FameEX Weekly Market Trend | October 21, 2024

2024-10-21 19:08:55

1. BTC Market Trend

From October 17 to 20, the BTC spot price swung from $66,647.88 to $69,354.45, a 4.06% range.

In the last three days, key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On October 18, The Fed’s latest tool showed ample reserve levels, suggesting that the quantitative tightening (QT) plan could continue.

Fed Governor Waller stated that DeFi could significantly impact financial market transactions, stablecoins may offer benefits for payments, but technologies like smart contracts and DLT are not yet fully capable of achieving financial decentralization.

ECB Governing Council member Villeroy indicated that the 2% inflation target should be reached by 2025, earlier than previously expected.

2) On October 19, Fed’s Bostic indicated that a sharp rate cut for the first time would be appropriate and expressed strong satisfaction with this. The Fed will act aggressively if inflation rises, and inflation is expected to reach 2% by the end of 2025.

3) On October 18, ECB Governing Council member Makhlouf did not believe the ECB should lower rates more quickly.

Governing Council member Müller stated that economic growth would be more moderate, with risks still present in services and wages.

Governing Council member Vasle indicated that the ECB would decide on rate policy at each individual meeting, expecting inflation to accelerate for the remainder of 2024.

Villeroy stated that further rate cuts may be possible.

Key takeaways from the ECB Rate Decision and Lagarde’s Press Conference

ECB Rate Decision:

1) Interest Rates: Deposit facility rate lowered from 3.5% to 3.25%. The main refinancing rate was adjusted from 3.65% to 3.4%, and the marginal lending rate from 3.9% to 3.65%.

2) Rate Outlook: Reaffirmed there is no pre-commitment to a specific rate path and will maintain restrictive policy as necessary. Decisions will continue to be data-dependent and made on a meeting-by-meeting basis.

3) Inflation Assessment: The anti-inflation process is progressing smoothly. Inflation is now expected to reach the 2% target by 2025 (previously forecasted for the second half of 2025).

4) Quantitative Tightening: The ECB plans to end reinvestments under the Pandemic Emergency Purchase Programme (PEPP) by the end of 2024.

5) Market Influence: EUR/USD rose slightly by over 10 pips after the rate decision.

STOXX Europe 600 Index pared its gains. Traders’ expectations for a 25 basis point rate cut in December remained stable.

Lagarde’s Press Conference:

1) Rate Outlook: No doors have been opened for any specific actions; restrictive measures will end at an appropriate time, but that time has not yet come.

Inflation Outlook:

2) Inflation Outlook: Downside risks to inflation outweigh upside risks, with inflation expected to fall to target levels within the next year.

3) Economic Outlook: Growth risks are tilted to the downside, with a focus on the possibility of a soft landing.

4) Labor Market: Surveys indicate a slowdown in employment growth.

The U.S. Department of Justice (DOJ) announced that the FBI arrested an Alabama man accused of being involved in the January 2024 SEC X hacking incident, which led to a sharp rise in Bitcoin’s value. The hacker reportedly profited illegally and manipulated the market through the incident. It is said that the Alabama man, suspected of hacking the SEC through a SIM-swapping attack in January 2024, searched for terms such as “SECGOV hack”, “how to know if the FBI is investigating you”, and “signs you’re under FBI or law enforcement investigation without notification” following the hack.

On October 19, local time, Elon Musk announced at an event in Pennsylvania that from that day until the U.S. election on November 5, he would randomly give $1 million daily to a registered Pennsylvania voter who signs the “America PAC” petition. The first winner was announced that same day. Earlier, on Tuesday, federal documents revealed that Musk had donated $75 million in the third quarter of the year to the “America PAC”, which supports Donald Trump’s presidential campaign.

On October 20, Vitalik released the third part of Ethereum’s future development protocol, The Scourge, outlining two key objectives:

1) Minimizing the centralization risks of Ethereum’s staking layer, particularly in block construction and capital supply (MEV and staking pools).

2) Reducing the risk of extracting excessive value from users.

Vitalik emphasized that addressing the issues of centralized block construction, staking centralization driven by economic incentives, the 32 ETH minimum staking requirement, and hardware demands would help further decentralize Ethereum.

Earlier in December 2023, Vitalik unveiled an updated 2023 Ethereum roadmap, which includes six phases: The Merge, The Surge, The Scourge, The Verge, The Purge, and The Splurge.

From October 21 to October 23, keep an eye on ETH spot trading opportunities. Maintain the sell orders at $3,425 and $5,040, as well as the buy orders at $1,730 and $2,040. For the BTC spot, it is recommended to keep the sell orders at $72,120, $79,870, and $96,820. In addition, maintain the buy orders at $36,720 and $45,900.

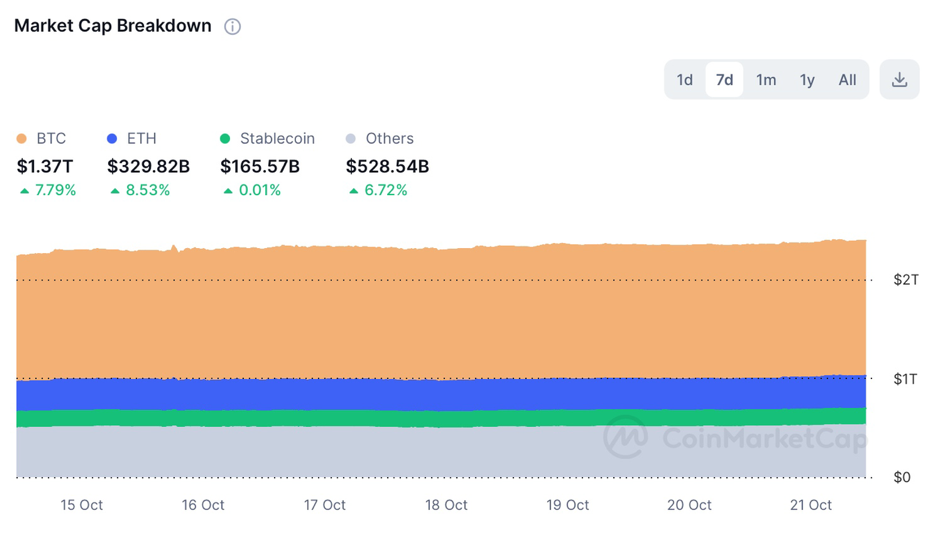

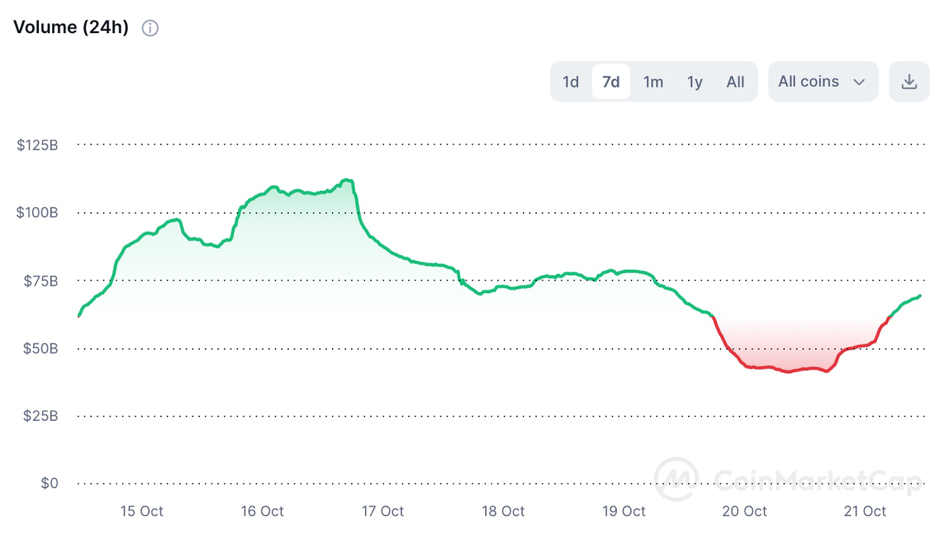

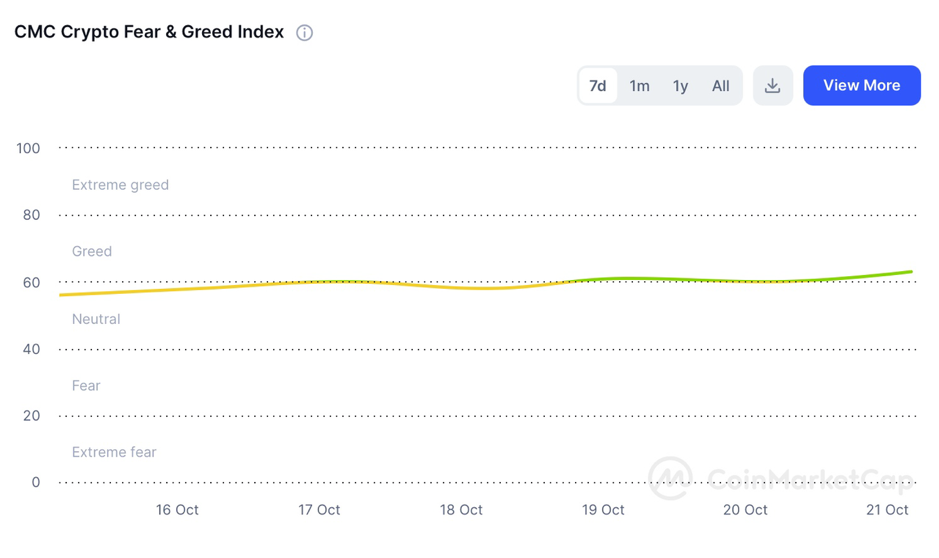

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

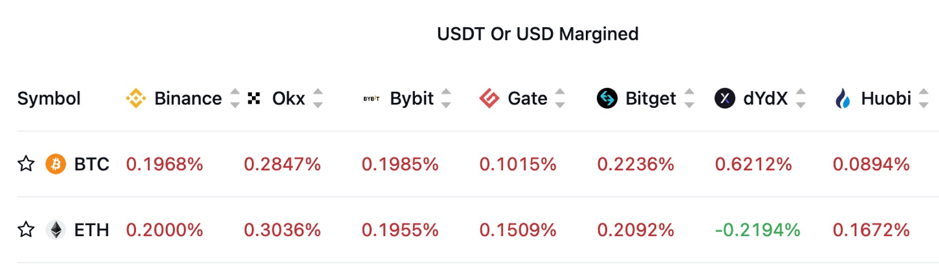

3. Perpetual Futures

The 7-day cumulative funding rates for mainstream cryptocurrencies across major exchanges are generally positive, indicating that the market is still dominated by the bulls.

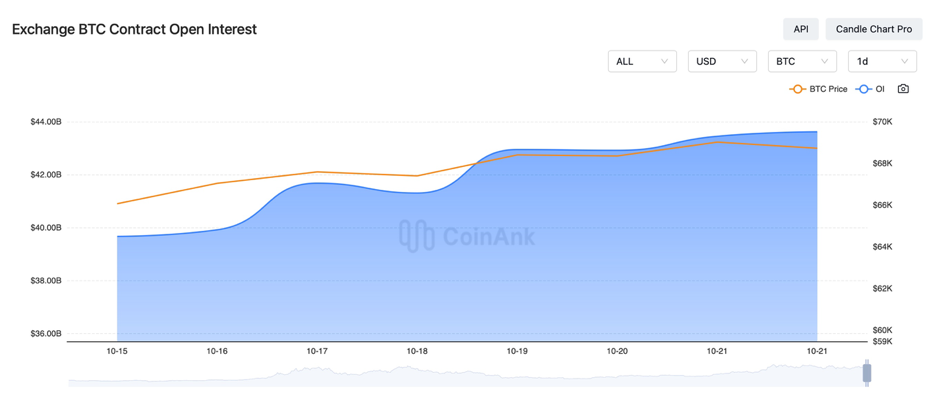

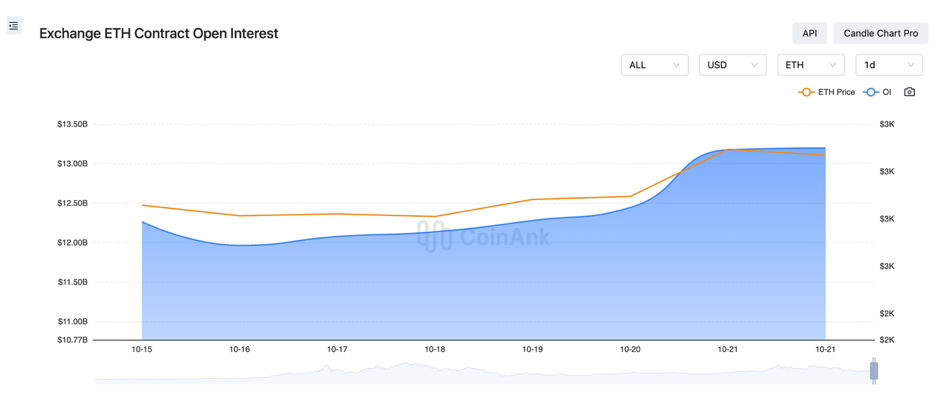

In the past four days, open interest in BTC and ETH contracts has seen a slight increase.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On October 17, U.S. initial jobless claims for the week ending October 12 were 241,000, below expectations of 260,000, with the previous figure revised from 258,000 to 260,000.

2) On October 17, Eurozone CPI for September came in at -0.1% month-over-month, in line with expectations. Year-over-year CPI was 1.7%, slightly below the forecast of 1.8%.

3) On October 17, Vietnam’s central bank vice governor stated that there is no forex shortage and they are open to considering a rate cut. Chile’s central bank cut interest rates by 25 basis points to 5.25%.

4) On October 17, China’s “National Blockchain Network Technology White Paper” introduced a “Cross-chain Innovation Consortium” to form a connected blockchain network.

5) On October 17: A poll in El Salvador revealed that 92% of citizens have not used Bitcoin for transactions, with only 1.3% viewing Bitcoin as the country’s future economic direction.

6) On October 18, U.S. Treasury Secretary Janet Yellen said that despite inflation nearing the Fed’s target, high living costs still burden American households.

7) On October 18, People’s Bank of China Governor Pan Gongsheng suggested that the reserve requirement ratio could be cut by 0.25-0.5 percentage points by the end of the year, depending on liquidity conditions. The loan prime rate (LPR), to be announced on the 21st, is also expected to decrease by 0.2-0.25 percentage points.

8) On October 18, 76% of family offices and high-net-worth individuals across 80 Asian firms were involved in digital assets, with another 18% planning future investments.

9) On October 18, according to MoonPay, Venmo U.S. users can now purchase cryptocurrencies via MoonPay; DBS Bank launched a “Token Service” for blockchain-based banking; Thailand’s SCB Bank is set to launch a stablecoin cross-border payment service.

10) On October 19, following the death of Hamas leader Sinwar, the U.S. pushed for a ceasefire in Gaza. Iran stated that his killing would strengthen the region’s “spirit of resistance”. Meanwhile, Israel reported the destruction of Hezbollah’s central underground command center in Lebanon.

11) On October 19, Japan’s core CPI for September was 2.4%, slightly above the 2.3% forecast but down from the previous 2.8%. China’s third-quarter GDP grew by 4.6%, above the 4.5% expected but slightly lower than the previous 4.7%.

12) On October 19, the EU’s MiCA regulations will be implemented on December 30, and Cyprus has suspended CASP applications.

13) On October 19, Dogecoin surged 15% after Elon Musk responded to a question with “D.O.G.E”.

14) On October 19, the UAE’s RAK Digital Assets Oasis (RAK DAO) announced plans to introduce a legal framework for decentralized autonomous organizations (DAOs).

15) On October 20, it was announced that next Wednesday, the Bank of Canada will release its interest rate decision and hold a press conference with Governor Macklem. On Thursday, the Fed will publish its Beige Book on economic conditions. Starting next Sunday, several European countries will begin observing daylight saving time, causing trading hours and the release times of economic data in European financial markets to shift back by one hour compared to summertime.

16) On October 20, Grayscale announced on its X platform that it has opened private placements for 20 token funds to qualified accredited investors. These include AAVE, AVAX, BCHG, GBAT, GRT, TAO, GLNK, MANA, FILG, LTCN, MKR, GLIV, NEAR, GSOL, RENDER, STX, GXLM, SUI, XRP, and ZCSH.

17) On October 20, Chinese quant firm Magic Square released a notice on October 18, stating that due to changing market conditions, future returns will be significantly lower than expected, and they will gradually reduce the investment positions of all hedge products to zero.

18) On October 20, BlackRock and its brokerage partner Securitize are in preliminary talks with major crypto exchanges to use BlackRock’s new BUIDL token as collateral for derivatives trading.

19) On October 20, Ethereum project FWOG CTO accused Solana project Fwog contract creator @deecayz of fraudulently taking $30,000 and moving it to a centralized exchange (CEX).

20) On October 20, Ripple’s Chief Legal Officer stated that XRP’s legal status remains unaffected by the SEC appeal, with Form C to be filed next week.

21) On October 20, Web3 investment firm DNA Fund acquired asset management company Coral Capital Holdings.

22) On October 20, VanEck’s CEO stated that Europe’s crypto ETP market has reached €2 billion, but institutional participation remains low.

23) On October 20, In San Pedro, Argentina, 20,000 people were scammed in a fake USDT investment scheme. Additionally, the official X account of EigenLayer appears to have been hacked, prompting users to exercise caution. A hacker attack also resulted in losses of approximately $51 million for Radiant Capital across Arbitrum and BNB Chain.

24) On October 20, North Korea sent 1,500 special forces troops to Russia to train for combat against Ukraine. Putin announced that BRICS countries will have the opportunity to use digital currencies for investments.

25) On October 20, IntoTheBlock reported that “high-risk” crypto loans on Benqi surged to $55 million, the highest level in two years.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.