FameEX Weekly Market Trend | February 26, 2024

2024-02-26 18:59:05

1. Market Trend

From Feb. 22 to Feb. 25, the BTC price swung from $50,521.00 to $52,065.78, with a volatility of2.93%. The prior analysis report noted a higher likelihood of BTC following a sideways trend, akin to its pattern near $43,000, based on the current daily chart. Recent BTC trends suggest a greater probability of this scenario over a deep correction, as outlined in the report. Since BTC rose above $50,000 on February 13, it has not fallen below this level once, and strong support from the bulls can be seen near $50,500 (observed from the volume generated near BTC’s price hitting $50,500 and the speed of recovering from the decline), which is very similar to the situation after BTC broke through $40,000; Currently, the BTC’s trend shows characteristics of a wide range box movement ($50,500-$52,500). Hence, short-term traders can leverage this for quick operations, while medium to long-term investors may view $50,500 as a key entry point for trading.

Source: BTCUSDT | Binance Spot

Between Feb. 22 and Feb. 25, the price of ETH/BTC fluctuated between 0.05674 and 0.05896, a 3.91% range. In the previous analysis, it was mentioned that 0.57800 would be the second threshold for adding to holdings. Investors can unconditionally buy in once it reaches this point, and holding for gains will likely be the theme for ETH/BTC in the near future. The recent trend of ETH/BTC has validated the viewpoints in the prior analysis report, with the position addition level reached in recent days and developing along the expected trajectory. Currently, on the daily chart level, it has reached a significant resistance level. If the closing price on the daily chart level can stay above 0.06000, it would be possible to initiate the third addition to ETH/BTC on the following day. There has been a lot of positive news for ETH recently, and many institutions and whales are actively positioning themselves in ETH, indicating promising prospects. Currently, the fundamental trend of ETH/BTC has established a primary uptrend, marked by consistent rises in moving averages and a notable surge in trading volume. Upholding the stance from the prior analysis: hold for potential gains.

Based on overall analysis, currently, BTC is trading in a box pattern, using this phase to digest previous profit-taking and repair various fundamental indicators. Based on BTC’s consolidation, various altcoins in the market have been quite active in recent days (including gaming tokens, AI series, etc.), successively launching and experiencing significant gains, resulting in a decent profit-making effect. As mentioned earlier, BTC’s consolidation phase will be an opportunity for many altcoins to rise, and positioning in high-quality altcoins is the main path to making money during this time. As of the time of writing, there are still many high-quality projects that have not yet started, so there are still opportunities for positioning (such as AXS). After BTC ultimately makes a directional choice (stabilizing above $53,000), funds will gradually converge back to mainstream coins.

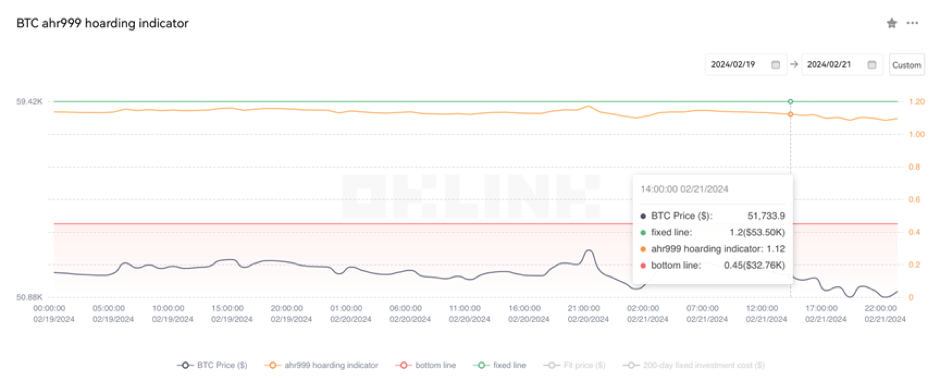

The Bitcoin Ahr999 index of 1.09 is between the buy-the-dip level ($33,050) and the DCA level ($53,980). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

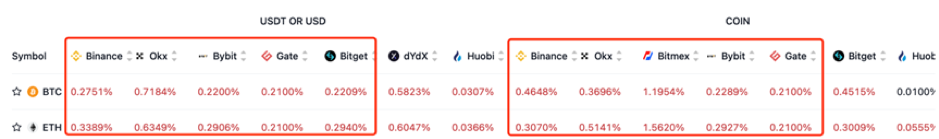

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

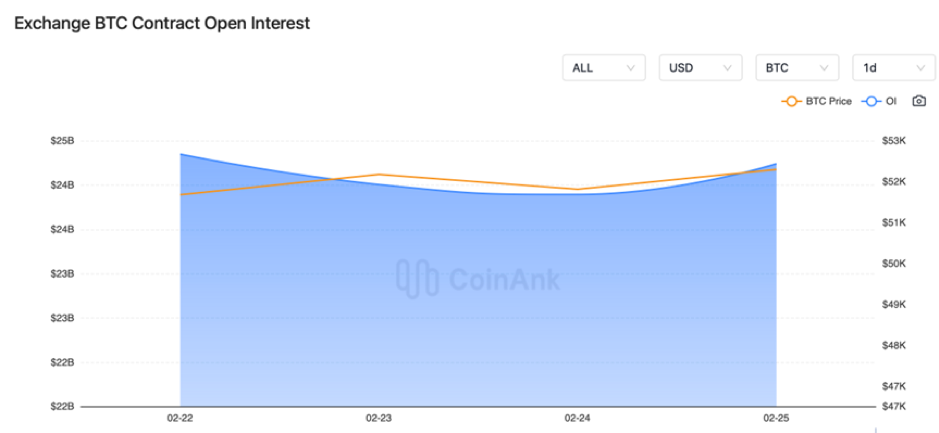

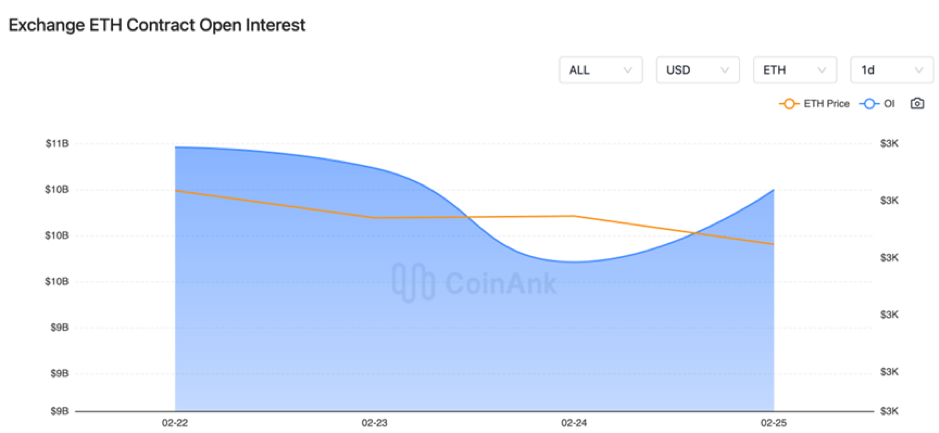

In the recent period, both BTC and ETH contract open interest have experienced brief declines, followed by a gradual recovery trend.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On February 22, a16z invested $100 million in the liquidity restaking protocol EigenLayer.

2) On February 22, Nigeria implemented a ban on cryptocurrency exchanges such as Binance, OctaFX, and Coinbase.

3) As of February 22, 19 companies have submitted applications for virtual currency asset trading platform licenses to the Hong Kong Securities and Futures Commission.

4) On February 23, data showed that over the past three weeks, 700,000 BTC were transferred to miners’ dedicated OTC platforms.

5) On February 23, the Bitcoin exchange rate reached historic highs in fourteen countries, including Japan and Argentina.

6) On February 23, NVIDIA’s (NVDA.O) pre-market stock price surpassed $800.

7) On February 24, the CEO of Grayscale expressed openness to merger-related opportunities.

8) On February 24, the guilty plea agreement for Binance to pay a $4.3 billion fine was approved by a US judge.

9) On February 25, the US Department of Energy and Information Management suspended its investigation into Bitcoin miners.

10) On February 26, cryptocurrency projects have raised over $90 billion in total funding since 2017.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.