FameEX Weekly Market Trend | May 20, 2024

2024-05-20 19:24:35

1. BTC Market Trend

From May 16 to 19, the BTC price swung from $64,663.12 to $67,649.71, a 4.62% range. The following three pieces of news and the speech of Richard Tang are relatively influential in predicting the next trends of the BTC price.

On May 16, on the occasion of the 75th anniversary of establishing diplomatic relations between China and Russia, a joint statement was issued regarding deepening the comprehensive strategic partnership in the new era. Both sides agreed to continuously expand bilateral trade, optimize trade structures, deepen cooperation in service trade, e-commerce, digital economy, and sustainable development fields, and jointly maintain the stability and security of industrial and supply chains.

Crypto researcher @tradetheflow_ posted on his social media platform, stating that in the past six months, the average Fully Diluted Valuation (FDV) of top CEX-listed projects reached $4.2 billion, with some projects exceeding $11 billion. However, over 80% of these projects have experienced continuous decline after listing. He further highlighted how leading CEX platforms exploit the limited access of retail investors to premium early investment opportunities, primarily utilizing listings to offer exit liquidity for insiders.

According to data from the Federal Reserve’s (Fed) official website, as of May 14, the size of the Fed’s balance sheet had fallen to around $7.3 trillion, currently standing at $7.304 trillion, with a cumulative reduction of about $58.2 billion since May.

Chris Rokos’ hedge fund executive, Richard Tang, indicated that the Fed is unlikely to ease monetary policy this year. Inflation trends have become exceptionally difficult to forecast, especially against the backdrop of this year’s presidential election. Currently, the market anticipates two rate cuts by the Fed this year.

During a Bloomberg TV interview on Thursday, Tang stated, “The Fed is unlikely to cut interest rates this year. We are approaching a very significant presidential election, which will indeed influence monetary policy. Therefore, considering all of this, the probability of whether the Fed will cut or raise rates is almost fifty-fifty.” Tang noted that central banks worldwide have become fixated on providing forward guidance, and predicting for monetary policy decision-makers has become extremely perilous. He added that recent history suggests that markets should not rely on economic data to forecast central bank policy moves. Despite Wednesday’s release of US CPI data appearing more moderate, Tang highlighted that the CPI year-over-year growth rate over the past six months remains close to 4.1%, still a distance from the Fed's 2% target.

Additionally, earlier this week, Fed officials were all attempting to delay market expectations for the first rate cut, emphasizing the need to maintain higher borrowing costs for a longer period in light of disappointing Q1 inflation data. Tang also pointed out that regardless of who leads the new government, their policies could potentially lead to inflation. Of particular concern is the uncertainty surrounding the tariff actions the Trump administration may take, which will make it especially difficult for the Fed to strategize for future policy actions.

Previously, American billionaire and Citadel hedge fund founder Ken Griffin stated that neither Trump nor Biden is likely to reduce US federal spending. He mentioned that this is a key obstacle to lowering the US inflation rate. “We are in a new regime,” Tang added. “The traditional correlations of econometric models no longer apply. How inflation is formed, I don’t think anyone really knows.”

From May 20 to May 22, BTC spot daily candlesticks may continue to fluctuate within a narrow range, with the probability of amplitude not exceeding 10% relatively high. It is advised to adopt a wait-and-see approach. For those with low overall positions, there’s no need to cancel all previously placed BTC spot buy and sell orders.

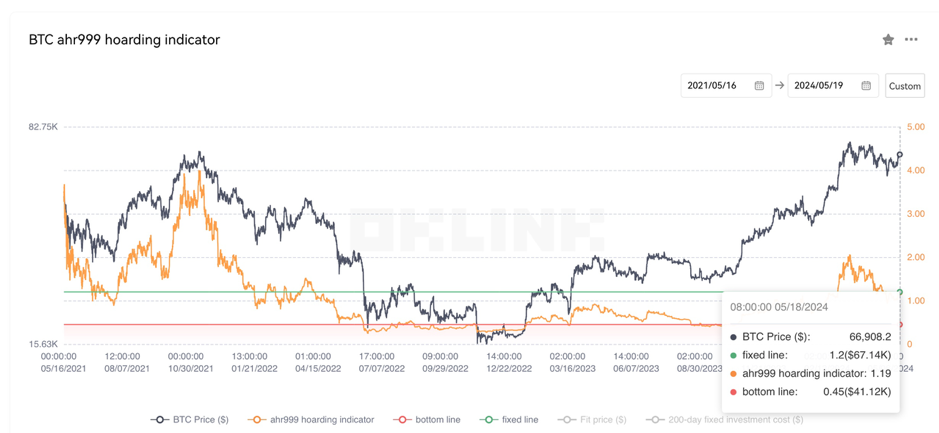

The Bitcoin Ahr999 index of 1.19 is below the DCA level ($67,140) but over the buy-the-dip level ($41,120). Therefore, it may be a good time to put the dollar-cost average into mainstream cryptocurrencies.

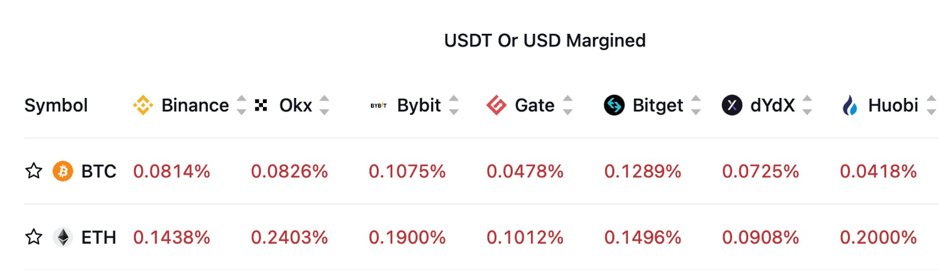

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

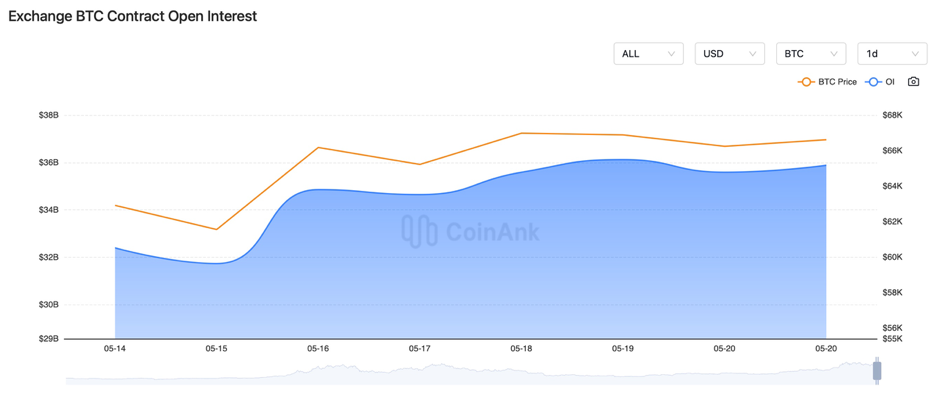

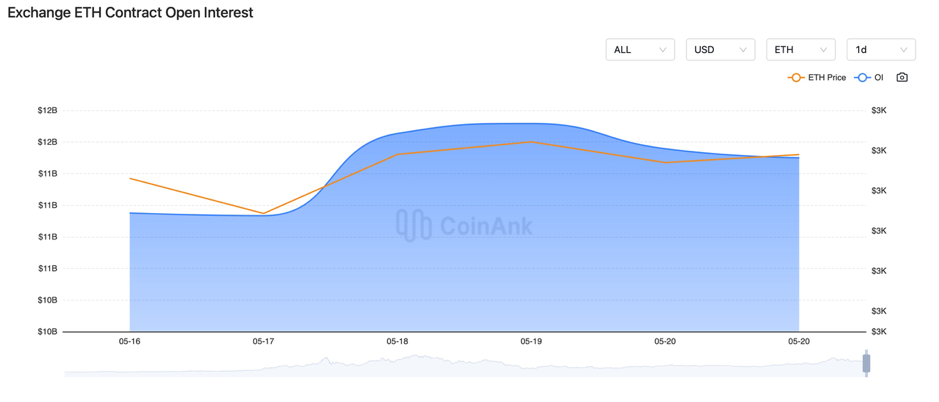

In the recent period, a slow climb has occurred in both BTC contract open interest.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On May 16, Fed’s Kashkari stated that there may be a need to maintain interest rates at their current level for some time to understand the direction of inflation.

2) On May 16, Mastercard teamed up with Standard Chartered Bank to complete a pilot on tokenized deposits.

3) On May 16, Bitcoin Lightning Network payment IBEX Pay announced that all services within the United States would be suspended from May 31, 2024.

4) On May 16, according to the “Fed Echo Chamber”, the Fed may still not cut interest rates before September.

5) On May 16, the Swiss Federal Council planned to implement the Cryptocurrency Asset Reporting Framework (CARF) to increase tax transparency.

6) On May 16, the number of active users on registered cryptocurrency exchanges in South Korea reached 6.45 million, accounting for approximately 10% of the country’s population.

7) On May 17, the Eurozone CPI month-on-month for April was 0.6%, as expected, with a previous value of 0.6%; the Eurozone CPI year-on-year for April, final value was 2.4%, as expected, with a previous value of 2.4%.

8) On May 17, Fed’s Williams expressed pleasure at the slowdown of inflation, but it is not enough to trigger an interest rate cut in the near term. Interest rates should remain high for a longer period.

9) On May 17, the US Senate voted to pass a resolution aimed at overturning SEC cryptocurrency accounting regulations.

10) On May 17, the Securities and Exchange Board of India (SEBI) suggested joint regulation of cryptocurrencies with other institutions in contrast to the country’s central bank’s position.

11) On May 17, Oklahoma passed bills protecting citizens’ rights to self-custody digital assets.

12) On May 17, the US Senate voted to overturn the controversial SEC cryptocurrency accounting regulations.

13) On May 17, the US Treasury Department planned to strengthen anti-money laundering regulations for cryptocurrencies and other illicit finance.

14) On May 18, the SEC’s policy director resigned, signaling that the SEC is expected to maintain a skeptical attitude towards cryptocurrencies.

15) On May 18, PancakeSwap revealed that the highest annual interest rates for altcoins are XCAD, NMT, and FOXY.

16) On May 18, Fed Governor Bowman stated that inflation would remain high for some time, and if inflation stagnates or rebounds, she is willing to support the Fed in restarting rate hikes.

17) On May 18, recent remarks from ECB Governing Council members suggested unanimous support for a rate cut in June.

18) On May 19, the total assets under management of the top 14 ETFs exceeded $3 trillion, but their performance since the beginning of the year has been inferior to Bitcoin spot ETFs.

19) On May 19, according to Bloomberg, donations from the cryptocurrency industry for the 2024 US election reached $94 million, setting a new record.

20) On May 19, it was reported that PYTH, AVAX, ID, and APE are set to experience significant unlocks in the next week.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.