FameEX Weekly Market Trend | October 28, 2024

2024-10-28 17:24:40

1. BTC Market Trend

From October 24 to 27, the BTC spot price swung from $65,548.34 to $68,762.39, a 4.9% range.

In the last four days, key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On October 24, according to the Fed’s Beige Book, since early September, economic activity in nearly all regions has remained mostly unchanged, with manufacturing activity declining in most regions.

2) On October 25, Fed’s Harker stated that the Fed policy has helped ease inflationary pressures, with long-term inflation expectations stabilized. Inflation is reasonably expected to decrease further, though geopolitical events could potentially reverse this trend.

3) On October 24, ECB, President Lagarde: “We need to remain cautious.”

Chief Economist Lane was confident in the progress of inflation reduction.

Governor Centeno stated that a 50-basis-point rate cut could be considered at the next meeting; inflation is under control.

Governor Holzmann said that December rate cuts are unlikely, but if they occur, a 25-basis-point cut might happen.

Executive Board Member Panetta indicated that the possibility of rates below neutral cannot be ruled out, with ECB targets expected well before the second half of 2025.

Governor Escrivá believed that inflation risks remain balanced, with the main forecast for inflation to converge with targets next year.

Governor Vasle indicated that rates should continue to decrease “moderately”; there is no urgent need to talk about inflation targets not being met. Lowering rates below neutral is not a priority.

4) On October 25, ECB Governor Wunsch stated that at this stage, there’s no need to discuss a 50-basis-point rate cut.

Kazaks highlighted that economic issues are the primary concern; no need for rates significantly below neutral.

Governor Müller suggested that a moderate rate cut is the best policy choice.

Governor Nagel was confident in achieving inflation targets by mid-next year.

Chief Economist Lane stated that the service sector remains strong but is slowing, and inflation will return to target levels by 2025.

In the UK’s case involving 60,000 laundered Bitcoins and China’s illegal fundraising case of 43 billion RMB by Tianjin Lantian GeRui, the main defendant, Qian Zhimin (transliterated, alias Zhang Yadi), pleaded not guilty to all money laundering charges during his trial at London’s Southwark Crown Court. Some investors from Lantian GeRui sent representatives to attend the trial and commissioned a cross-border asset dispute legal team to observe. The appointed lawyers have filed a civil claim on behalf of creditors in the UK High Court.

The UK Crown Prosecution Service (CPS) announced on October 22 that it would inform Chinese victims that it had initiated a civil recovery process for assets frozen in the UK from Qian Zhimin and others earlier this year. According to the process, after reaching the progression stipulated by Section 281 of the Proceeds of Crime Act 2002, international proceedings will commence. The CPS filed a civil recovery application with the High Court earlier this year. If no other individual or entity claims rights to the criminal assets, half of the 60,000 Bitcoins will be awarded to the UK police, and the other half to the Home Office. This is intended to facilitate the handling of proceeds from crime and prevent further offenses.

According to Blockworks Research, after setting an all-time high on October 22, Solana’s fee revenue broke records again on October 23, reaching nearly $8.7 million, up from just under $8 million the day prior. This amount includes all revenue sources, such as base fees, priority fees, and tips. In July, Solana’s weekly total fee revenue surpassed Ethereum’s for the first time, with Solana generating about $25 million weekly compared to Ethereum’s $21 million.

From October 28 to October 30, keep an eye on ETH spot trading opportunities. Maintain the sell orders at $3,425 and $5,040, as well as the buy orders at $1,730 and $2,040. For the BTC spot, it is recommended to keep the sell orders at $72,120, $79,870, and $96,820. In addition, maintain the buy orders at $36,720 and $45,900.

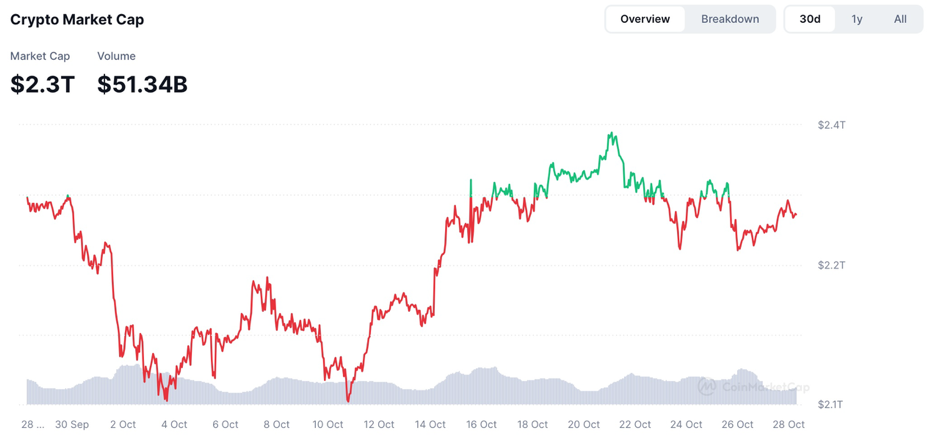

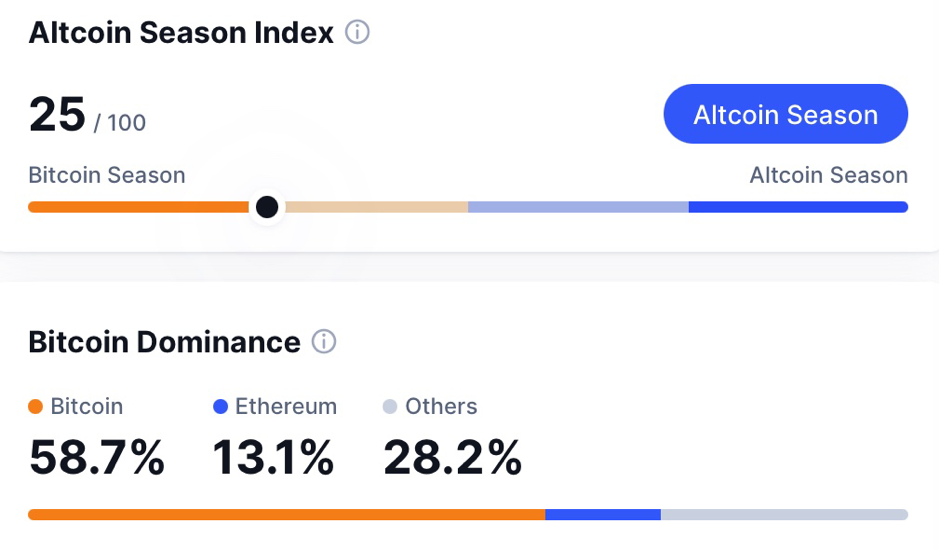

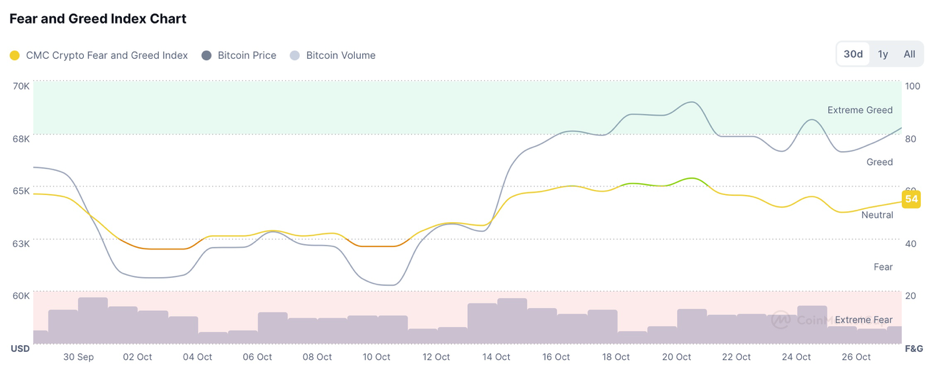

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

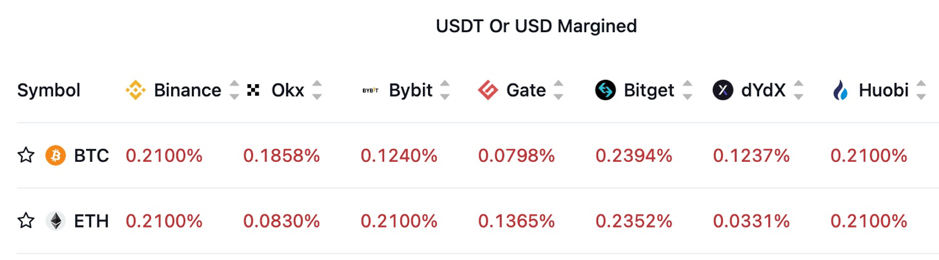

Funding fees for mainstream coins on major exchanges have remained positive over the past 7 days, with a bull market trend becoming widely accepted. The market is primarily driven by leveraged long positions.

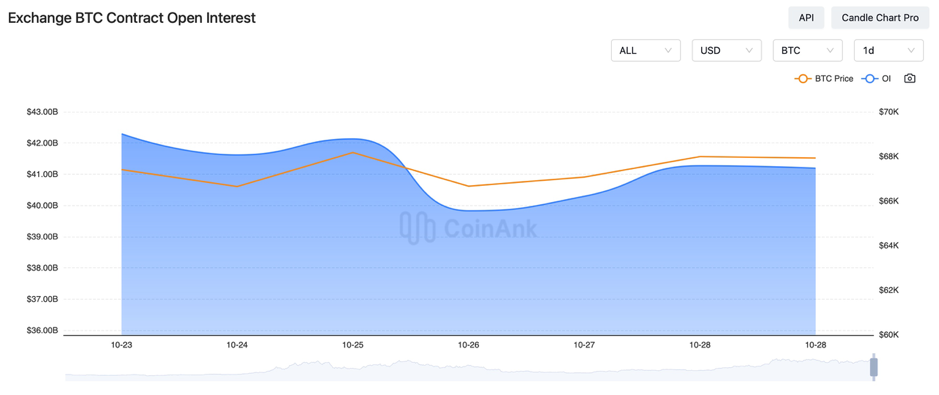

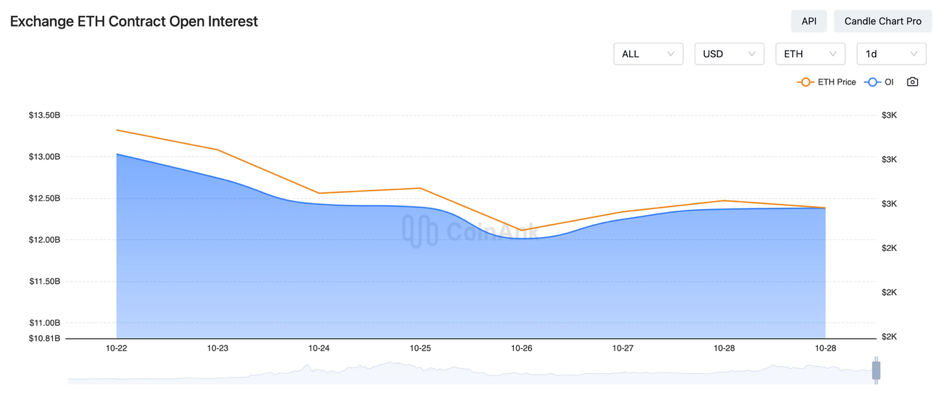

In the past four days, the open interest for BTC and ETH contracts has been slowly declining.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On October 24, in the week ending October 19, the number of initial jobless claims in the U.S. recorded 227,000, the lowest since the week of September 28, 2024.

2) On October 24, French President Macron declared that France would provide €100 million in humanitarian aid to Lebanon. The meeting will support the recruitment of 6,000 new soldiers for the Lebanese army.

3) On October 24, the Bank of Canada significantly cut interest rates by 50 basis points, with the swap market estimating a 25% probability of another 50-basis-point cut in December. Bank of Canada Governor Macklem stated that further rate cuts are expected, though the timing and extent remain to be determined.

4) On October 24, a financial system report from the Bank of Japan (BoJ) indicated that the BoJ has a sufficient capital base and stable funding to withstand various stress events. Governor Ueda Kazuo is assessing future policy normalization and the allocation of rate hikes. Clarifying Japan’s monetary policy strategy is vital to prevent excessive yen carry trade accumulation.

5) On October 24, Bank of England Governor Bailey stated that the anti-inflation process in the UK is proceeding faster than officials expected, which could be a hint that the central bank may continue to lower rates next month. The September inflation drop below target was mainly affected by the “base effect”. Monetary Policy Committee member Mann noted that inflation is expected to rise significantly in the future.

6) On October 25, the U.S. announced a $20 billion loan to Ukraine, while the European Council approved a €35 billion loan to Ukraine.

7) On October 25, Arkham reported that a U.S. government wallet address is suspected to have been attacked, resulting in approximately $20 million being transferred to the attacker’s address. Additionally, the on-chain total holdings of the U.S. spot Bitcoin ETF have exceeded 1 million BTC.

8) On October 25, it was reported that Microsoft’s December shareholder meeting would consider a Bitcoin investment proposal, with the board recommending a vote against it. Microsoft CEO’s total compensation for 2024 is nearly $80 million, up from $48.5 million in 2023.

9) On October 25, the Pennsylvania House of Representatives passed a bipartisan bill aimed at providing regulatory clarity for digital assets. Musk has donated over $132 million to support Trump’s and Republican allies’ elections. ConsenSys sent a letter to the future U.S. president, urging the establishment of clear cryptocurrency regulations.

10) On October 25, an executive from a major exchange was released in Nigeria. The U.S. and Nigeria have formed a bilateral liaison group to consolidate resources to combat cryptocurrency-related crime.

11) On October 26, data showed that the President of El Salvador donated 2 BTC to help Honduras raise funds to build 1,000 schools.

12) On October 26, the U.S. SEC listed “registrants providing cryptocurrency-related services” as a key focus in its 2025 review priorities. U.S. prosecutors are advocating for a reduced sentence for FTX executive Nishad Singh due to his cooperation and good behavior.

13) On October 26, over 100 Israeli warplanes participated in attacks on Iran, including advanced F-35 stealth fighters, targeting military objectives. According to Israeli media, following three waves of airstrikes, Israel’s operation against Iran has concluded, named the “Day of Atonement”.

14) On October 26, an IMF senior official stated that as the Fed begins to cut rates, most Asian central banks have room to lower rates, alleviating concerns among regional policymakers. It is now expected that the Bank of Japan’s policy rate will reach 1.5% by 2027.

15) On October 26, the former acting director of the White House Office indicated that cryptocurrency is an industry that “breaks the U.S. political mold”, appealing to both parties.

16) On October 27, Mu Changchun, Director of the Digital Currency Research Institute of the People’s Bank of China, announced systematic enhancements to currency bridge technology, focusing on three key aspects.

17) On October 27, according to 10x Research, Bitcoin may regain upward momentum after the market digests higher bond yields.

18) On October 27, it was reported that Japan is considering approving cryptocurrency ETFs. South Korea plans to strengthen regulation of cross-border cryptocurrency trading. Denmark plans to propose taxing unrealized cryptocurrency gains in upcoming legislation.

19) On October 27, China’s Alibaba Group agreed to pay 3 billion RMB to settle a collective lawsuit by U.S. shareholders, denying any wrongdoing.

20) On October 27, U.S. researchers claimed that Israeli attacks had destroyed key equipment at Iran’s missile bases. Khamenei responded to the Israeli attacks for the first time: Iran’s power and determination should be shown to the enemy. According to the Islamic Republic News Agency (IRNA), the Speaker of Iran’s Parliament stated that Iran would definitely respond to Israel's recent provocations.

21) On October 27, Next Wednesday, the U.S. will release the October ADP employment figures and the preliminary GDP for the third quarter. Next Thursday, initial jobless claims in the U.S. and the BoJ’s interest rate decision and outlook report will be published. Next Friday, the U.S. will announce the October adjusted non-farm payroll and unemployment rate.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.