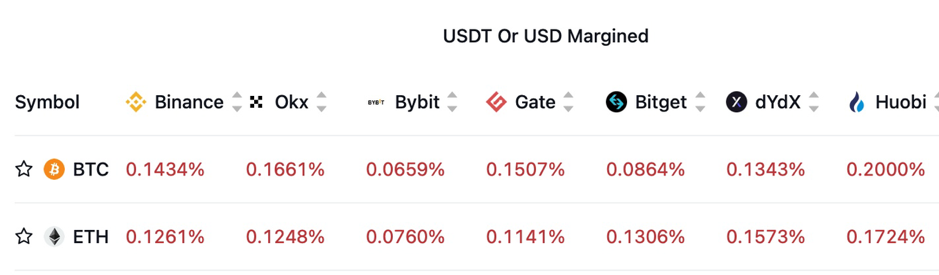

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

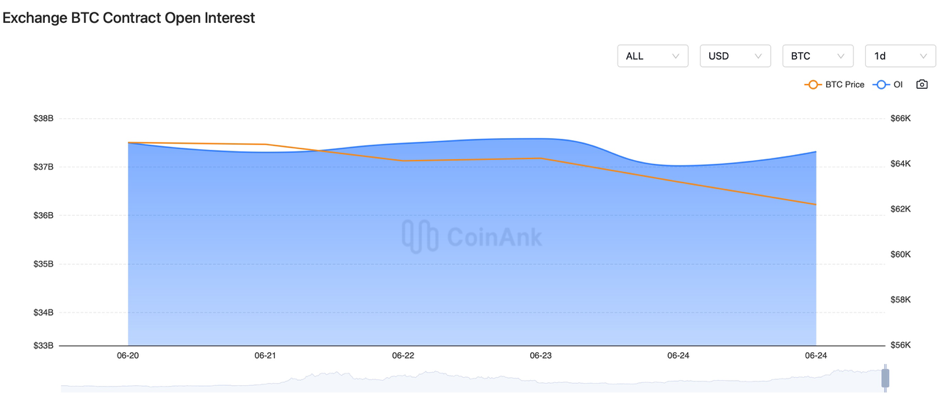

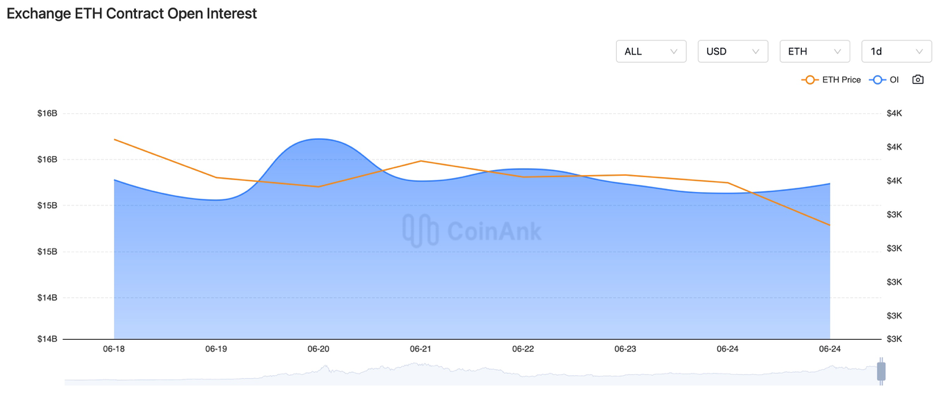

Recently, the BTC contract open interest has been gradually increasing, while the ETH contract open interest has been decreasing.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On June 20, the Bank of England held the benchmark interest rate steady at 5.25% for the seventh consecutive time, in line with market expectations.

2) On June 20, a Bitcoin spot ETF was listed for the first time on Australia’s main stock market.

3) On June 20, data showed that over 60% of the incremental trading volume on DEXs in May occurred on the Solana blockchain.

4) On June 20, initial jobless claims in the US for the week ending June 15 were 238,000, slightly higher than the expected 235,000 and down from the previous 242,000.

5) On June 20, South Korean crypto finance company Delio, accused of misappropriating $180 million in crypto assets, would establish a new company and transfer its debt.

6) On June 20, PwC predicted that FTX customers could receive 119 to 143 cents on the dollar for their claims.

7) On June 20, Singapore classified digital payment tokens as a high-risk category for anti-money laundering.

8) On June 21, a Bank of America report revealed that young affluent individuals prefer cryptocurrencies and alternative investments.

9) On June 21, Kraken’s Chief Strategy Officer stated that white-hat hackers had stolen millions in crypto. The company was coordinating with law enforcement to recover the funds.

10) On June 21, Bitwise CIO noted that a properly diversified portfolio of BTC and ETH could yield higher returns and lower downside volatility compared to investing in Bitcoin alone.

11) On June 21, US presidential candidate Robert F. Kennedy Jr. announced he would speak at the Bitcoin 2024 conference and promised to release Silk Road founder Ross Ulbricht if elected.

12) On June 21, Thailand formally applied to join BRICS.

13) On June 21, Italy announced it would enhance surveillance of the cryptocurrency market, with fines of up to €5 million.

14) On June 21, ConsenSys urged the IRS to delay its cryptocurrency reporting requirements due to heavy compliance burdens.

15) On June 21, South Korea’s Ministry of Strategy and Finance reassessed its plan to tax virtual assets starting January next year.

16) On June 22, the US crypto political action committee Fairshake raised $160 million by the end of May.

17) On June 22, the US Treasury reported that Mexican criminal organizations are using BTC, ETH, and USDT for drug transactions.

18) On June 22, sources indicated that the US CFTC was investigating Jump Crypto; the FBI charged the FIN9 crypto network group.

19) On June 22, Dubai’s DFSA was studying a three-year digital asset plan by the UK Law Commission, planning to develop two sets of digital asset regulations and an innovation testing license.

20) On June 22, the founder of CryptoQuant stated that BTC fundamentals could support a market cap three times higher than the current cycle peak.

21) On June 23, the US closed Russia’s visa centers in Washington and New York, while Japan announced a new round of sanctions against Russia, which promised to respond.

22) On June 23, the South African Revenue Service was reviewing tax filings by crypto traders for potential historical violations.

23) On June 23, the US Federal Accounting Standards Advisory Board classified seized cryptocurrencies as “non-monetary assets”.

24) On June 23, Taiwan planned to introduce new rules for fintech and virtual assets.

25) On June 23, CoinStats was hacked, affecting 1,590 crypto wallets and prompting users to transfer their funds immediately.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.