FameEX Weekly Market Trend | October 23, 2023

2023-10-23 18:53:25

1. Market Trend

From Oct. 19 to Oct. 22, the BTC price fluctuated between $28,100.66 and $30,379.99, with a volatility of 8.11%. The prior report stated this uptrend as the third wave of BTC’s major bullish trend. Despite past Bitcoin ETF-related false events causing a roller-coaster market (sharp rise followed by a sharp fall), the overall uptrend remains intact. Reaching $30,000 again is only a matter of time, and the current trend supports this. The report also advised traders to exit at the BTC 99-day MA or hold for potential gains. Recently, BTC has traded above the critical $28,000 level, particularly around $28,200, without dropping below $28,000. Notably, when BTC reached $29,000, it also moved sideways above that mark, assessing selling pressure and buyer support, never falling below $29,000. At these two key integer levels, the price movement of BTC and the details of the candlestick patterns can be used to probabilistically determine that this current uptrend is still in its early stages. This is due to four key factors: 1. The current BTC price increase is modest. 2. Both bullish and bearish sentiment is similar, lacking divergent trends. 3. The timing of the bull-bear transition aligns with the current pattern in the larger BTC market. 4. The uptrend isn’t driven by specific positive news or reforms. In summary, barring unexpected events, it’s viable to hold coins for potential gains or buy more during price corrections.

Source: BTCUSDT | Binance Spot

Between Oct. 19 and Oct. 22, the price of ETH/BTC fluctuated within a range of 0.05384-0.05560, showing a 3.26% fluctuation. ETH/BTC remains weak as usual and has continued to establish new lows in these past few days. It is advisable to stay away from this currency. For any structural changes during this period, please stay updated with our analysis report.

Based on overall analysis, with the continuous rise of BTC in the market, there is a consistent inflow of capital, leading to increased trading activity (which can be more intuitively observed through the 1-minute candlestick formation of various mainstay cryptocurrencies). Consequently, trading volumes have naturally seen significant increases. Before this BTC surge, many popular and even altcoins had reached rock-bottom prices. With BTC’s rise, there are several coins in urgent need of an upturn, such as SOL, LINK, AAVE, and others. Following this pattern to identify coins that have not yet initiated their upward movement and positioning oneself by holding these coins for potential gains might be a favorable investment strategy during this current period. The overall market trend is currently bullish, and it’s wise to follow this trend in your operations. Any downward movements should be viewed as corrections rather than a shift in the overall trend. In this situation, it’s essential to remember that the trend is the dominant factor, and it’s not advisable to take a bearish stance easily.

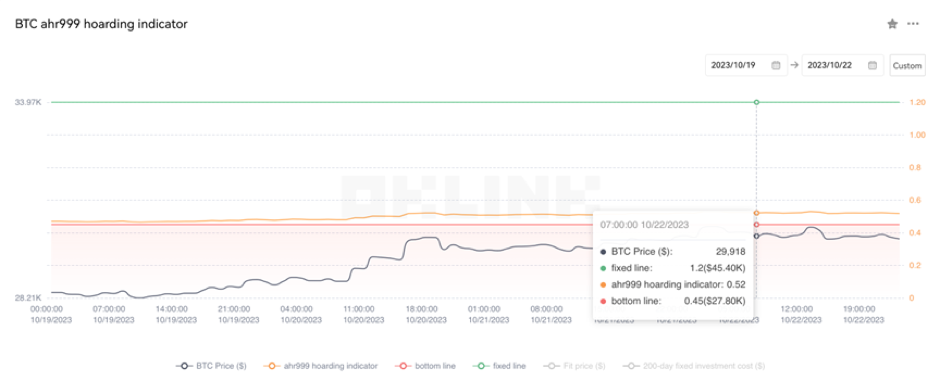

The Bitcoin Ahr999 index of 0.52 is between the buy-the-dip level ($27,800) and the DCA level ($45,400). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

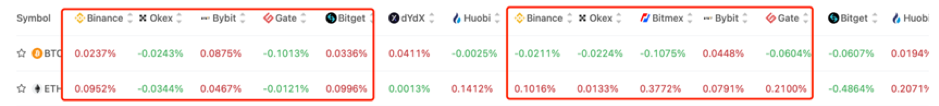

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

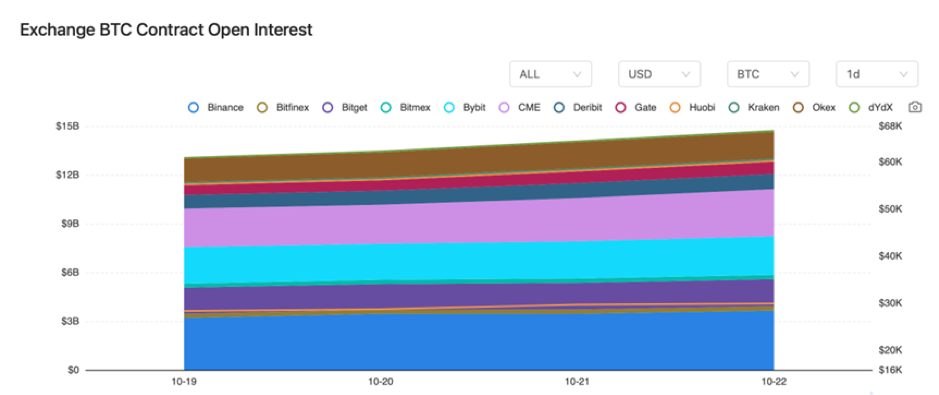

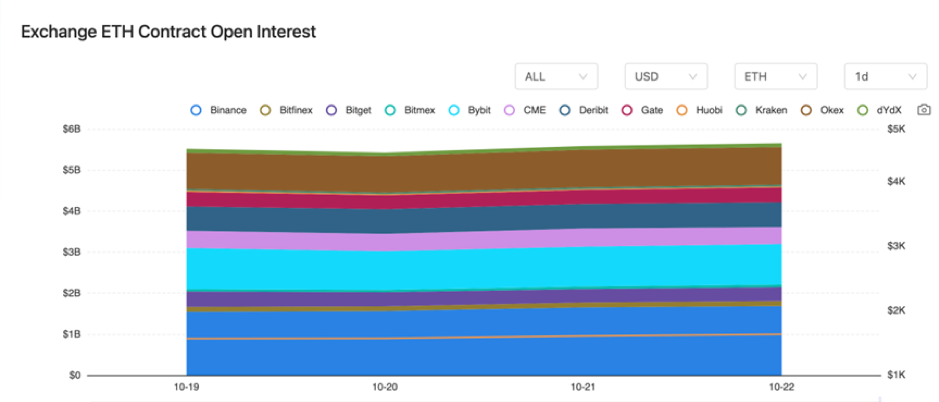

BTC contract interest saw a substantial rise, while the ETH contract interest on major exchanges remained relatively stable.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On October 19, in the United States, the weekly jobless claims totaled 198,000, below the estimated 210,000 and slightly lower than the previous figure of 209,000.

2) On October 19, according to data, 76.2% of Bitcoin is held by long-term investors, marking a historical high.

3) On October 20, JPMorgan predicted that a physically settled Bitcoin ETF would receive approval “within a few months”.

4) On October 20, OpenAI’s API experienced a severe malfunction, rendering it unusable.

5) On October 20, Vitalik stated that Ethereum and Bitcoin do not have a direct competitive relationship.

6) On October 21, Republican Congressman Tom Emmer, known for his support of cryptocurrencies, tried to get a nomination as Speaker of the House.

7) On October 21, the Hong Kong Securities and Futures Commission updated cryptocurrency market regulations in response to market developments.

8) On October 22, large European fund management companies believed that European Central Bank interest rates had not yet peaked.

9) On October 22, Thailand postponed the implementation of its “digital currency” plan.

10) On October 22, the total market capitalization of cryptocurrencies surpassed $1.2 trillion for the first time since August 2023.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.