FameEX Weekly Market Trend | June 8, 2023

2023-06-08 17:26:35

1. Market Trend

Between June 5 and June 7, the BTC price fluctuated between $25,351 and $27,455, with a volatility of 8.29%. According to the 1-hour candle chart, since the early morning of June 5, BTC price has been traded sideways at around $27,000. At 06:00 am on June 5, there was a surge in trading volume, leading to a peak price of $27,455. During this time, the market sentiment was predominantly bullish. However, following the market news of the U.S. Securities and Exchange Commission (SEC) suing Binance and its CEO Changpeng Zhao (CZ) for violating U.S. securities trading rules, the BTC price responded with a decline, reaching as low as $25,351.02. Additionally, BNB, the platform’s token, experienced a daily decrease of over 10 percentage points. And then CZ tweeted to support Binance and expressed that funds were entering the market to take advantage of the price dip. As a result, BTC rebounded to $27,391, recovering all the losses caused by the negative news. As the price level of $27,000 became a crucial battleground for both bulls and bears, BTC retraced to around $26,500 after reaching the peak of $27,391, entering a sideways consolidation phase. Recently, due to regulatory issues and the constant influx of negative news (Coinbase also being sued by the SEC), the market has experienced volatile fluctuations with an uncertain direction. Observing the market more closely and trading less can be a prudent strategy in the current uncertain environment.

Source: BTCUSDT | Binance Spot

Between June 1 and June 4, the price of ETH/BTC fluctuated within a range of 0.06906 to 0.07088, showing a 2.63% fluctuation. Looking at the 1-hour candle chart, the ETH/BTC pair showed a counter-trend rally during the market’s reaction to the negative news. It even broke through previous highs, reaching a peak of 0.07088 (providing additional validation to rumors of significant bullish positions being taken by whales). Subsequently, during the BTC rebound, it dropped to a low of 0.06906, but it still remained above the trendline, indicating that the price was still within a healthy range of movement.

Based on overall analysis, the market is currently going through a period of increased uncertainty, with frequent regulatory events affecting both leading companies and cryptocurrencies. Technical analysis has diminished in its effectiveness at this moment, as market movements are heavily influenced by news factors. It is advisable to reduce trading activities and be patient, waiting for opportune moments to enter the market with sufficient funds.

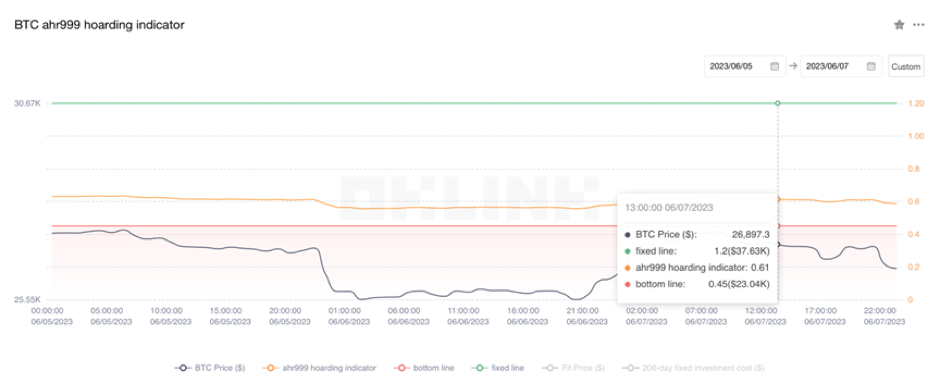

The Bitcoin Ahr999 index of 0.61 is above the buying-the-dip level ($23,040) but below the DCA level ($37,630). It is viable to purchase popular coins through DCA.

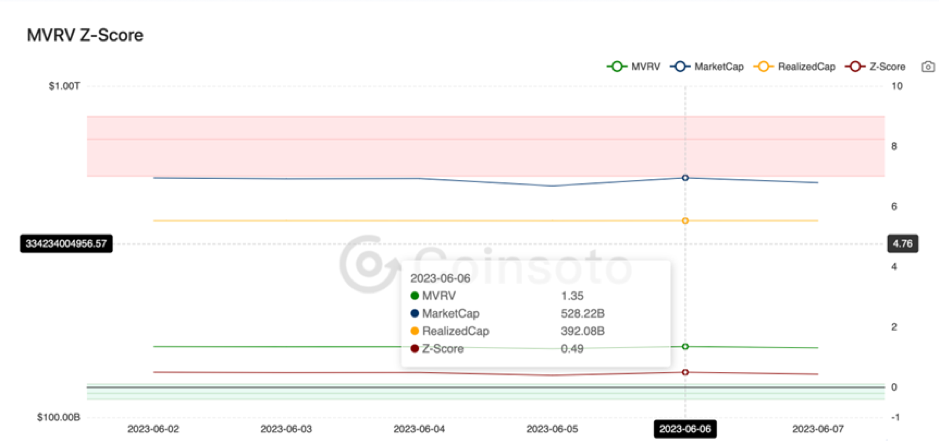

From the perspective of MVRV Z-Score, the value is 0.49. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.33-0.11).

2. Perpetual Futures

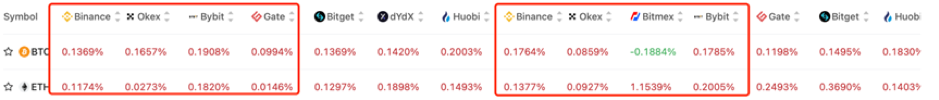

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

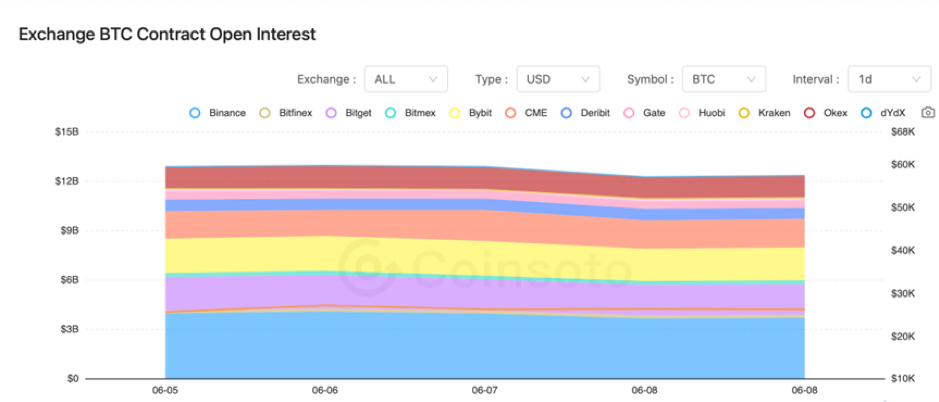

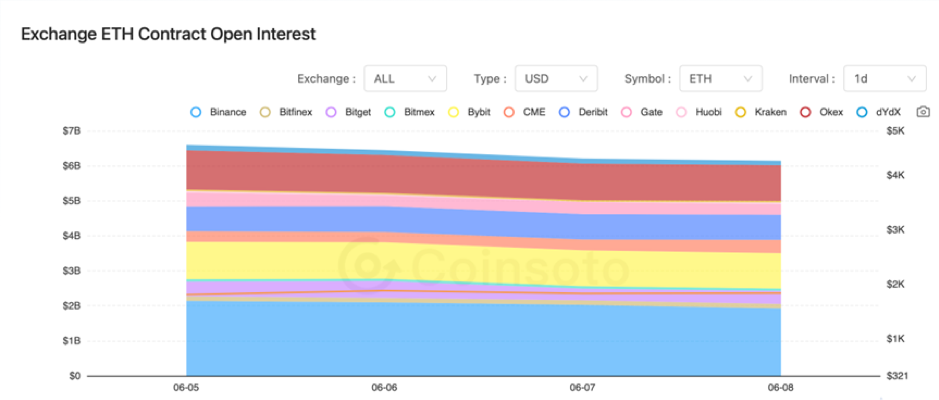

The contract open interest of BTC from major exchanges basically remains unchanged. On the other hand, there has been a gradual and slight decline in the open interest for ETH between June 5 and June 7.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On June 5, the OpenAI website experienced a surge in traffic, reaching 1 billion visits.

2) On June 5, according to the data, Binance increased its BTC holdings by approximately 420,000 coins over the past three years, while Coinbase reduced its BTC holdings by nearly 560,000 coins.

3) On June 5, the U.S. SEC sued Binance and its CEO CZ for violating U.S. securities trading regulations.

4) On June 6, the SEC filed a lawsuit against Coinbase for alleged violations of securities laws.

5) On June 6, there was a net outflow of approximately $2.18 billion from the Binance platform, accounting for around 4% of its total assets.

6) On June 6, in the Coinbase case, the SEC classified tokens such as SOL and FIL as securities.

7) On June 6, the CCTV financial channel reported on “Binance and its CEO being sued by the U.S. SEC.”

8) On June 7, the market capitalization of BUSD dropped below $5 billion, experiencing a 50% decrease in three months.

9) On June 7, Coinbase stated that it would take its legal battle with the SEC to the U.S. Supreme Court if necessary.

10) On June 7, U.S. Treasury Secretary Janet Yellen expressed support for regulatory oversight of cryptocurrencies by U.S. regulatory agencies.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.