FameEX Weekly Market Trend | August 31, 2023

2023-08-31 18:29:00

1. Market Trend

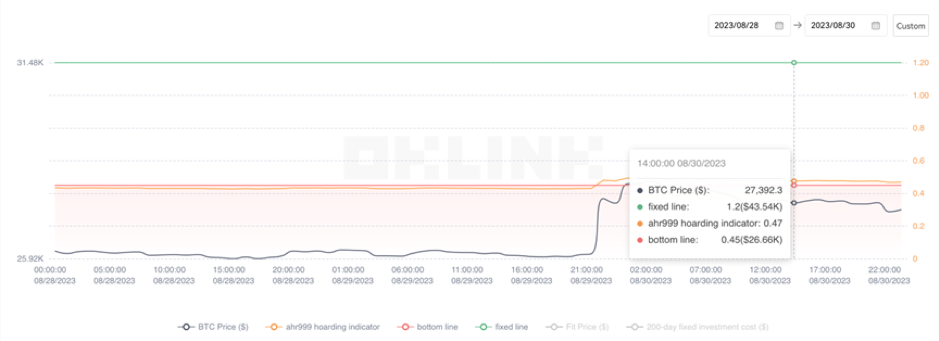

Between August 28 and August 30, the BTC price fluctuated between $25,872.05 and $28,142.85, with a volatility of 8.77%. According to the 1-hour chart, as mentioned in the previous analysis report, after experiencing a sharp drop, BTC’s trend entered into a consolidation phase ($25,500 - $26500). Aggressive traders could enter at range edges. On Aug 29, 22:00, BTC surged about 10 points ($28,142) due to news (Grayscale won an SEC lawsuit). $120M shorts were liquidated, and BTC’s avg. trade volume peaked since June, breaking the prior consolidation range. In the 2-hour and 4-hour frames, moving averages broke and turned up. BTC underwent anticipated trend adjustment, now retracing to about $27,000 (above $27,000). Yet, this surge doesn’t confirm BTC's shift from bearish for the following reasons:

1. The pullback has not yet concluded, and it’s uncertain where the pullback will find its bottom.

2. The significant resistance level of $28,500 has not been reached, questioning the continuity of bullish momentum.

3. After the Grayscale lawsuit victory, there are still numerous issues to be addressed, and negative news releases are possible.

4. A change in trend is never solely driven by a single bullish news item or a 1-2 day price increase

Currently, to confirm a bullish market shift, BTC must rise and hold above $28,500 (99-day daily moving average). Aggressive traders might consider entering near $26,800, setting a stop-loss at $26,500. Conservative investors can hold, watching for clearer opportunities.

Source: BTCUSDT | Binance Spot

Between August 28 and August 30, the price of ETH/BTC fluctuated within a range of 0.06192-0.06356, showing a 2.64% fluctuation. From the 1-hour chart, it’s evident that during BTC’s upward movement, ETH/BTC chose to pull back, contrasting sharply with the trend of the previous days. This reflects a corrective downturn. As mentioned earlier, employing a strategy based on moving averages for ETH/BTC was viable. However, presently, ETH/BTC has dropped below significant moving average supports across various levels, highlighting its current weakness. It’s advisable to stay away from this currency pair in the near term.

Based on overall analysis, due to the news of Grayscale’s lawsuit victory, the majority of cryptocurrencies have risen in tandem with BTC, and many prominent trending coins (such as BCH and LTC) have shown strong gains. Stimulated by this news, the entire market has witnessed a substantial increase in capital inflow, trading activity, and trading volume. It’s crucial to monitor the sustainability of these characteristics in the coming days (of utmost importance). For specific operational analysis, it is recommended to refer to the analysis provided above for BTC.

The Bitcoin Ahr999 index of 0.47 is between the buy-the-dip level ($26,660) and the DCA level ($43,540). Therefore, It is viable to purchase popular coins through DCA.

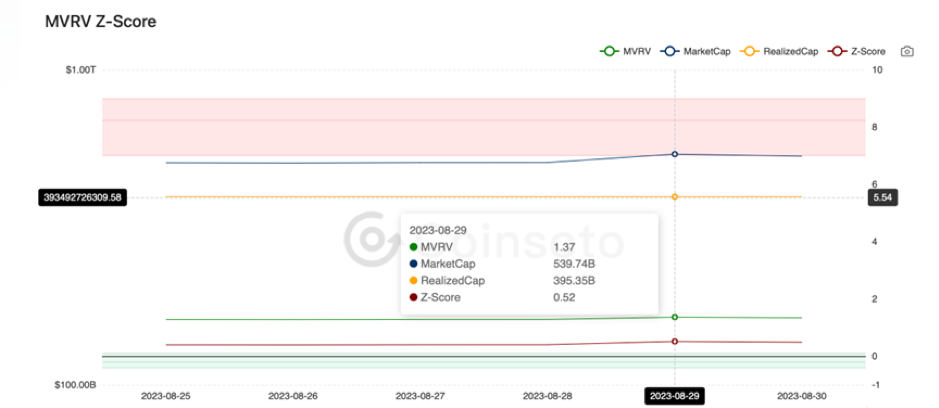

From the perspective of MVRV Z-Score, the value is 0.52. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.36-0.09).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

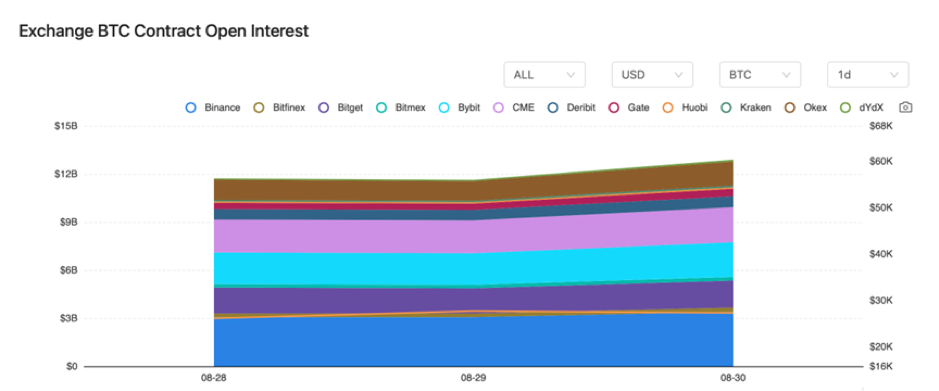

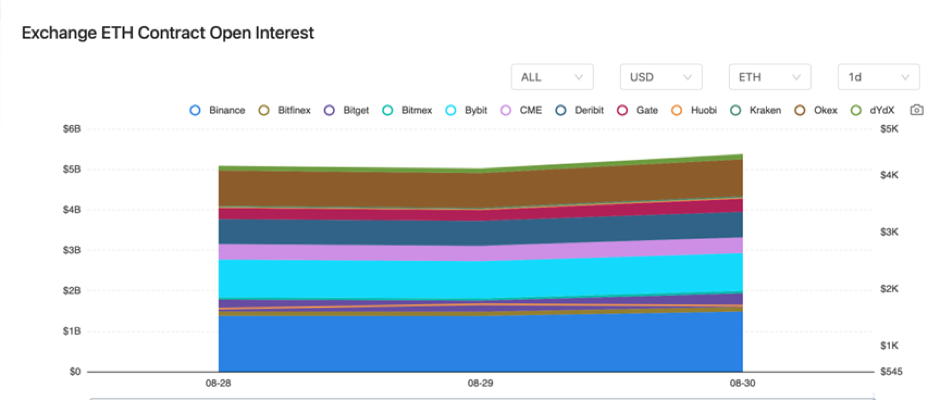

There were significant surges in BTC and ETH contract open interest from major exchanges on August 29.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On August 28, Indian Prime Minister Modi highlighted the need for a global framework and regulations on cryptocurrencies.

2) On August 28, according to the Hong Kong Monetary Authority, five major fintech initiatives would be promoted, including distributed ledger technology, in the next 12 months.

3) On August 28, Binance prohibited Russian users from using any fiat currency other than the Russian Ruble.

4) On August 28, it was reported that currently, 130 economies are exploring Central Bank Digital Currencies (CBDCs).

5) On August 29, the Wall Street Journal reported that Binance considered a complete exit from the Russian market.

6) On August 29, the total trading volume on dYdX exceeded $1 trillion.

7) On August 29, Hong Kong adopted a dual-license system for virtual asset platforms. OSL and HashKey are still applying for the second license.

8) On August 30, Binance would cease support for BUSD in 2024.

9) On August 30, data showed that GBTC’s assets under management reached $17.4 billion.

10) On August 30, SEBA received preliminary approval from the Hong Kong Securities and Futures Commission, allowing virtual asset trading.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.