The Complete Guide to Using Fundamental Analysis in Crypto Trading

2024/01/23 17:10:40

This educational journey in trading encompasses both technical and fundamental analysis, tailored for both new and seasoned traders, and highlights the benefits of technical analysis in crypto trading derived from traditional markets. This guide delves into fundamental analysis, a key to understanding the volatile crypto market, helping traders make strategic decisions amidst price fluctuations. It serves as a comprehensive companion in order to offer clarity and insight in a market where information is paramount.

Understanding the Core of Fundamental Analysis in the Crypto Realm

The core of fundamental analysis in the crypto realm is akin to acquiring a map in a treasure hunt. It's about comprehending the true essence of what drives value in the world of digital currencies. This section will illuminate the multifaceted nature of crypto assets and provide a solid foundation for understanding their intrinsic value, ensuring that your investment decisions are grounded in comprehensive and insightful analysis.

What Is Fundamental Analysis in Crypto?

Fundamental analysis in the context of cryptocurrency is a holistic approach to understanding and evaluating digital assets. It involves a thorough examination of various elements such as the project's vision, the robustness of the underlying blockchain technology, the competency and integrity of the development team, market adoption rates, and the regulatory environment. Unlike traditional assets where financial statements and industry trends are key, in crypto, fundamental analysis often hinges on the potential for technological innovation, network effects, and the ability to solve real-world problems. This method of analysis aims to ascertain the inherent value of a cryptocurrency, forecasting its long-term potential and sustainability in an ever-evolving market. It's about peeling back the layers to reveal the core drivers of value and the potential for growth and adoption in the broader economic and technological landscape.

What Makes Fundamental Analysis Crucial for Cryptocurrency Trading?

The necessity of fundamental analysis in cryptocurrency trading cannot be overstated. In a market characterized by high volatility and speculative fervor, understanding the substantive qualities of a cryptocurrency is paramount. This approach empowers traders and investors to make decisions based on more than just market sentiment or price trends. It involves a deep dive into the project's roadmap, the practicality and novelty of its use cases, and the overall health and activity of its ecosystem. By focusing on these core aspects, traders can discern long-term value and potential growth, mitigating risks associated with market hype or short-term price movements. Fundamental analysis serves as a beacon, guiding through the fog of market speculation with insights into the real-world utility, technological innovation, and the economic principles governing the crypto asset in question.

Difference between Fundamental Analysis and Technical Analysis in Crypto Market

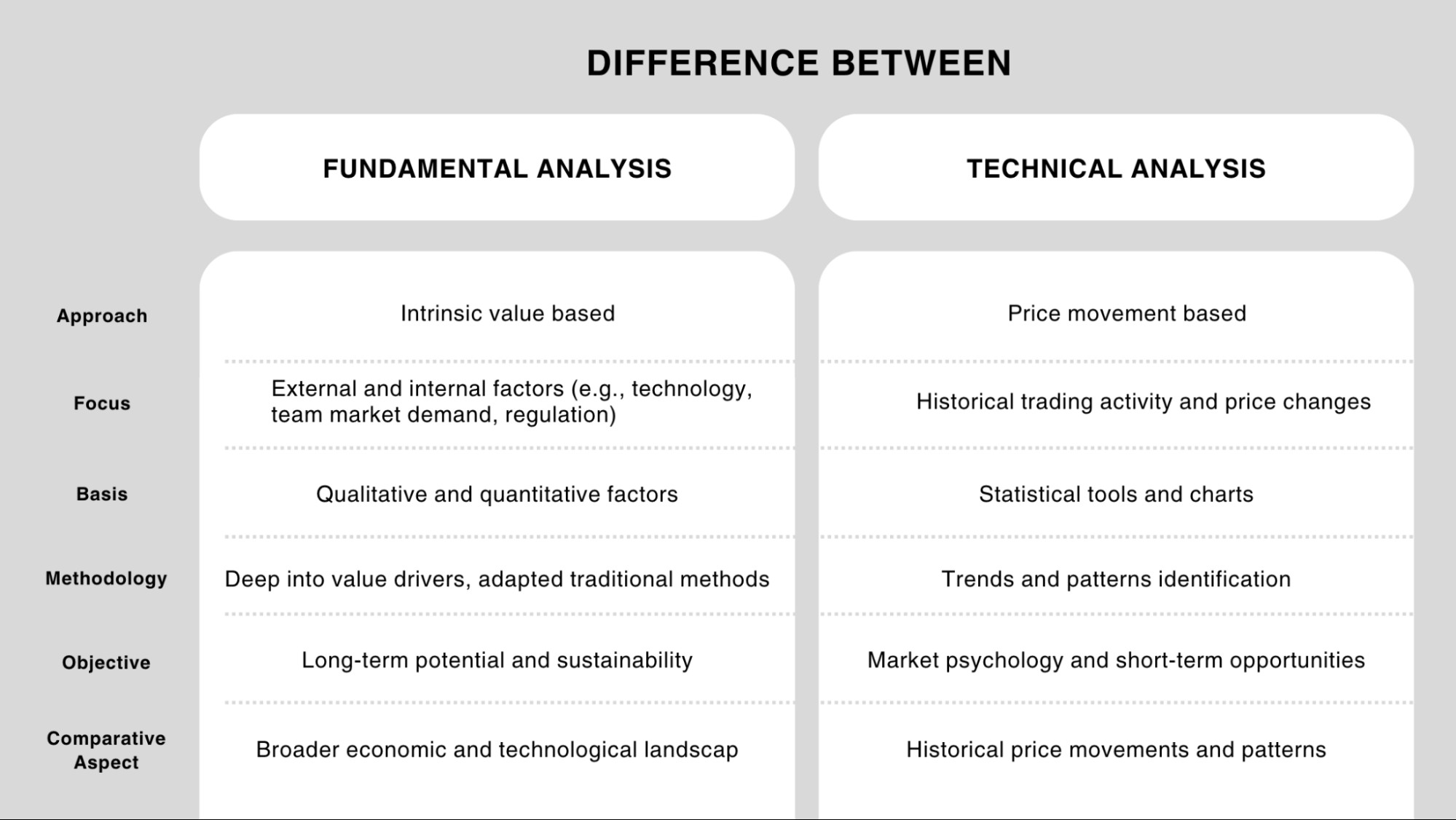

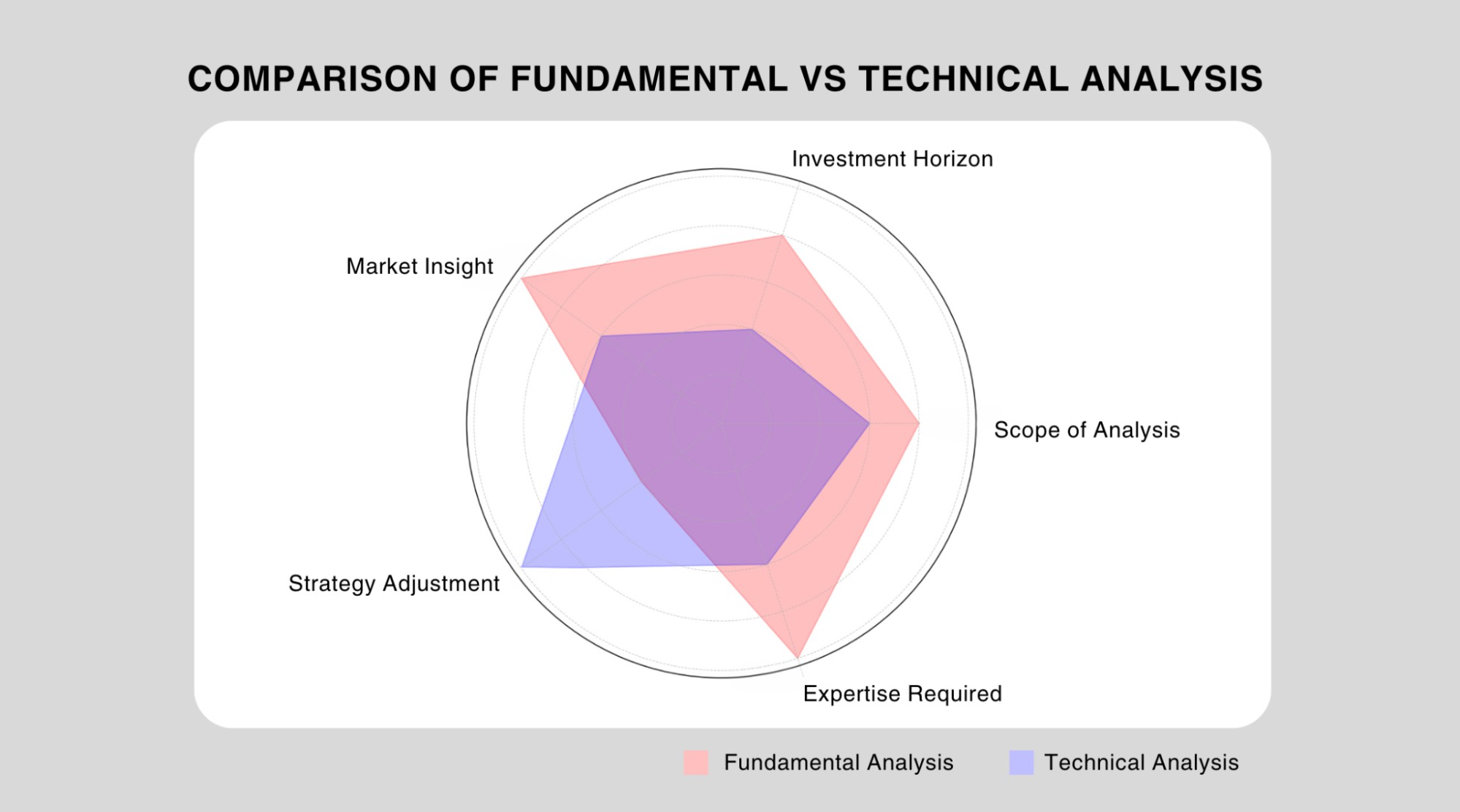

While both methodologies aim to predict future market movements, their approaches and focus areas are distinctly different. Fundamental analysis is rooted in the belief that a cryptocurrency's intrinsic value is influenced by external and internal factors, including technological advancements, team expertise, market demand, and regulatory changes. This approach is forward-looking, seeking to determine a cryptocurrency's potential based on qualitative and quantitative factors. On the other hand, technical analysis is primarily concerned with price movements and trading volumes, employing various charts and statistical tools to identify trends and patterns. This method is predicated on the idea that historical trading activity and price changes can indicate future price movements. While fundamental analysis provides a deeper understanding of a cryptocurrency's underlying value, technical analysis offers insights into market psychology and short-term trading opportunities.

The objective of fundamental analysis (FA) in crypto is not only to understand an asset's current value but also to forecast its long-term potential and sustainability in a constantly evolving market. It's a deep dive into the core drivers of value, assessing whether a cryptocurrency is overvalued or undervalued. Traditional FA methods, like analyzing earnings per share or price-to-book ratio, are adapted to suit the unique characteristics of cryptocurrencies, focusing on the broader economic and technological landscape.

While technical analysis (TA) provides different insights through historical price movements and patterns, fundamental analysis in crypto is about comprehensively evaluating the asset's inherent worth and its potential for growth and widespread adoption. This comprehensive methodology contrasts with traditional FA, which often focuses on narrow business metrics within a specific niche to determine an asset's standing compared to its peers.

The Impact of On-chain Analysis on Crypto Fundamental Analysis

The on-chain analysis has revolutionized fundamental analysis in the cryptocurrency domain. This innovative approach involves scrutinizing blockchain data to glean insights into the health and dynamics of a cryptocurrency's network. Metrics such as transaction volume, active addresses, network fees, and token distribution offer a transparent and quantifiable view of a cryptocurrency's usage and adoption. On-chain analysis helps in understanding the depth of user engagement, the distribution of assets among holders, and the overall security and scalability of the network. This data-driven approach complements traditional fundamental analysis by providing tangible evidence of a cryptocurrency's performance and potential. It is especially crucial in a market where transparency and trust are paramount.

When considering a potential investment, it's essential to assess the right timing for your purchase. For instance, a significant movement of the circulating supply to exchanges could signal a trend toward selling, suggesting it may not be the ideal time to buy. To aid in this decision-making process, it's advisable to compile all relevant on-chain data into a cohesive set of documents and tables. This centralized repository of information will prove invaluable for future reference.

Understanding the Intrinsic Value of a Given Cryptocurrency

Evaluating the intrinsic value of a cryptocurrency is a multifaceted process that requires a deep understanding of various factors. This assessment goes beyond market speculation, focusing on the core attributes that give a cryptocurrency its value. Key factors include the technological innovation and uniqueness of the blockchain, the scalability and security of the network, and the real-world applications and use cases of the cryptocurrency. Additionally, the strength and activity of the community, strategic partnerships, and the development team's track record and vision are crucial in determining the long-term viability and success of the digital asset. Market demand and adoption rates, regulatory environment, and the overall market sentiment also play significant roles. The information above aims to uncover the true worth of certain cryptocurrencies, helping traders and investors identify assets with substantial value and long-term growth potential, distinct from their current market price or hype.

Key Aspects to Examine in Fundamental Crypto Analysis

To truly grasp the potential of a digital asset, one must delve into the fundamental aspects that underpin its value. This crucial section explores the key aspects integral to conducting a comprehensive fundamental analysis of the cryptocurrency market. From unraveling the intricacies of financial metrics and market capitalization to deciphering the implications of trading volumes, use cases, and circulating supply, each element is a piece of the puzzle in understanding the true worth and potential of a cryptocurrency. This journey into the depths of fundamental crypto analysis is designed to arm you with the knowledge and insight necessary to navigate the often turbulent waters of the crypto market, enabling you to identify opportunities and risks with greater clarity and confidence.

Decoding Financial Metrics in Crypto Fundamental Analysis

Financial metrics offer crucial insights into the health and potential of a cryptocurrency. Unlike traditional financial analysis, which relies heavily on income statements and balance sheets, crypto analysis requires a different set of metrics. These include token economics, funding and spending patterns of the project, and revenue models. Understanding these financial underpinnings helps in evaluating the sustainability and economic viability of a crypto project. A robust financial foundation often indicates a higher likelihood of long-term success and stability in the volatile crypto market.

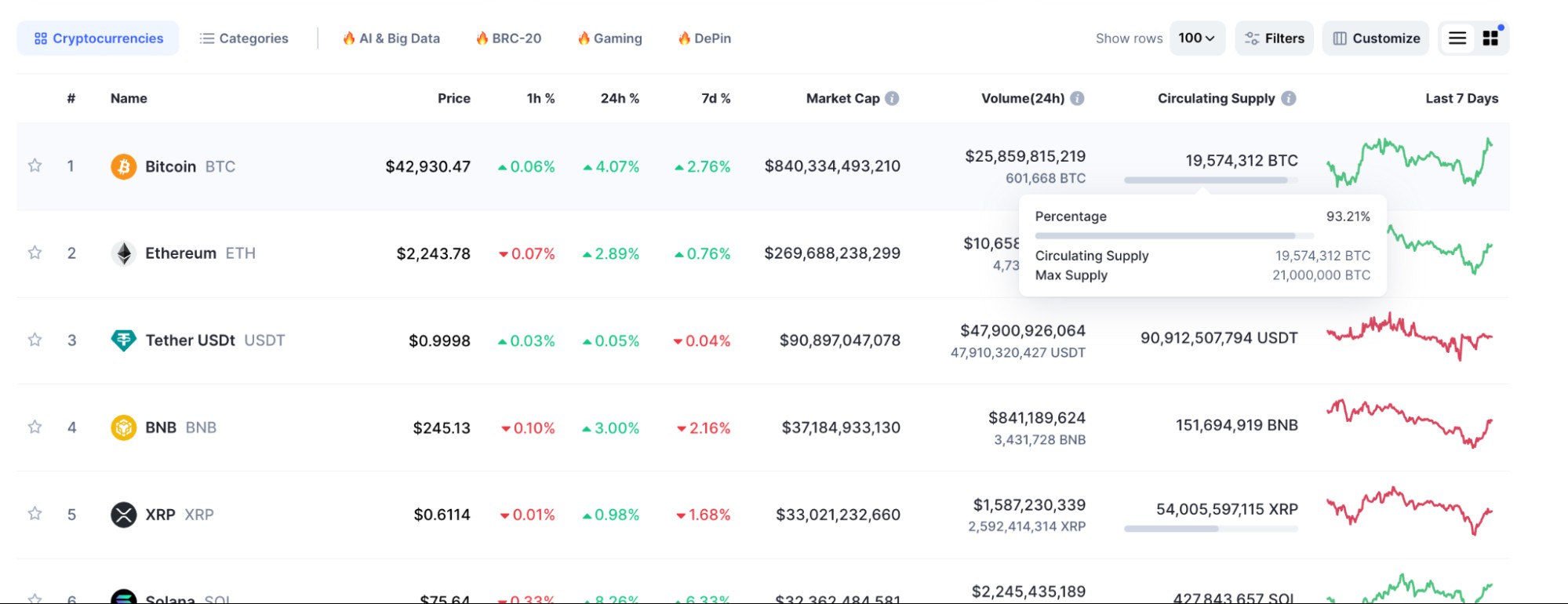

Financial metrics play a crucial role and are broadly categorized into general and on-chain metrics. General metrics include Market Capitalization, which assesses the total market value of a crypto project, with higher caps indicating more investor trust. The 24-hour Volume metric measures transaction values over a day, indicating liquidity and investor confidence. The Unit Price is vital for short-term trading strategies, reflecting market sentiment. Price Correlation with Bitcoin is also analyzed, as Bitcoin's performance often influences other cryptocurrencies. Total Exchange Inflows/Outflows track the movement of coins into or out of exchange wallets, reflecting investor reactions to market conditions.

On the on-chain side, active addresses and transaction amounts give insights into the usage and activity level of a network. Transaction Fees, particularly significant in networks like Ethereum, indicate the cost of activity and network congestion. Hash Rates apply to proof-of-work cryptos like Bitcoin, showing the computational power used in transactions and network security. The Network Value to Transaction Ratio (NVT Ratio) compares market cap with transaction volume to assess network valuation. Finally, the Market Value to Realized Value Ratio (MVRV Ratio) contrasts market cap with realized capitalization, offering insights into market profitability and investor behavior. These metrics collectively provide a comprehensive view of a cryptocurrency's fundamental health and potential.

How Market Cap Influences the Crypto Fundamental Analysis?

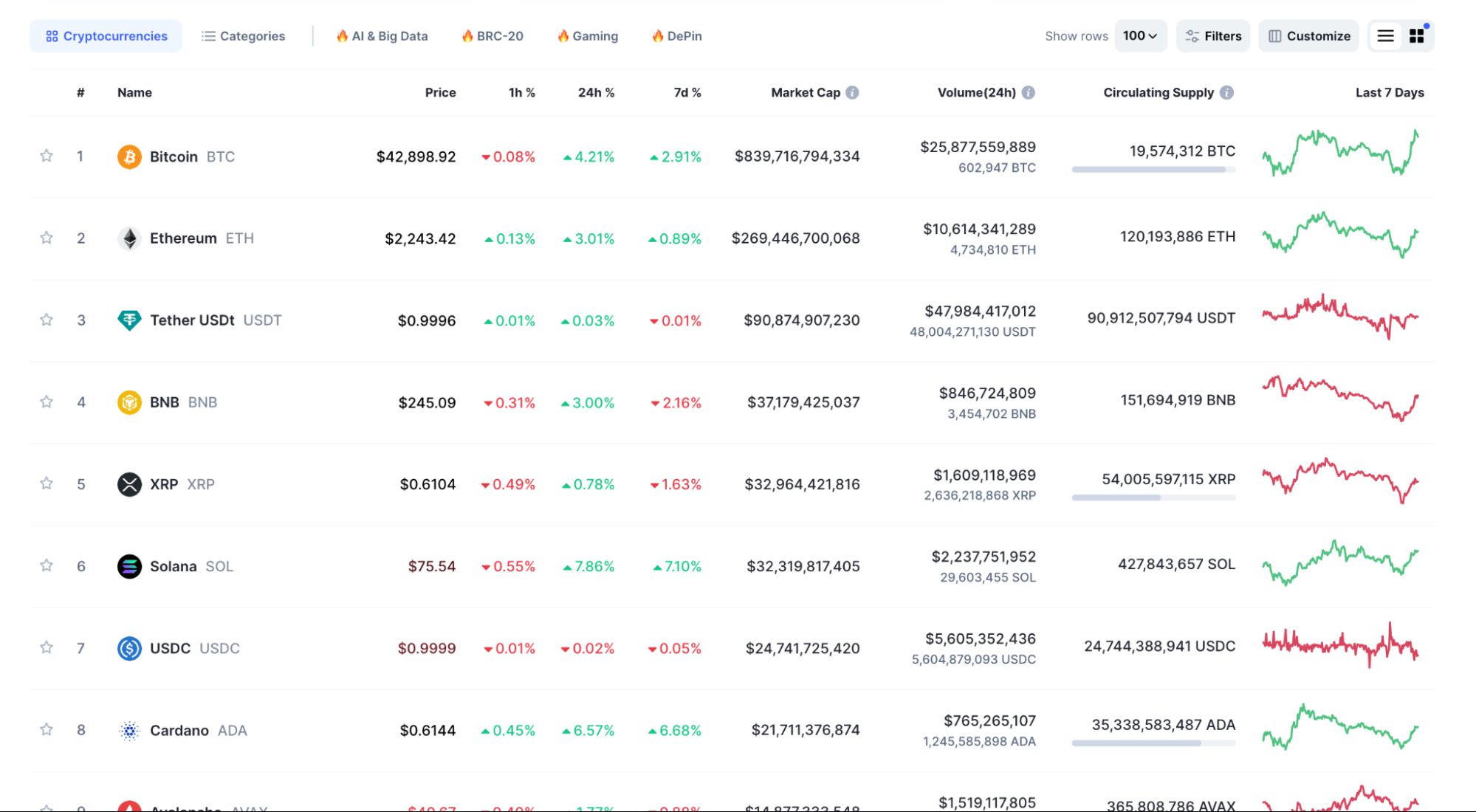

Market capitalization is a vital metric in crypto fundamental analysis, providing a quick snapshot of a cryptocurrency's market value. Calculated by multiplying the current price of a coin or token by its total circulating supply, the market cap offers insight into the size and significance of a cryptocurrency within the market. A higher market cap can indicate greater market adoption and stability, while smaller market caps may suggest higher potential for growth or, conversely, higher risk. However, the market cap should not be the sole factor in evaluating a cryptocurrency's worth, as it doesn't account for factors like token distribution or project maturity.

Source: CoinMarketCap

A Closer Look at Trading Volume and Price Movement in Fundamental Analysis

Trading volume and price movement are integral components of fundamental analysis in the cryptocurrency market. Trading volume, the total amount of a cryptocurrency traded in a given period, helps gauge the market's interest and liquidity in a particular asset. High trading volumes can indicate strong market interest or activity, while low volumes might suggest a lack of investor interest or a stagnant market.

The trading volume, a key liquidity indicator representing the total dollar value of all transactions in the last day, greatly influences investor confidence. Projects with a higher 24-hour volume are often seen as more reliable due to their active trading, which facilitates easier buying and selling of the asset. However, low liquidity can lead to significant price shifts from a single transaction. Short-term traders often focus on the price movement which is crucial for strategies aimed at buying low and selling high. This price not only aids in technical analysis but also reflects current market sentiment. Additionally, the price correlation with Bitcoin, often deemed the "safe haven" of the crypto market, is another vital metric. Assets with a high correlation to Bitcoin tend to yield more benefits in favorable market conditions. This correlation also helps traders in developing effective diversification and risk management strategies.

These metrics can reveal market sentiment and potential trends, although they should be analyzed in conjunction with other fundamental factors for a more comprehensive understanding.

Evaluating the Use Case of a Cryptocurrency Project

The use case of a cryptocurrency project is a cornerstone in its fundamental analysis. This involves examining the real-world applications and problems the project aims to solve. A strong, viable use case can be a significant indicator of a project's potential for adoption and success. Projects that address tangible needs, offer innovative solutions or tap into large and growing markets often have a competitive edge. The clarity, feasibility, and scalability of a project's use case are critical in assessing its long-term value and sustainability in the market.

When assessing the potential of a cryptocurrency project, several critical factors must be taken into account. Initially, the project's vision and background are paramount. It's essential to verify that the project has a feasible and compelling vision. The success of a cryptocurrency venture largely hinges on the team's capabilities. Factors such as the team members' experience in the crypto space, their prior achievements, and the team's overall cohesion are vital indicators of the project's potential for success. Despite numerous innovative ideas within the industry, only a select few possess the practicality and feasibility for actual implementation.

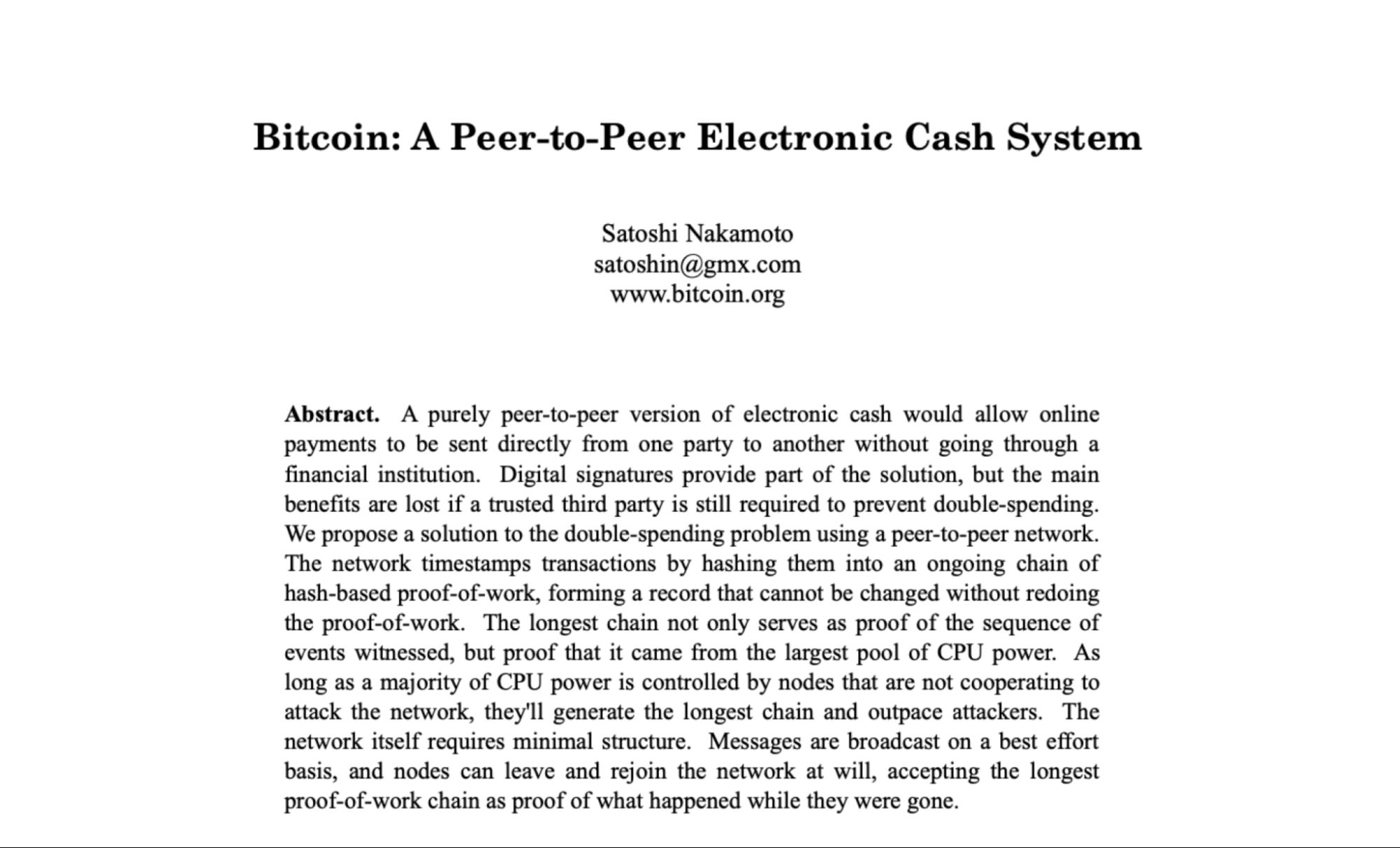

Another significant element to evaluate is the quality of the project's white paper. This document should comprehensively detail the project's goals, the problems it aims to address, its proposed solutions, tokenomics, and more. A well-constructed white paper is not only informative and accessible but also specific about the issues the project targets and the mechanisms of its proposed solutions. Conversely, white papers filled with jargon or lacking clarity might signal a project that isn't worth investing in.

BTC White Paper

Significance of Circulating Supply in Crypto Valuation

Circulating supply plays a crucial role in the valuation of cryptocurrencies. It refers to the number of coins or tokens that are publicly available and circulating in the market. Circulating supply is an important factor in determining a cryptocurrency's market cap and, by extension, its market perception and value. A limited supply can lead to higher demand and potentially higher prices, especially if the cryptocurrency has a strong use case and adoption. Conversely, a large circulating supply might dilute the value unless it's counterbalanced by significant demand or utility. Understanding circulating supply dynamics is essential for investors to gauge the potential price impact and investment attractiveness of a cryptocurrency.

Comprehensive Guide to Performing Fundamental Analysis

Embarking on the journey of fundamental analysis in cryptocurrency is akin to equipping yourself with a finely-tuned compass in a vast and often unpredictable digital terrain. This section of our guide serves as a comprehensive manual for performing nuanced and effective fundamental analysis. It's tailored to provide you with the analytical skills needed to dissect the complexities of the crypto market. From the very basics of market analysis to the advanced intricacies of valuation techniques, this guide illuminates every aspect of fundamental analysis.

Getting Start with Crypto Market Analysis

To start with crypto market analysis, one must first familiarize themselves with the unique dynamics of this digital marketplace. This involves understanding the fundamental principles of blockchain technology, the variety of cryptocurrencies available, and the factors that drive market movements. It's crucial to develop an awareness of how global events, regulatory changes, and technological advancements can impact the market. This foundation sets the stage for a more detailed analysis, allowing traders and investors to comprehend the broader economic and technological context in which cryptocurrencies operate. If you would like to learn more about Technical Analysis, you can refer to our guide here.

The Role of Fundamental Analysis Indicators in Understanding Crypto Assets

Fundamental analysis indicators are vital tools in unraveling the complexities of crypto assets. These indicators, including market capitalization, trading volume, token economics, and network activity, provide valuable insights into the health and potential growth of a cryptocurrency. A thorough understanding of these indicators helps in assessing the true value of crypto assets, beyond the often volatile market prices. They offer a more grounded approach to evaluating cryptocurrencies, enabling investors to make decisions based on substantive, data-driven insights.

Identifying an Undervalued Crypto Asset Through Fundamental Analysis

Identifying an undervalued crypto asset is one of the key objectives of fundamental analysis. This involves a meticulous evaluation of various factors such as the asset's market capitalization relative to its intrinsic value, the strength and feasibility of its use case, the robustness of its underlying technology, and the competence of its development team. An undervalued asset typically has strong fundamentals but is not yet fully recognized by the market. By spotting these discrepancies between market price and inherent value, investors can discover potential investment opportunities that others might overlook.

Numerous websites on the internet specialize in offering blockchain-related data with some services being paid and others partially free. These big data sources provide a wealth of valuable information. If utilized effectively, they can help you understand the patterns of cryptocurrency price fluctuations more easily than the average person. While these data might not predict exact price movements, certain indicators can reveal if a cryptocurrency is overvalued or undervalued. This information can serve as a signal for making informed purchase decisions.

Crypto Fundamental Analysis Checklist for Informed Investment Decisions

This checklist should include an examination of the market cap and circulating supply, as these provide a snapshot of the asset's market position and potential scarcity value. As mentioned earlier, reviewing the project's whitepaper is essential for understanding its purpose, technology, and roadmap. Considering regulatory and legal factors is also important, as they can significantly impact a cryptocurrency's future. Additionally, evaluating the community and social media presence gives insight into the project's popularity and user engagement. This checklist, when used diligently, equips investors with a holistic view of a crypto asset, aiding in the identification of promising investments and avoidance of potential pitfalls.

Benefits of Using Fundamental Analysis in Crypto Investing

Fundamental analysis in crypto investing stands as a cornerstone of sound investment strategy, offering a myriad of benefits that can significantly enhance the decision-making process. This critical approach goes beyond mere speculation, grounding investment choices in thorough, data-driven research. Fundamental analysis empowers investors with the ability to unearth the intrinsic value of cryptocurrencies in order to provide a clearer picture of their long-term potential. By focusing on factors such as technological innovation, market demand, and the strength of the development team, it helps in distinguishing robust investment opportunities from fleeting trends. This method also aids in risk mitigation, as it encourages a comprehensive understanding of each asset's strengths and vulnerabilities.

How Traders Use Fundamental Analysis for Investing in Cryptocurrencies?

Traders utilize fundamental analysis in cryptocurrency investing as a way to sift through the vast array of digital assets and identify those with the most promising future prospects. They delve into aspects such as the project or token’s volume, capitalization, and circulation, as well as the technology, scalability, and security of its network, and the real-world applications of its token. Traders also examine the team behind the project, their track record, and the level of community support. By analyzing these factors, traders can estimate the long-term viability and profitability of a cryptocurrency. This approach enables them to make more informed investment decisions based on the asset's fundamental value, rather than on short-term market fluctuations.

The Pros and Cons of Using Fundamental Analysis in Crypto Trading

The primary benefit of fundamental analysis lies in its ability to offer a thorough and detailed examination of the inner mechanics of cryptocurrencies, thereby reducing investment risk. It surpasses technical analysis by providing a more practical viewpoint, aiding investors in making better-informed choices. This approach enables the gathering and scrutiny of information beyond the market's internal dynamics, providing a clearer insight into actual market activities and a more comprehensive understanding of asset values. Fundamental analysis allows for a broader scope of action compared to technical analysis, as it informs medium- to long-term decision-making. On the other hand, technical analysis is more suited for frequent market engagement to adjust strategies based on its insights.

However, fundamental analysis has its limitations, particularly due to the highly volatile and complex nature of the cryptocurrency market, which often leads to less precise outcomes from such analysis. Conducting an effective fundamental analysis demands extensive knowledge and experience in accounting, business, and the specific sector of interest. In essence, fundamental analysis is more intricate than technical analysis and necessitates a longer investment horizon. This is because it requires more time and research, causing investors to wait for certain market conditions to determine buying or selling points. While offering a broader perspective of the cryptocurrency market, fundamental analysis can be overshadowed by opportunistic factors.

Conducting Accurate Future Price Prediction with Fundamental Analysis

This includes assessing the project's long-term roadmap, the potential market size for its application, and the effectiveness of its technology in solving real-world problems. Investors also consider the rate of adoption and network growth, as well as the overall market trends and economic factors. While fundamental analysis does not guarantee precise future price predictions, it provides a more informed and holistic view of a cryptocurrency's potential, enabling investors to make educated guesses about its future performance. To make accurate predictions, you might need to delve deeper into several factors below for better forecasting.

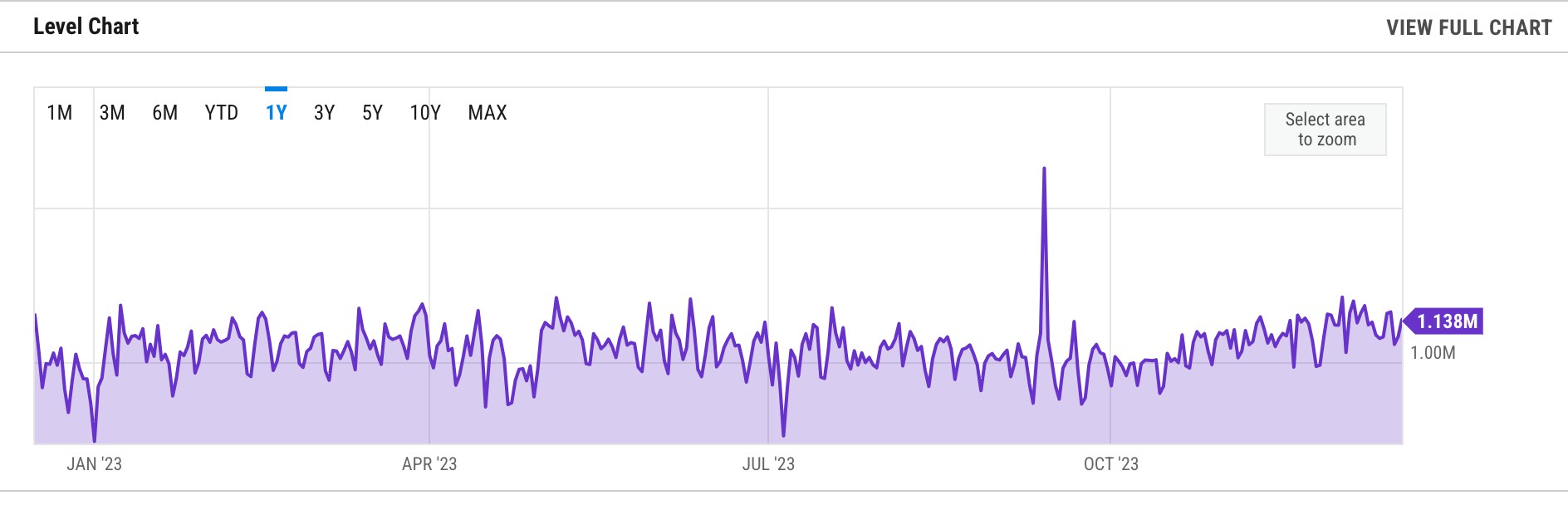

Transaction Amount

The transaction amount is a key indicator of the level of activity on a blockchain network. By analyzing the number of transactions over specific periods or using moving averages, one can track the fluctuation in network activity. However, caution is advised as this metric can be misleading, with potential scenarios like a single entity conducting multiple transactions between their wallets, falsely inflating the apparent activity.

Transaction Value

Distinct from transaction amount, transaction value measures the total value of transactions within a certain timeframe. For instance, if there were ten Ethereum transactions, each valued at $100 on a given day, the daily transaction volume would be $1,000. It can refer to the activity and value of certain projects and how people circulate this value.

Ethereum Transactions Per Day, source: YCHARTS

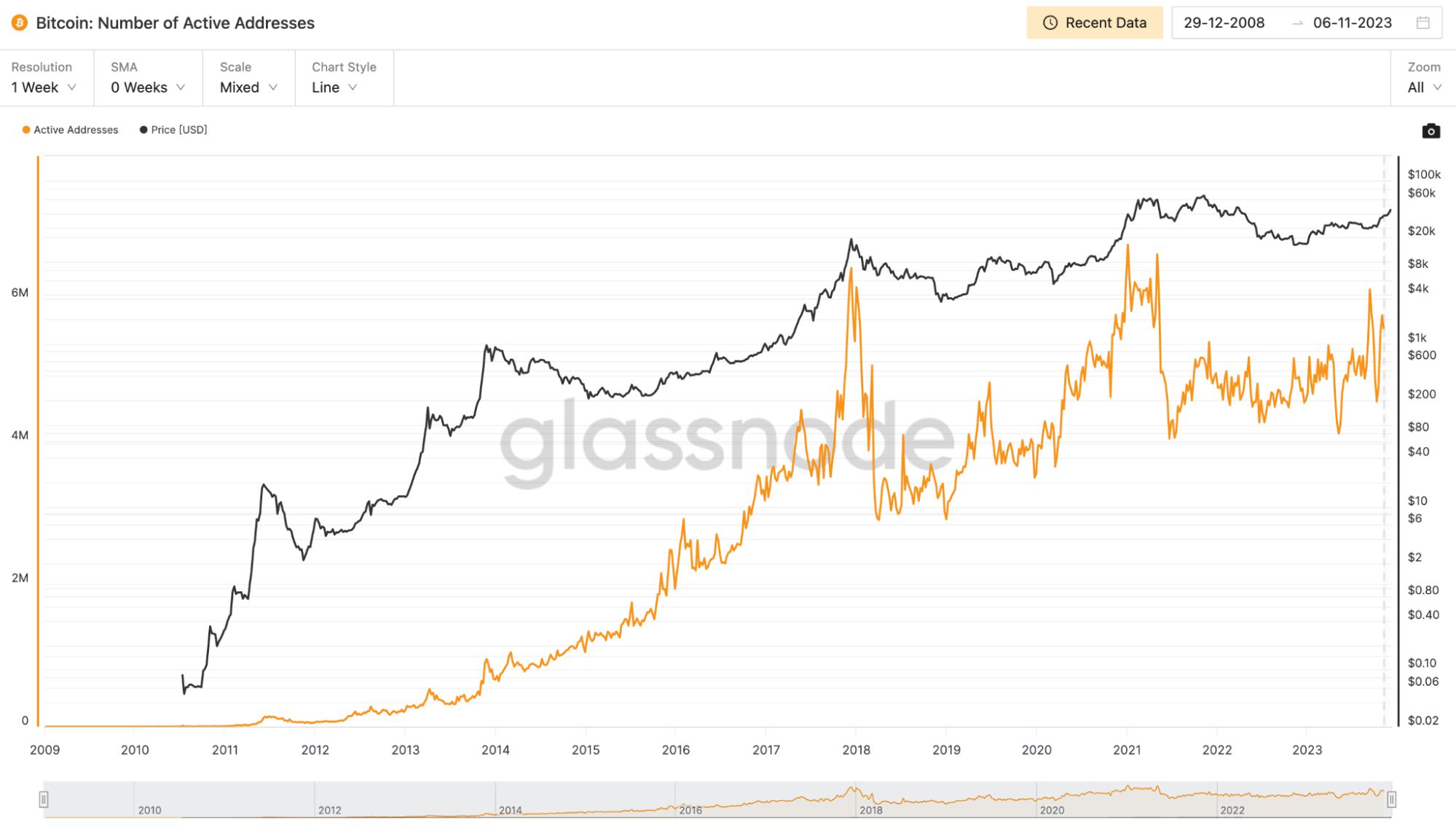

Active Addresses

Active addresses are those engaged in transactions during a specified period. Various methods exist for calculating this, one common approach being to count both sending and receiving addresses in each transaction. Some analyses also track the cumulative number of unique addresses over time.

Bitcoin: Number of Active Addresses, Source: Glassnode

Hash Rate and Amount Staked

Different blockchains use various consensus algorithms, which are central to network security. In Proof of Work (PoW) systems, the hash rate is a crucial health indicator. A high hash rate signifies a more secure network, resistant to attacks. It can also reflect the profitability of mining. Factors affecting mining costs include the cryptocurrency's price, transaction volume, fees, and direct operational costs like electricity and hardware.

In contrast, Proof of Stake (PoS) systems involve staking, where users lock in their own cryptocurrency to participate in block validation. Monitoring the amount staked can provide insights into the network's appeal or lack thereof to potential stakeholders.

How Fundamental Analysis Factors into Different Types of Cryptocurrency?

Fundamental analysis plays a crucial role in evaluating different types of cryptocurrencies, each with its unique characteristics and use cases. For example, when analyzing a utility token, the focus might be on the token's application within its respective platform and the demand for its use case. For security tokens, the emphasis would be on the underlying asset or business and its financial health. In the case of stablecoins, factors like the reserve assets and the mechanism for maintaining price stability are critical. This tailored approach in fundamental analysis allows investors to understand the specific factors that drive value for different types of cryptocurrencies, facilitating a more nuanced and effective investment strategy.

Crypto Fundamental Analysis Tools: Resources for Efficient Research

Having the right tools for fundamental analysis is akin to possessing a treasure map in a vast digital landscape. This section introduces a suite of reliable and powerful tools and resources, each meticulously designed to aid in the fundamental analysis of cryptocurrencies. These tools range from blockchain explorers, which provide real-time data on transactions and wallet activities, to sophisticated platforms offering in-depth market analysis, social media sentiment analysis, and historical data trends. Moreover, we explore specialized software that gives insights into on-chain metrics, such as transaction volumes, wallet addresses, and token distribution, crucial for gauging the health and activity of a cryptocurrency's network.

Novice analysts interested in on-chain analysis can start by using a blockchain explorer. Although on-chain analysis might seem intricate and intimidating, it can be as straightforward as observing the different explorers like Etherscan or BscScan to check for increasing or decreasing transaction volumes.

Accessing this on-chain data can be achieved more efficiently by utilizing specialized websites or APIs designed to facilitate investment decisions. For example, traders commonly refer to information resources such as CoinMarketCap's on-chain analysis. Other valuable resources include data charts from Glassnode and DeFi information from DeFiLlama. Additionally, project reports can be found at FameEX Research.

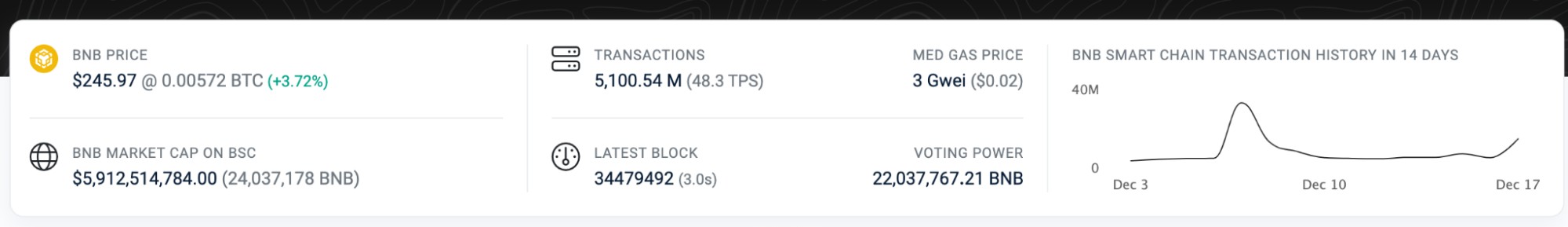

CoinMarketCap's on-chain analysis

CoinMarketCap: A website globally recognized for tracking cryptocurrency prices, stands as a pivotal resource in the ever-expanding domain of digital currencies. The platform is dedicated to facilitating the discovery and efficient utilization of cryptocurrencies on a worldwide scale. It achieves this by providing retail users with impartial, high-quality, and precise information, enabling them to make well-informed decisions in the crypto market. CoinMarketCap provides user knowledge and understanding of crypto assets through reliable and comprehensive data.

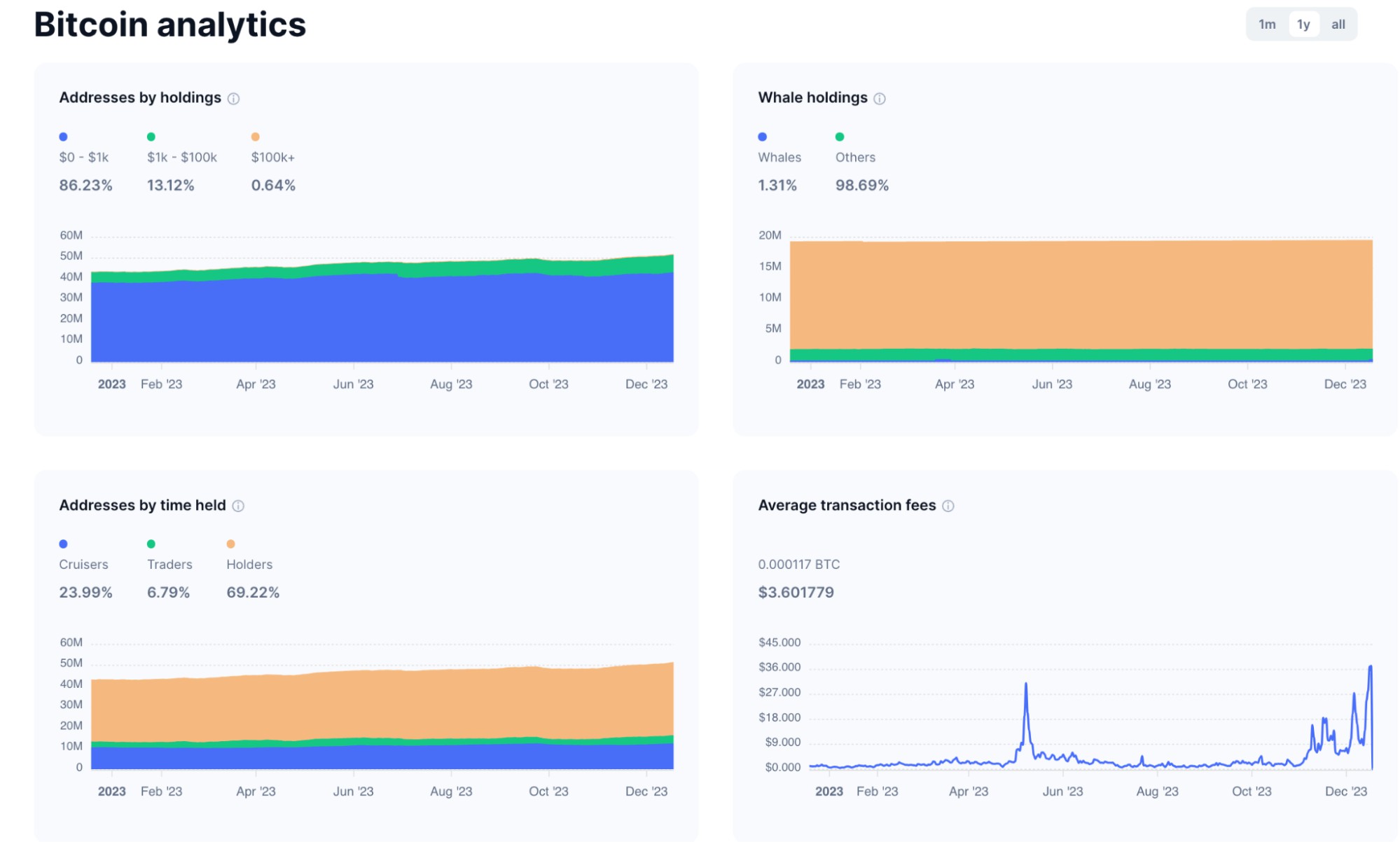

BTC from Glassnode

Glassnode: On-chain analysis examines the publicly available data on blockchain networks, focusing specifically on cryptocurrencies. This emerging field allows traders to analyze market trends and sentiments by understanding the actions of various market players. For example, traders can determine why different entities like miners and hedge funds buy or sell cryptocurrencies, such as miners selling to cover expenses or hedge funds realizing profits.

Traders utilize various indicators like wallet balances, how long coins have been inactive, and the volume of transactions to make informed decisions. Glassnode, a prominent tool in on-chain analysis, provides valuable insights. For instance, a recent Glassnode chart illustrates a notable shift in Bitcoin ownership. There's been a decrease in the proportion of Bitcoin held by miners and large holders, while the holdings of everyday investors have risen significantly. This trend indicates an increasing decentralization of the Bitcoin network.

Glassnode's data helps traders assess the impact of different market participants on Bitcoin's price. Rafael Schultz-Kraft, the co-founder and CTO of GlassNode, noted a significant growth in Bitcoin whales and their holdings since 2020, implying a surge in interest from institutional investors, funds, family offices, and high-net-worth individuals (HNWIs).

Key on-chain metrics that offer insights include the number of active addresses, transaction count, on-chain volume, hash rate, miner revenue, total value locked (TVL), market value to realized value (MVRV), network value to transactions (NVT), and realized cap. These indicators are crucial for understanding market dynamics and making strategic investment decisions.

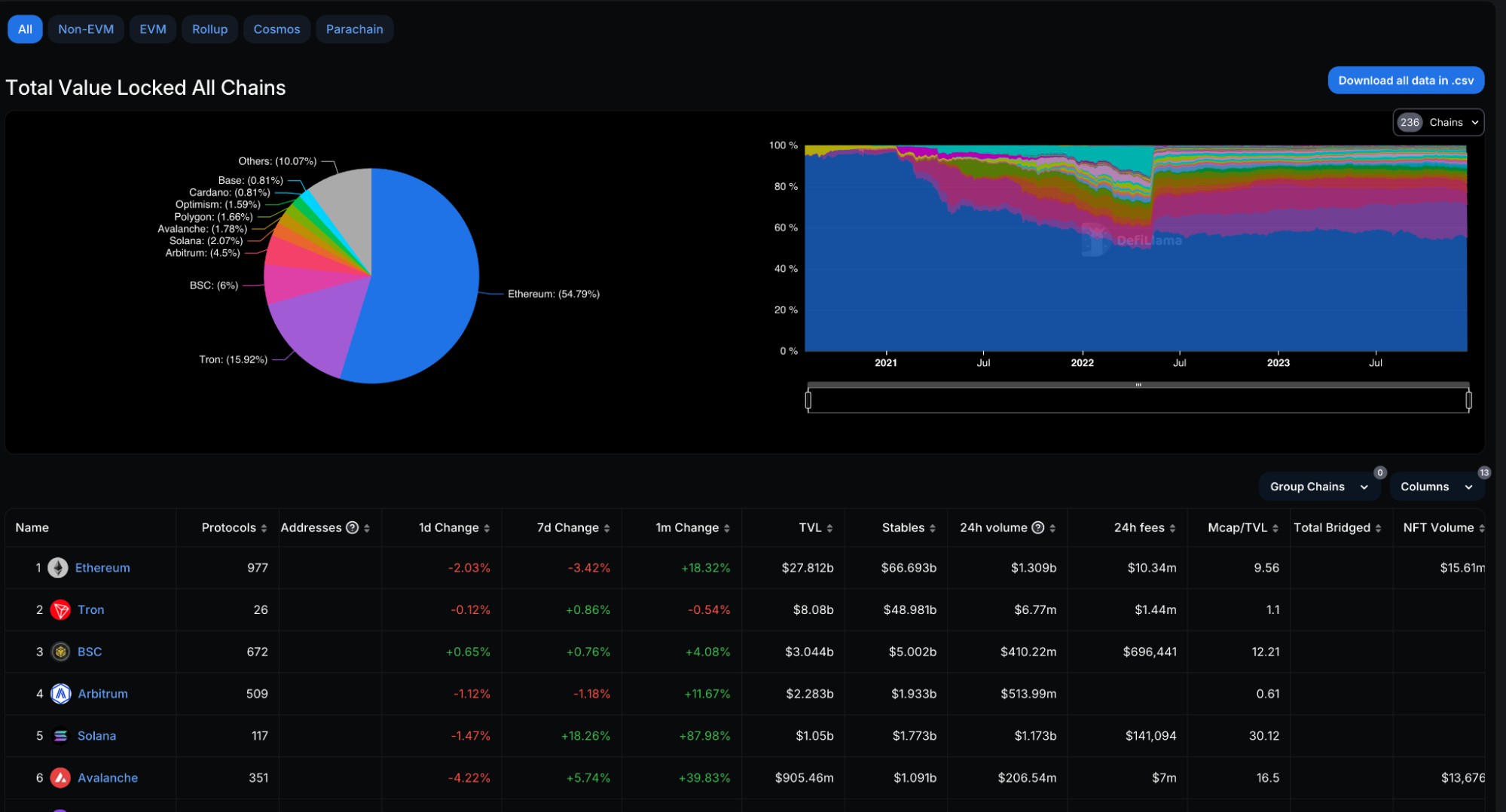

TVL all chains from DeFiLlama

DefiLlama: This is a comprehensive analytics platform that specializes in aggregating total value locked (TVL) data. It serves as an essential tool for fundamental analysis in the cryptocurrency and blockchain sector. This platform provides crucial insights into various projects, including major names like Ethereum, Tron, and BSC. Users can access detailed information about stablecoins linked to these projects, along with their transaction volumes and fundraising amounts. Moreover, DefiLlama extends its capabilities to cover both prominent and lesser-known oracles and forks. Oracles in this context refer to mechanisms that bridge blockchain-based data with external information sources, while forks represent divergences or modifications in open-source blockchain code.

Another key feature of DefiLlama is its ability to provide data on token usage and associated expenses. This information is vital for understanding a token's adoption level and its practicality in terms of use and liquidity. Tokens with limited adoption might pose challenges in usage and liquidation compared to more widely accepted ones. It offers the opportunity to explore and discover lesser-known projects. This can be particularly beneficial for those looking to invest or engage in projects that align with their interests but are not yet mainstream. Overall, DefiLlama stands out as a fundamental analysis tool in the decentralized finance space, offering diverse and in-depth data crucial for informed decision-making.

Conclusion

Fundamental analysis emerges as a beacon of clarity and insight. We've explored the various dimensions of using fundamental analysis in crypto trading, from understanding its core principles to leveraging specialized tools for in-depth research. We've highlighted the importance of key aspects such as financial metrics, market capitalization, and project use cases, each playing a pivotal role in assessing the true value of digital assets. It's clear that fundamental analysis is not just a tool but an essential framework for anyone serious about navigating the volatile waters of the crypto market. It empowers traders and investors with the knowledge to make decisions grounded in substantive, data-driven insights. This approach helps in distinguishing between fleeting market trends and cryptocurrencies with genuine, long-term potential. By understanding the intricacies of each asset and the market as a whole, investors can mitigate risks and position themselves for sustainable growth and success in the world of cryptocurrency. Remember, in a market as fluid and fast-paced as crypto, being equipped with the right knowledge and tools is not just an advantage, but a necessity.

FAQ About Fundamental Analysis Crypto

Q: How to do fundamental analysis in crypto?

A: To perform fundamental analysis in crypto, start by researching the cryptocurrency's underlying technology, project goals, and team expertise. Evaluate the market demand, use case, and real-world application of the token. Examine financial metrics like market capitalization, trading volume, and token distribution. Also, stay informed about regulatory changes and the community and social media presence surrounding the project. This comprehensive approach helps in assessing the intrinsic value and long-term potential of the cryptocurrency.

Q: Does fundamental analysis work on crypto?

A: Yes, fundamental analysis works on crypto. It provides a deeper understanding of a cryptocurrency's value beyond just market speculation. By evaluating factors such as technology, team, market demand, and regulatory environment, investors can gain insights into the long-term viability and growth potential of a cryptocurrency. Fundamental analysis helps in making informed decisions, especially important in the volatile and rapidly evolving crypto market.

Q: How can I use fundamental analysis to inform my crypto trading strategies?

A: Fundamental analysis can inform your crypto trading strategies by helping you identify cryptocurrencies with strong fundamentals and long-term growth potential. Use it to evaluate the health and viability of a project, understand market trends, and assess the potential impact of external factors like regulations.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.