Crypto Options 101: An Investor’s Guide on Crypto Options Trading

2023/01/19 15:15:05

Introduction to Crypto Options Trading

An options contract is a type of financial product in which traders can purchase derivatives of underlying assets like stocks, commodities or cryptocurrencies. For traders who are looking to hedge risk on a long or short trade, this derivative is definitely one of the tools. Instead of holding spot, crypto options are a contract that give you the right but not the obligation to buy or sell an asset at a specific price. The difference between futures and options is mainly that options have an expiry date and/or time. At the time of expiry, the price of the underlying asset must be on the correct side of the strike price (based on the trade taken) for the trader to make a profit. American options provide that right within a given timeframe and European options can only be exercised on a specific expiration date.

Are There Options for Crypto?

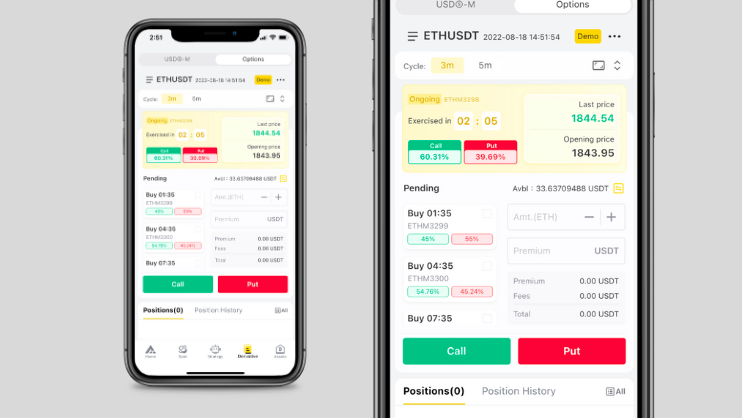

Cryptocurrency exchanges are rapidly adopting several traditional financial processes and tools, with options being one of the latest derivatives to be integrated into the crypto ecosystem. Traders prefer options due to the short cycle returns and as a method of hedging risk, rapid profits and diversifying a trader’s portfolio. Exchanges and traders are growing more interested in options trading in the past few years, with outstanding contracts racking up billions of dollars. So far, the most popular option pair is ETH/USDT. FAMEEX pioneered ETH/USDT options pairs in 2022. Crypto options proponents believe that the market should adopt more mainstream pairs to provide ample hedging and investment opportunities.

What are Crypto Options?

Options offer users to buy the options, predicting the price movement of the underlying asset before the predetermined cycle finishes. Afterwards, the price moves in the same direction as the traders prediction by the time of expiry. The winners then share in the premiums placed by traders who predicted incorrectly.

Premium: An option premium is the price of an option contract. It is thus the income received by the seller (writer) of an option contract from the buyer.

Open Price: Usually, on the candlestick chart, a line marks the open price. Traders will win if the last price is above the gray line during each cycle, or vice versa.

Closing Price: Also called last price. When the options exercise, the last price will determine the gain or loss in each cycle.

Call and Put Options

There are two types of options contracts on FAMEEX options: call options and put options. That is to say, the user wagers correctly on the market’s movement by a certain time of expiry, that the price of underlying asset may go up, down, or remain in the same range.

Call Options

When it comes to call options, you can buy call options in 3-minute or 5-minute cycles.

Buying Call Options

When you buy a call option, you are essentially buying an underlying asset at a particular predetermined price, regardless of the market price before/at the contract’s expiration.

When speculating in the market, you can purchase a call option when you believe the market price at the contract expiration will be higher than the closing price. In short, you anticipate that the value of the underlying asset of your option will increase.

Buying Call Options: Example

For example, you buy an Ethereum call option, with a premium of $6 and close price is $1943.8. The open price of the option will be $1942. Your option is exercised automatically at $1943.8. With 71.59% of the premium in call options and 28.41% of the premium in put options, this will result in a gain of $8.38. If you subtract the $6.18 premium paid for the option, your net profit will be $2.2. [Your profit condition is when Market Price > Your Open Price, you gain profit.]

Put Options

Put options allow you to buy put options in 3-minute or 5-minute cycles.

Buying Put Options

Similar to calls, you can buy sell/put options. When you buy a put option, you are essentially selling the underlying asset at a predetermined price before/at the expiration of the contract, regardless of the market price at that time.

A speculator could also purchase a put option if they believe the price of the underlying asset class would be lower than the close price, in order to make a profit, by repurchasing it at a lower price than the one at which they bought it.

Buying Put Options: Example

You bought your put options with $6 in premium. The open price at option will be $1933.91. Your option is exercised automatically at $1922.84. As you expected its price to fall, with 42.69% of the premium in call options and 57.31% of the premium in put options, this will result in a gain of $10.503. If you subtract the $6.18 premium paid for the option, your net profit will be $4.323. [Your profit condition is when Your Open Price > Market Price, you gain profit.]

How do Crypto Options Work?

In the money (ITM): It refers to an option that possesses intrinsic value. It’s in favor of the owners of the options contract. For a call, that’s when the strike price is lower than the current price of the underlying asset. For a put, it’s when the strike is higher than the current price.

At the money (ATM): For both a call and a put, it’s when the strike is equal to the current price.

Out of the money (OTM): It means an options contract that contains negative value. For a call, it’s when the strike price is higher than the current price of the underlying asset. For a put, it’s when the strike is lower than the current price.

Crypto Options Market: Options Trading in Cryptocurrency Market

FAMEEX options trading is a user-friendly product that has been newly launched as a derivative giving traders the ability to trade options with cryptocurrency as the underlying asset. It simplifies options trading, currently only supporting the mainstream ETH/USDT trading pair to enhance the user experience and reduce difficulty. There are some advantages to trading options on FAMEEX, which include: hedging risk, ease of use, higher potential returns, flexibility, short-duration strategies, and competitive premium price.

Common Crypto Options Strategies

Bull Market Example

The bull put strategy is used when a trader or speculator believes that the underlying asset will experience price increase compared to the open price. The bull put strategy can be achieved by OTM to buy several different call options at different times. The potential loss would be all of your premium.

Bear Market Example

The inverse of the bull put strategy is when investor feels bearish on an asset. It helps to reduce cost and risk while simultaneously offering the chance to profit. To execute this strategy, you buy a series of “buy put” options to foresee the possibility of price drop.

Managing Risk with Options

During the bear market, it’s very cost-efficient that you know your potential loss upfront before trading. People who want to hold cryptocurrency but don’t enjoy the market volatility can try options to reduce risk as a hedging tool for market moves. The maximum loss will be your premium and fee. You can hedge your risk by buying in the opposite direction of the current market trend. If the price goes down, the downside is limited to the premiums you paid. It’s a way to diversify your portfolio.

Where to Trade Crypto Options?

FAMEEX:

One of the secure crypto derivatives exchanges offering options trading. Compared to most exchanges, FAMEEX options are easy-to-use and beginner friendly. FAMEEX officially added crypto options to its product list in August 2022. It currently carries ETH/USDT options.

Deribit:

Deribit is based in Amsterdam, Netherlands, the largest crypto options market by volume. It’s a BTC, ETH options market and only executes contracts at expiration. It settles options contracts in cash by crediting contract owners the cash equivalent of the underlying assets. It also offers up to 50 times leverage for option traders.

FTX:

FTX Exchange Derivatives is available to both retail and institutional investors and offers physical settlement of all contracts. Since its launch in 2017, FTX options has accumulated over 10 million options and swaps contracts. They offer trading in only European-style Bitcoin options, which you cannot exercise early. All options are cash-settled in USD on the expiration date.

OKEx:

They currently offer a wide range of assets to trade and its low fees make it one of the most sought-after platforms where you can trade BTC and ETH options. Different from Deribit, it settles contracts physically. It doesn't allow the settlement of contracts before execution dates.

FAQ

Are There Ethereum Options?

Yes, Ethereum has been one of the trending projects in the cryptocurrency market. Ethereum’s smart contract capabilities offer many opportunities for risk management. The ability to trade derivatives makes ETH-based options some of the most sophisticated financial instruments.

How to Trade Ethereum Options?

Ethereum options trade the same as any other basic call or put option, where an investor pays a premium for the right to buy or sell an agreed amount of Ethereum on an agreed date.

Where Can I Buy Crypto Options?

You can buy options from exchanges like FAMEEX supporting options trading. You may follow this link to start your first options trading. https://www.fameex.com/en-US/download

Can You Trade Crypto Options?

Yes, futures and options are now among the financial products commonly found on cryptocurrency exchanges or trading platforms.

This is not investment advice. Please conduct your own research when investing in any project.