FameEX Weekly Market Trend | December 14, 2023

2023-12-14 19:18:11

1. Market Trend

From Dec. 11 to Dec. 13, the BTC price swung from $40,222.00 to $44,046.00, with a volatility of 9.50%. The last analysis mentioned that in the coming week, there would be important events such as interest rate decisions by multiple central banks, including the Fed. Negative news could trigger panic selling in the bull market, leading to significant volatility, as seen in historical patterns. Despite this, the recovery tends to be swift. Hence, setting stop-loss orders should coincide with opening positions. Recent BTC trends precisely mirrored scenarios from the prior analysis. On Dec. 11 morning, BTC rapidly broke through psychological barriers at $43,000, $42,000, and $41,000, reaching a low of $40,400 within an hour, exhibiting a rapid, stampede-like decline. It also fell below the upward trend line and breached MA25 and MA99 within one hour, later oscillating around $42,000 after a rebound, showing a slightly insufficient upward momentum. On Dec. 12, BTC retested the low, reaching a new low of $40,222 before recovering to hover around $42,000. On Dec. 13, it dropped below $41,000 again, hitting a low of $40,555 but did not establish a new low, rebounding for the third time to $42,000.

Analyzing BTC’s trend over the past three days suggests that the recent panic selling may have concluded, forming a pattern of three bottom tests. The strength and speed of the recovery are promising. In theory, investors can maintain long positions, setting a stop-loss at $40,500. However, a breach below this level could signal an extremely risky market situation. Looking at the 4-hour chart, the declines over these three days have not caused any damage to the upward trend, simultaneously confirming the support strength of the MA99 (4-hour level). It is expected to break through the previous high points without surprises. For those not in the market, consider entering near $42,500, and for those who have entered, set a stop-loss at $40,500. Follow the market’s lead, adhering to the strategy of holding positions, awaiting an upward trend, and aligning with the broader market flow.

Source: BTCUSDT | Binance Spot

Between Dec. 11 and Dec. 13, the price of ETH/BTC fluctuated within a range of 0.05252-0.05431, showing a 3.41% fluctuation. The ETH/BTC pair has shown relatively mild fluctuations in the past few days, with overall stability and no significant structural changes. As mentioned earlier, it was suggested to consider entering long positions in the range of 0.05200 to 0.05250. Since this level has not been reached yet, it is advisable to continue waiting for its attainment. If there is a breakthrough above 0.05350, traders can consider attempting to chase the upward movement.

Based on overall analysis, the current market sentiment has cooled down, with BTC experiencing a continuous 3-day decline. The initial stampede-like drop undermined bull confidence, but the following 2-day decline indirectly confirmed the effectiveness of the established low point, serving as a precise exit. Following the three-day market pullback (defined by the absence of structural trend disruption), Bitcoin’s Meme Tokens like ORDI, RATS, and SATS gained popularity. Investors can explore other sectors within the Meme Token series for potential breakouts. The overall market trend remains upward, even with short-term corrective trends. It is advisable to adopt a cautious approach without going short, holding positions and awaiting upward movements.

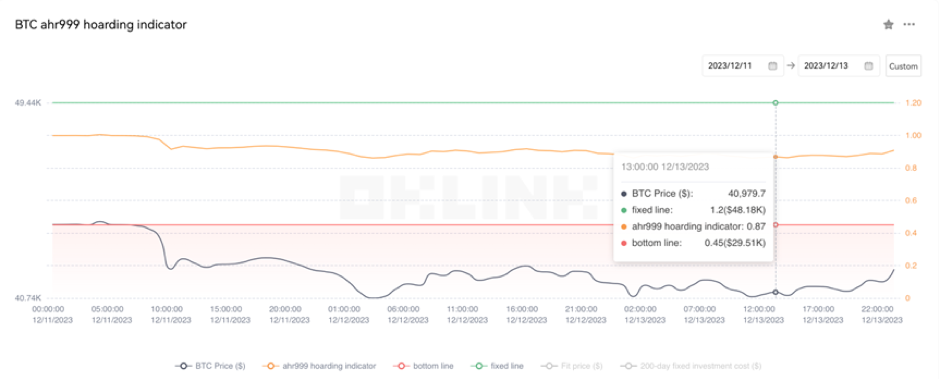

The Bitcoin Ahr999 index of 0.87 is between the buy-the-dip level ($29,510) and the DCA level ($48,180). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

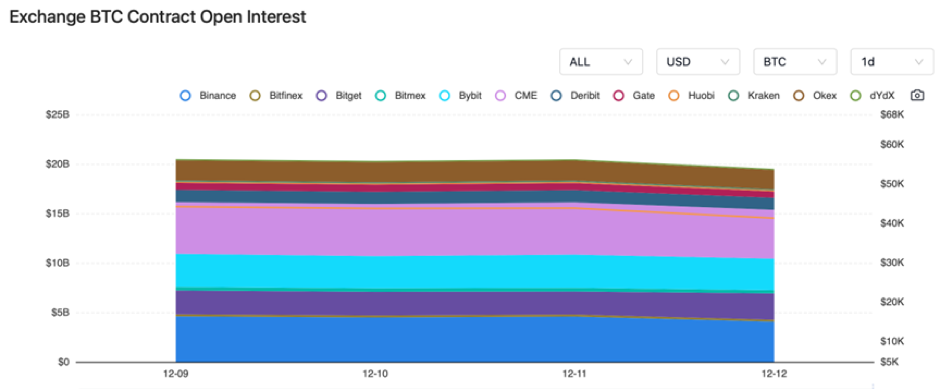

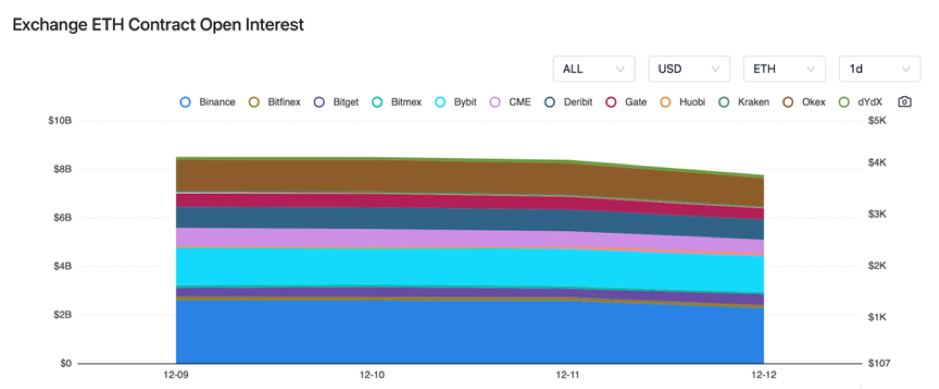

The BTC contract open interest remained unchanged, while the ETH contract open interest underwent a slight decline. Exchange BTC Contract Open Interest: Exchange ETH Contract Open Interest: 1) On December 11, this week’s important events include rate decisions from various central banks, including the Federal Reserve, and Binance is set to conclude its support for BUSD. 2) On December 11, the South Korean regulatory body, FSC, declared that NFTs are not subject to cryptocurrency regulations. 3) On December 11, China Telecom applied for a blockchain patent to enhance the overall security of its system. 4) On December 11, Tether froze 161 addresses, with only 11 holding a total of over 3.5 million USDT. 5) On December 12, El Salvador’s volcano bonds would be launched in the first quarter of 2024. 6) On December 12, the U.S. Internal Revenue Service (IRS) noted that the amount of unpaid taxes by FTX is still under audit. 7) On December 12, He Yi announced that Binance’s Web3 wallet would increase investments in the Meme Token sector. 8) On December 13, the Chairman of the U.S. Commodity Futures Trading Commission (CFTC) stated that, according to current laws, many tokens constitute commodities. 9) On December 13, Line Next announced securing $140 million in funding. 10) On December 13, Coinbase added BONK to its listing roadmap. Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.

3. Industry Roundup