FameEX Weekly Market Trend | August 24, 2023

2023-08-24 18:27:50

1. Market Trend

From August 21 to August 23, the BTC price fluctuated between $25,300.00 and $26,299.00, with a volatility of 3.95%. According to the 1-hour chart, the BTC price, after a major drop to $25,166, hasn’t rebounded effectively, showing limited volatility and a flat trend. This suggests weak market sentiment and confidence. On the evening of August 23, BTC saw a high-volume decline to $25,300, then rapidly surged past $26,000. Around the $25,000 mark, it’s a strong defense line contested by bullish traders. Given past trends, the area near $25,000 will likely see multiple tests and quick upward movement. Should BTC dip here and shift to oscillation instead of quick upward movement, or if the speed of ascent slows notably, the $25,000 level is at risk. It is advised to monitor the $25,000 trend closely. Aggressive investors might consider it a stop-loss mark. Conservative investors should watch more and act less in the current market, waiting for clearer conditions before proceeding.

Source: BTCUSDT | Binance Spot

Between August 21 and August 23, the price of ETH/BTC fluctuated within a range of 0.06230-0.06447, showing a 3.48% fluctuation. From the 1-hour chart, ETH/BTC shows a relatively stronger performance compared to BTC. After a significant drop in BTC, ETH/BTC reclaimed its losses and achieved a recent high. Over the past few days, ETH/BTC has been trading in a tight range at higher levels. On the evening of August 23, it experienced a slight decline to a low of 0.06230, but later recovered most of the losses. Looking at the recent period, ETH/BTC has become a relatively strong and stable asset in the context of a weak market. On higher timeframes (4-hour and daily charts), it stays above important moving averages. At this point, it is viable to employ the moving average strategy mentioned in the previous analysis report, entering positions at appropriate points for corresponding actions. However, it’s important to control your positions and set up stop-loss points.

Based on overall analysis, the market is in a period of oscillation following a major decline with a relatively stable trend. Combining the analysis of BTC above, the primary strategy remains cautious observation with limited action. The $25,000 level serves as the first crucial point after the significant drop (recently a pivotal level for both bulls and bears), holding particular importance for overall market sentiment and investor confidence. In terms of operations, the $25,000 level should be treated as a significant support level.

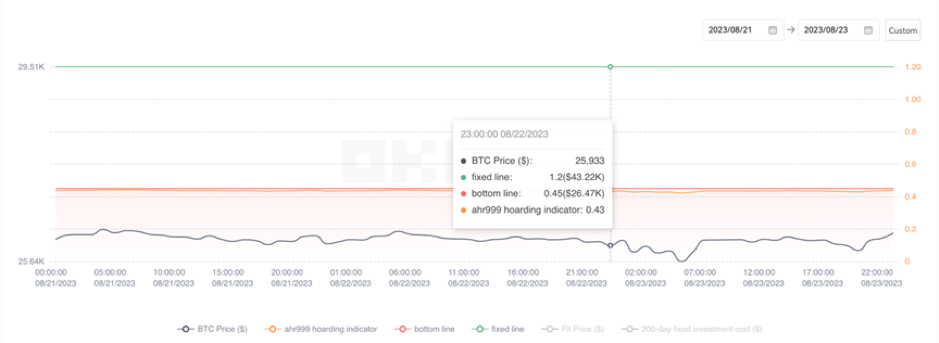

The Bitcoin Ahr999 index of 0.43 is below the buy-the-dip level ($26,470) and the DCA level ($43,220). Therefore, it is viable to implement spot trading for popular coins.

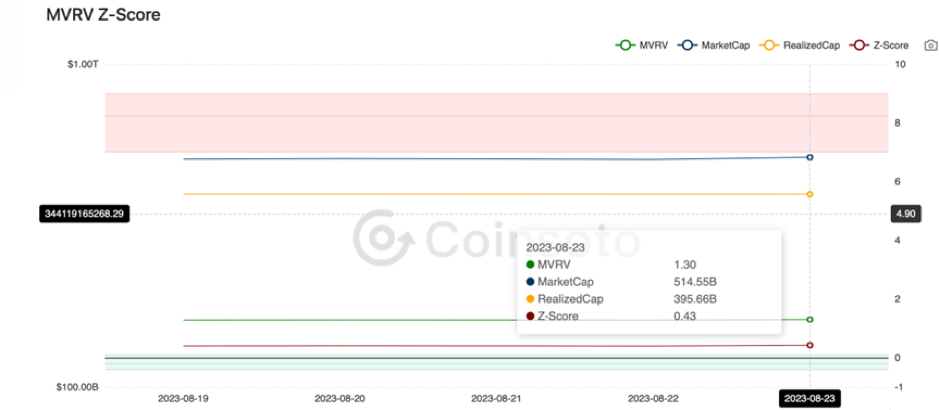

From the perspective of MVRV Z-Score, the value is 0.43. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.36-0.06).

2. Perpetual Futures

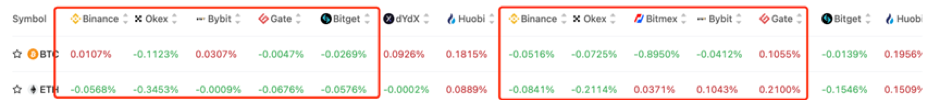

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are negative, indicating that short leverages are relatively high.

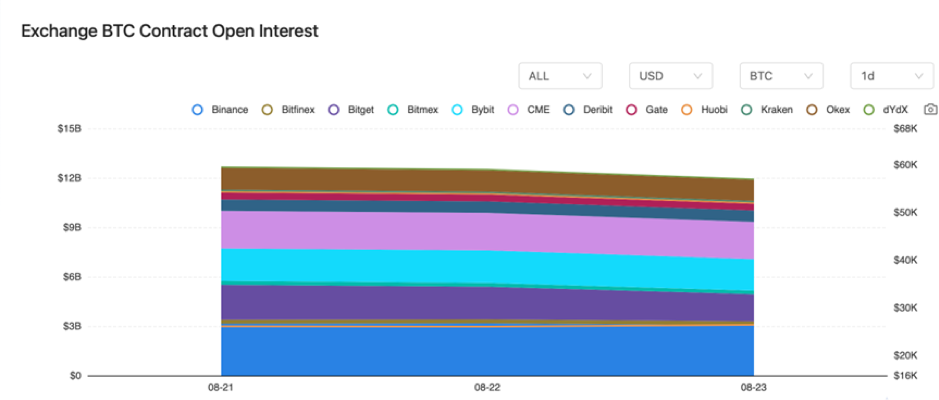

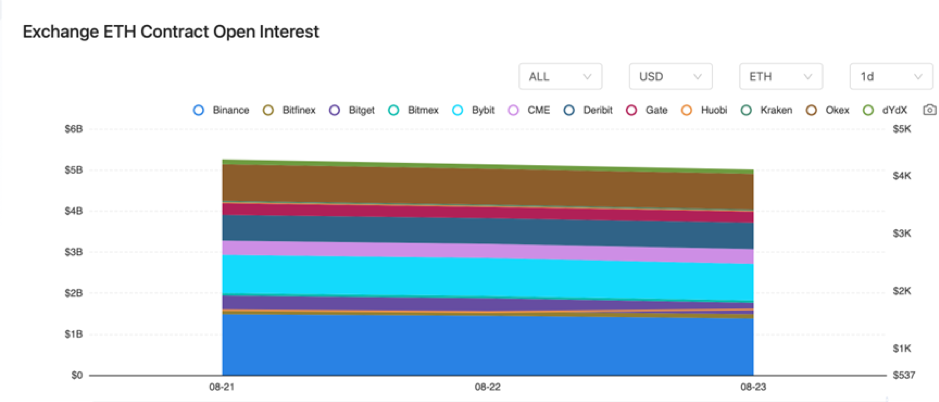

There were slight declines in BTC and ETH contract open interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On August 21, data showed that over 16 billion USD in capital has flowed into Bitcoin in 2023 so far.

2) On August 21, Hong Kong media reported that HKVAX was in search of a new round of financing and would launch a virtual asset platform and establish an OTC over-the-counter trading system in six months.

3) On August 21, SlowMist stated that the total losses from last week’s Web3 security incidents amounted to approximately 19.963 million USD.

4) On August 22, Komainu obtained approval from the Virtual Assets Regulatory Authority (VARA).

5) On August 22, Oman invested 370 million dollars to launch a new cryptocurrency mining center.

6) On August 22, Binance launched Binance Pay in Brazil.

7) On August 22, FTX’s bankruptcy hearing would take place this Thursday.

8) On August 23, Uniswap’s spot trading volume for Q1 and Q2 2023 surpassed that of Coinbase.

9) On August 23, the Wall Street Journal reported that Binance no longer enforces trading restrictions on Russian users, potentially violating global sanctions.

10) On August 23, the newly appointed Prime Minister of Thailand is an active cryptocurrency investor.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.