FameEX Weekly Market Trend | November 6, 2023

2023-11-06 19:23:05

1. Market Trend

From Nov. 3 to Nov. 5, the BTC price swung from $34,120.00 to $35,380.99, with a volatility of 3.69%. The prior market analysis notes consistent fluctuations around $34,000 in BTC’s price since October 29 without presenting the second type of fluctuation pattern (a deep retracement followed by a return to the starting point), displaying three instances near this mark at $34,074, $34,097, and $34,120. This implies a likelihood of an eventual market rise after these fluctuations, with a lower chance of a significant retracement before an upward movement. Investors who haven’t entered the market yet can make staggered purchases between $33,800 and $34,500 (setting a stop-loss at $33,500, but staggered purchases should be made between $30,000 and $31,000; the specific logic and operation of this method can be found in the previous report). Meanwhile, existing investors should hold their positions, avoiding intricate operations and waiting for the market to rise. In the current bullish phase, it’s not advisable to be bearish easily. It’s best to steer clear of short-term bearish trading to prevent financial losses and maintain a clear mindset. Patience is key in a potential future bull market – holding assets and avoiding short-term strategies can lead to greater benefits by disregarding normal fluctuations.

Source: BTCUSDT | Binance Spot

Between Nov. 3 and Nov. 5, the price of ETH/BTC fluctuated within a range of 0.05153-0.05434, showing a 5.45% fluctuation. Recently, there have been signs of a possible bottom for ETH/BTC, showing a stabilizing trend in its price. On the daily chart, the price has reached the critical 25-day MA (where it has been suppressed for over a month), potentially poised to break above this average in the near term. However, the trading volume for ETH/BTC has not significantly increased at this point, even generally lower than the volume during the previous decline. This indicates a hesitant signal for a price rise. For such assets just emerging from a downtrend, entering into trading should involve setting tight stop-loss points due to the high risk. In the current market environment where there are numerous options available, it might be advisable to refrain from engaging in ETH/BTC for now. Waiting for a clearer market trend before deciding whether to participate would be prudent.

Based on overall analysis, the main theme of the current market remains a period of oscillation, with the lows in this oscillation trend getting progressively higher, which is a positive signal. The primary reason for the current market stagnation is the significant surge between $31,000 and $33,000 in the previous period, resulting in a clear overbought situation that needs to be absorbed through consolidation. Furthermore, in previous bull markets, each upward movement has occurred in a step-like pattern, which is consistent with the current scenario. Hence, it’s advisable not to be overly bearish. Presently, there are numerous assets available in the market for potential accumulation. Examples include mainstay assets like ETH, which tends to exhibit robust performance in the later stages, as well as DOGE within the MEME coin category, both of which are currently worth considering for potential accumulation.

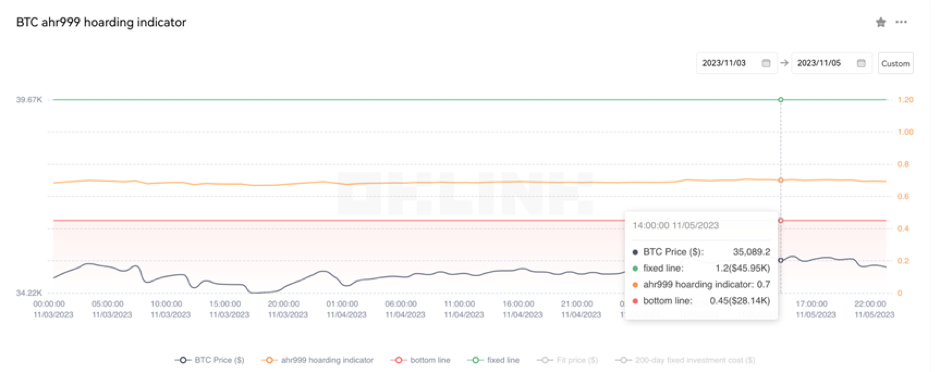

The Bitcoin Ahr999 index of 0.70 is between the buy-the-dip level ($28,140) and the DCA level ($45,950). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

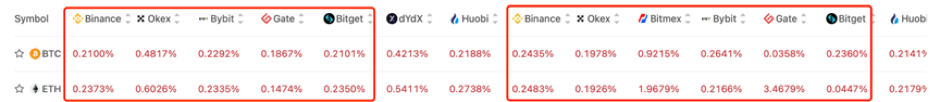

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

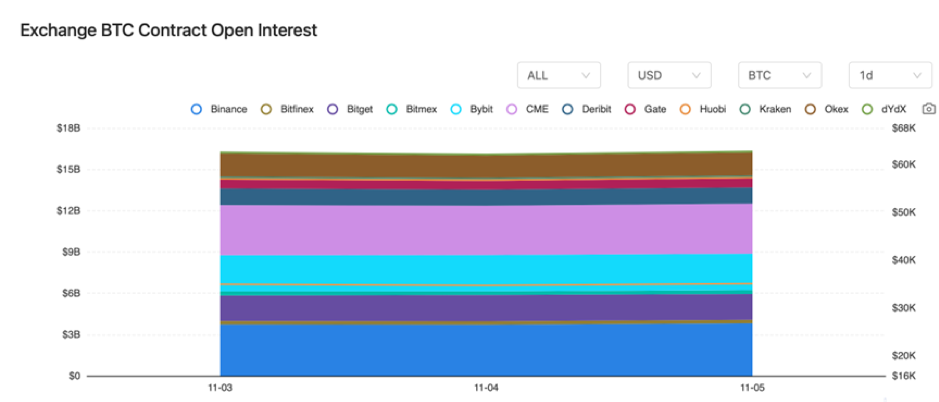

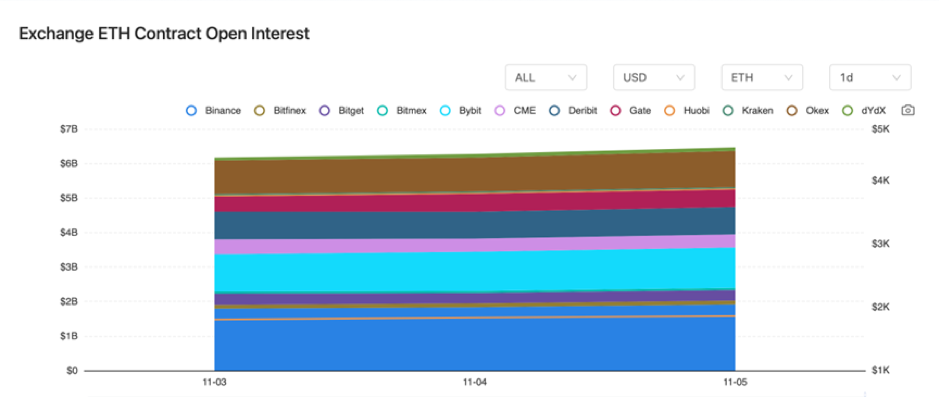

There were barely any changes in the BTC and ETH contract interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 3, Musk announced that X-AI would release its first AI model to selected groups the next day.

2) On November 3, the UAE had a plan to issue tokenized bonds on HSBC Orion and list them on ADX.

3) On November 3, BTC options contracts with a nominal value of $14.6 billion and ETH options contracts worth $3.9 billion were set to expire.

4) On November 4, U.S. Treasury Secretary Yellen stated that more non-bank financial institutions would face strict regulations.

5) On November 4, according to Coinbase COO, Coinbase prepared for the approval of a spot Bitcoin ETF.

6) On November 4, USDC’s circulation decreased by 600 million coins in the past week.

7) On November 5, Galxe distributed 7.42 million GAL tokens to 142 addresses.

8) On November 5, Mastercard announced it provided customer protection through NFT certificate programmability in the Digital Yuan.

9) On November 5, Musk revealed the recent release of xAI's AI model GROK system.

10) On November 5, Nansen’s CEO stated that the new version of Nansen 2 would be launched.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.