Ethereum Price Data Indicates A Robust Resistance Level Around $3.5K

2024-04-24 17:49:35

Investor interest in Ether remains tepid amid declining expectations for the approval of a spot ETH ETF.

Source: www.tarlogic.com

An analyst proposes that Ether's price weakness relative to Bitcoin is due to a dearth of fresh fundamentals, as the Ethereum native token lacks a compelling new narrative and inflows. Ethereum (ETH) experienced a notable decline of 14.8% from April 13 to April 14, bringing its price down to $3,241. Since then, it has consistently traded below $3,300. Whenever ETH approached the $3,000 mark, buyers stepped in to reinforce the support level. Despite this, concerns persist among some traders about Ethereum's ability to surpass the $3,500 threshold without a more compelling narrative.

Ethereum Grapples With Ongoing Regulatory Ambiguity

In the past two months, Ether has lagged behind Bitcoin by 16%, a trend exacerbated on April 9 when Jan van Eck, the chief investment officer of VanEck investment firm, suggested that U.S. requests for a spot Ether ETF might face 1 / 1 does not fit U.S. legal definitions of a securities exchange or broker. rejection in May. This comes after a period of inaction by the U.S. SEC on seven pending applications for spot Ether ETFs. Despite Ether being classified as a non-security asset, ongoing disputes between regulators and exchanges have dampened investor sentiment toward the broader Ethereum ecosystem, including layer-2 solutions, decentralized finance, and (NFT) marketplaces.

On April 11, Uniswap Labs announced its readiness to contest a potential enforcement notice from the U.S. Securities and Exchange Commission (SEC). While Uniswap Labs did not disclose the specifics of the Wells notice, it asserted in a blog post that UNI was not a security and emphasized that its platform does not fit U.S. legal definitions of a securities exchange or broker.

Meanwhile, there are signs of change in the regulatory landscape. Michael Welsh and Joseph Watkins, lead SEC attorneys in the lawsuit against crypto platform DEBT Box, resigned on April 22 following a Bloomberg report that revealed "gross abuse" of power in the case.

Furthermore, the Blockchain Association and the Crypto Freedom Alliance of Texas have filed a lawsuit against the SEC in the Northern District of Texas. They aim to challenge the regulator's broad interpretation of the term "dealer" within the Securities Exchange Act of 1934, arguing that this expansion creates an unclear and burdensome regulatory environment for digital asset businesses.

Ether's On-Chain and Derivatives Data Present Different Narratives

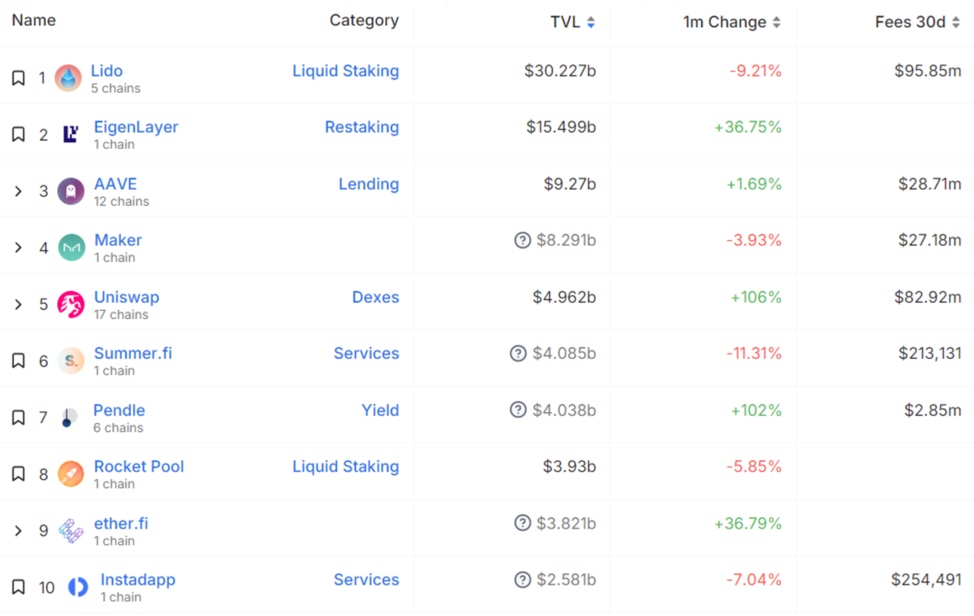

On April 23, Ether surged above $3,200, driven by growing demand for Ethereum decentralized applications (DApps). Exchanges reported that the network's smart contract deposits, measured by total value locked (TVL), hit their highest level since July 2022, reaching 30.2 million ETH on April 22, indicating an 8% increase from the prior month.

Top Ethereum DApps Ranked by TVL in USD, Source: DefiLlama

Between April 9 and April 18, the skew metric for Ether options indicated a decrease in risk aversion among traders. However, this trend shifted on April 19 when ETH fell below $3,000. Current data shows an equilibrium between call (buy) and put (sell) options, reflecting neutral market sentiment. On-chain metrics and data from ETH derivatives show resilience despite Ether's recent challenges in sustaining the $3,000 support level. Still, it appears too early to expect a bull run that exceeds $3,500, especially with the subdued investor excitement around the potential approval of a U.S. spot Ethereum ETF.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.