FameEX Weekly Market Trend | May 6, 2024

2024-05-06 18:10:10

1. BTC Market Trend

From May 2 to May 5, the BTC price swung from $56,229.34 to $64,541.88, a 14.78% range. The US economic data released on May 3, coupled with the weakening dollar, drove attention. April witnessed a greater-than-expected job growth slowdown and wage cooling. Despite this, it’s premature to expect the Fed to cut interest rates before September due to the still tight job market. The Bureau of Labor Statistics reported a rise of 175,000 nonfarm payroll jobs last month. March’s data was revised up to show 315,000 new jobs, up from the previously reported 303,000. The unemployment rate rose from 3.8% to 3.9%, staying below 4% for the 27th consecutive month. April’s wage growth was 3.9% year-on-year, lower than March's 4.1%. Wage growth between 3.0% and 3.5% aligns with the Fed’s 2% inflation target. The slowdown in job numbers raises concerns about the economy losing momentum in Q2. Financial markets expect the Fed to begin its easing cycle in September.

From May 2 to May 5, the BTC spot daily candlestick chart is gradually decreasing in volume. On May 4, a US investment report revealed that hundreds of American banks face the risk of collapse in a high-interest-rate environment. Additionally, President Biden’s proposal for a high long-term capital gains tax has been a looming threat pending congressional approval.

As the US dollar weakens, it is expected to continue favorably impacting the short-term trends of cryptocurrencies. From May 6 to May 8, it is advisable to maintain a wait-and-see approach with existing positions. Consider appropriate additions during significant downturns. For those with relatively low total positions, there’s no need to cancel BTC spot buy orders at $52,800.

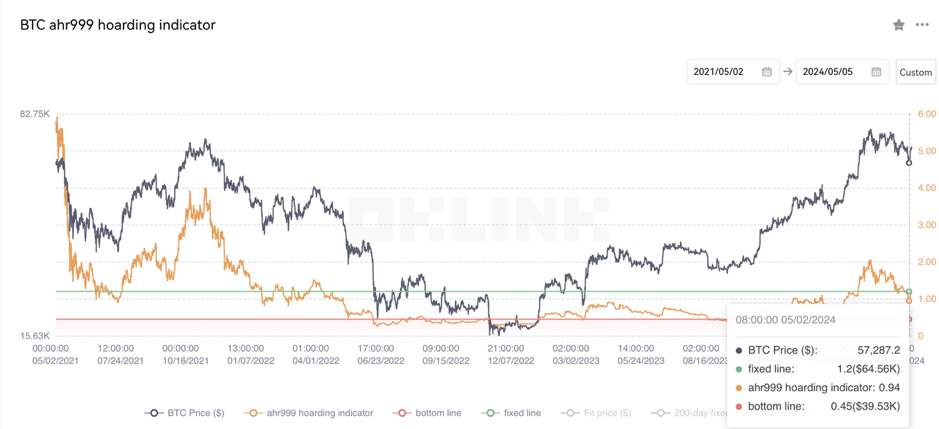

The Bitcoin Ahr999 index of 1.02 is below the DCA level ($64,740) but over the buy-the-dip level ($39,650). Therefore, it may be a good time to put the dollar-cost average into mainstream cryptocurrencies.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

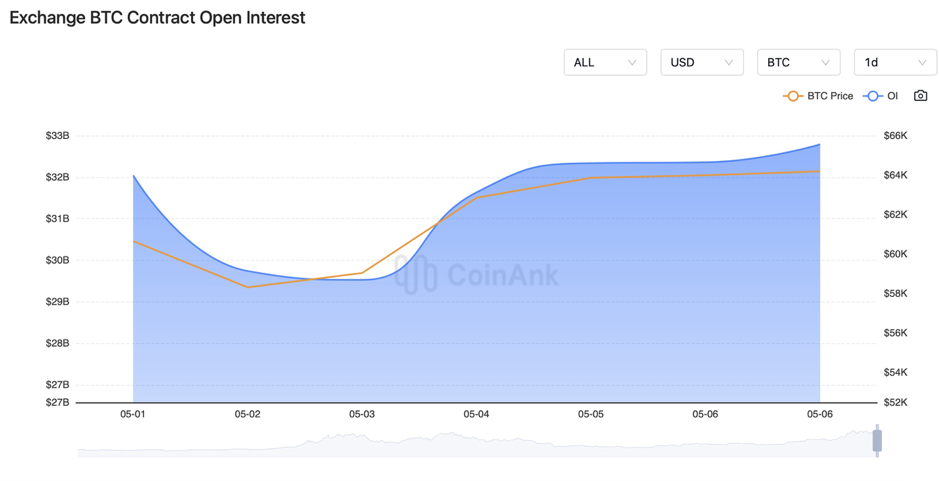

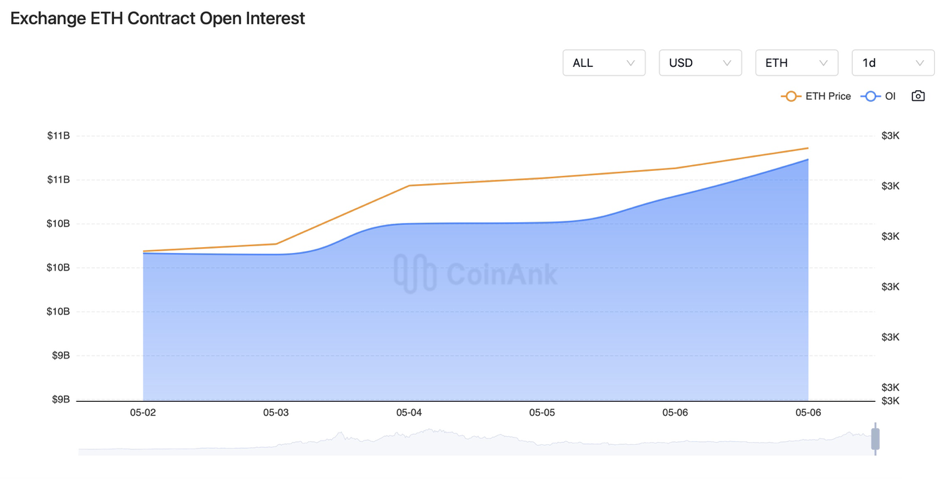

In the recent period, a slow rise has occurred in both BTC contract open interest.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On May 2, the Fed kept interest rates unchanged at its May meeting, acknowledging recent inflation challenges and announcing plans to slow down tapering starting in June.

2) On May 2, ECB board member Stournaras stated that the European Central Bank is more likely to cut interest rates three times in 2024.

3) On May 2, US legislators introduced a Tax Transparency Act for digital assets.

4) On May 3, US April nonfarm data recorded the smallest increase in six months, well below market expectations, with the unemployment rate rising to 3.9%.

5) On May 3, US lawmakers urged the SEC to approve options based on Bitcoin spot ETFs.

6) On May 3, Dogechain Wallet announced its closure on June 1, advising users to withdraw their DOGE tokens promptly.

7) On May 3, Onyx announced that users affected by the previous attack can now claim compensation.

8) On May 4, Galaxy Research reported that Q1 total financing in the crypto sector reached $2.49 billion, a 29% increase compared to the previous period.

9) On May 4, a report revealed that in a high-interest-rate environment, hundreds of US banks face the risk of collapse.

10) On May 4, Tesla’s website announced the addition of Dogecoin as a payment method.

11) On May 4, the SEC delayed its decision on 7RCC spot Bitcoin and carbon credit futures ETFs.

12) On May 5, the Fed reduced its balance sheet by $77 billion in April, bringing its total assets to $7.362 trillion.

13) On May 5, according to data, MAVIA, HFT, GLMR, and EUL would undergo unlocking this week.

14) On May 5, over $4 billion was injected into startups through cryptocurrency venture capital investments this year.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.