FameEX Weekly Market Trend | September 25, 2023

2023-09-25 18:47:15

1. Market Trend

From Sep. 21 to Sep. 24, BTC traded between $26,377.70 and $27,300.00, with a volatility of 3.50%. In the previous analysis, the upward momentum and trading volume near $27,000 were crucial for determining entry and exit points. Historically, when BTC dropped below $27,000, it quickly surged with higher volume. On Sep. 21 at 4:00 PM, BTC dropped below $27,000, closing at $26,926. Failing to recover above $27,000, with low trading volume, it was wise to exit and observe. BTC continued declining, steadying around $26,500 from the 22nd to the 24th, with reduced trading and no rebound indications. The price stayed sideways for two days without signs of a rebound, suggesting a downbeat near-term outlook. Across timeframes (1-hour, 2-hour, 4-hour, and daily), charts broke key MA positions and turned bearish, targeting $26,000. Given the overall market uncertainty, how the market evolves around the previous low of approximately $25,000 could be a crucial turning point for future trends.

Source: BTCUSDT | Binance Spot

Between September 21 and September 24, the price of ETH/BTC fluctuated within a range of 0.05940-0.06022, showing a 1.38% fluctuation. From a 1-hour perspective, ETH/BTC has not experienced a strong rebound since breaking the new low. The overall market remained somewhat bearish. The change was evident in the upward breakthrough of the 25-day MA, hovering around 0.6000, ready to seize opportunities. The MA also showed an upward-turning trend with an increasing trading volume. The downward trend of ETH/BTC is probably approaching its end. At this point, you can apply the MA strategy mentioned in previous analysis reports (specific operational details can be found in previous reports).

Based on the overall analysis, the overall market situation has once again become perplexing. BTC has fallen below $26,500, and the critical level of $26,000 is also at risk. The area around $25,000 marks the low point of the previous market cycle. This might be either a second test of the bottom or a continuation of the decline. In recent days, trading volume has notably declined compared to earlier periods, and there is a decrease in the number of traders, with more adopting a wait-and-see approach. From the perspective of the current market’s profit potential, entering at this point may not be a wise choice. “Losses in the midst of fluctuations” may be the prevailing theme in the short term. Therefore, it is advisable for everyone to exit and observe, with a particular focus on changes around $25,500 and $25,000. Wait for the right opportunity to enter and participate in significant market movements.

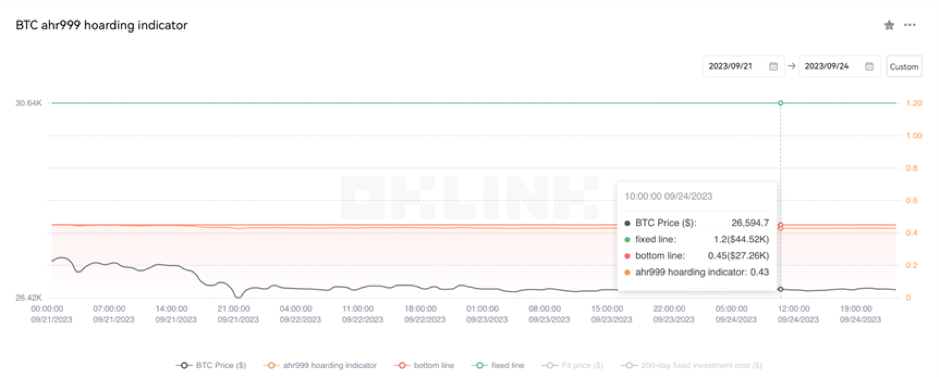

The Bitcoin Ahr999 index of 0.43 is below the buy-the-dip level ($27,260). Therefore, it is advised to purchase popular coins in the spot market at low points.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

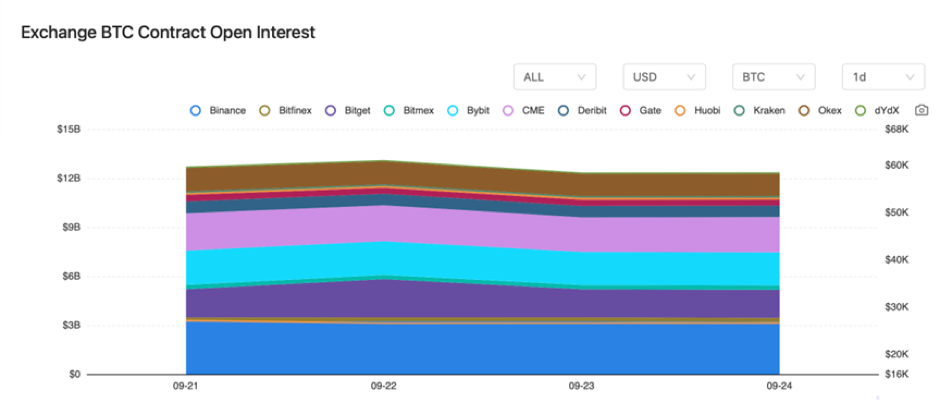

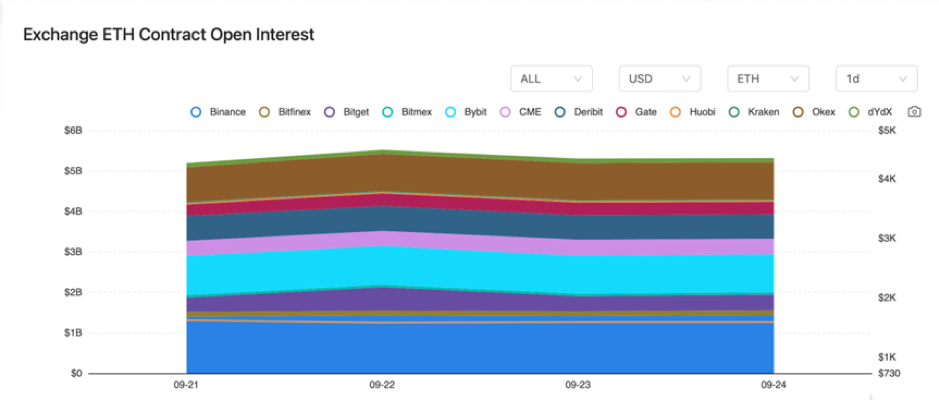

From September 21 to September 22, there were slight climbs in the BTC and ETH contract open interest from major exchanges, followed by a decline from the 22nd to the 24th, returning to levels seen on September 21.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On September 21, Ripple CEO stated that legal expenses for Ripple reached $200 million.

2) On September 21, Binance Labs announced 12 incubation projects for its sixth season.

3) On September 22, Bybit would suspend its operations in the UK next month.

4) On September 22, Tether’s CTO declared that Tether’s new global strategy will be fully implemented by 2024.

5) On September 23, the Fed would reduce its workforce by approximately 300 employees by the end of 2023.

6) On September 23, Coinbase’s CEO stated that artificial intelligence should not be subject to regulation.

7) On September 23, according to the CEO of EOS Network Foundation, the EOS ecosystem urgently needs funding, and the community must start building from scratch.

8) On September 24, long-term holders possessed 13.44 million BTC, accounting for 69% of the circulating supply.

9) On September 24, based on the research, Ethereum is the most popular cryptocurrency.

10) On September 24, USDC circulation decreased by $400 million in the past week.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.