FameEX Weekly Market Trend | July 27, 2023

2023-07-27 18:04:20

1. Market Trend

Between July 24 and July 26, the BTC price fluctuated between $28,861.9 and $30,350.0, with a volatility of 5.16%. As mentioned before, the BTC price has repeatedly touched $29,500 (8 times), the lower boundary of the recent price range movement ($29,500-$30,500). Thus, $29,500 is the crucial near-term turning point. On July 24 at 5:00 pm, BTC dropped significantly below $29,500, reaching a low of $28,861 in the evening. After hitting a new low, BTC’s trend stabilized and hinted at a potential recovery toward $29,500. However, upon closer observation of higher timeframes such as 2H and 4H, the sharp decline caused significant slopes in the candlesticks, distancing them from the 7-day moving average, necessitating correction. In addition, frequent upper shadows in the candlesticks (4H) and lack of volume during upward movements indicate that BTC is still relatively weak, and it is likely that the overall market will continue to develop in its current state. The old price range is broken, with $29,500 now acting as resistance for BTC’s upward movement. Long positions will be available if BTC breaks and stabilizes above $29,500. Otherwise, a bearish trend is likely to persist.

Source: BTCUSDT | Binance Spot

Between July 24 and July 27, the price of ETH/BTC fluctuated within a range of 0.06266-0.06386, showing a 1.91% fluctuation. From the 1-hour chart, the ETH/BTC pair displayed relatively strong momentum. While BTC is choosing to decline, ETH/BTC is moving against the trend and rising. Currently, on the 1-hour, 4-hour, and daily charts, all levels of moving averages are beginning to turn upwards. Thus, it’s a suitable time to adopt the moving average strategy. When the price retraces to the 7-day moving average (on timeframes of 1-hour or above), it is advised to open appropriate positions and set the stop-loss point just below the moving average (breaking below without recovery).

Based on overall analysis, the market has made an initial decision to break below the lower boundary of the price range and search for suitable support at lower levels. Despite this decision, there is still a lack of significant funds and trading volume, resulting in a weak rebound after the decline. There are not many bottom-fishing funds, which typically leads to bearish market sentiment. In the next few days, It is crucial to pay attention to the turning point as BTC surpasses and maintains a stable position above $29,500. Apart from that, maintaining a bearish outlook should be the dominant logic.

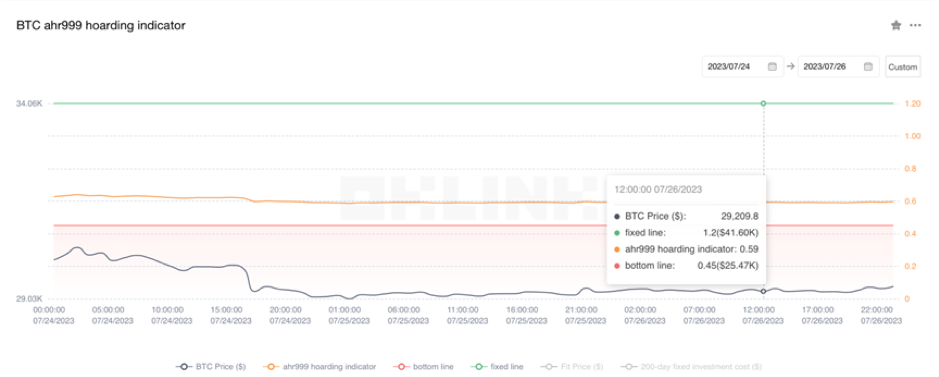

The Bitcoin Ahr999 index of 0.59 is above the buy-the-dip level ($25,470) but below the DCA level ($41,600). It is viable to purchase popular coins through DCA.

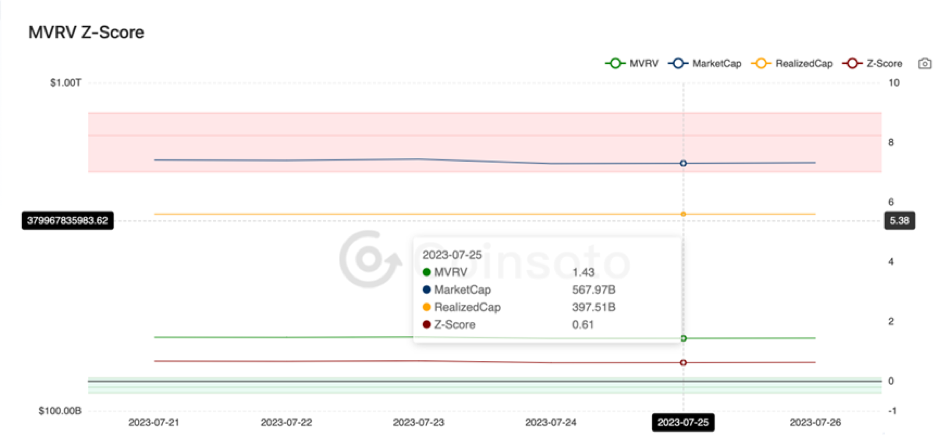

From the perspective of MVRV Z-Score, the value is 0.61. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.36-0.06).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

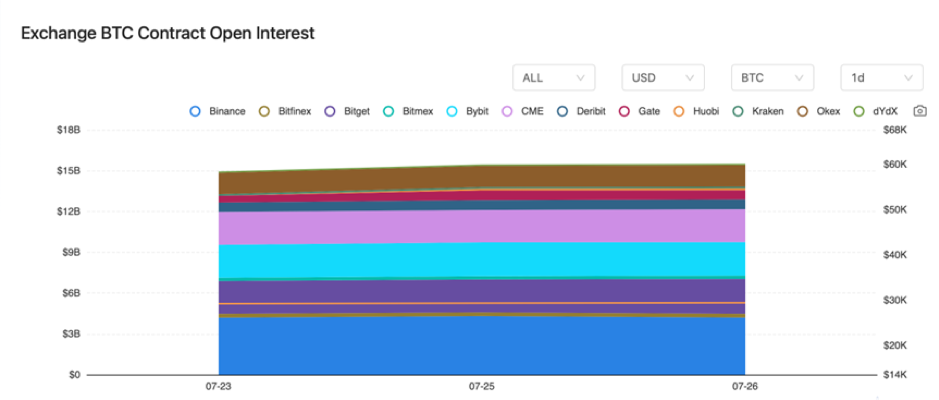

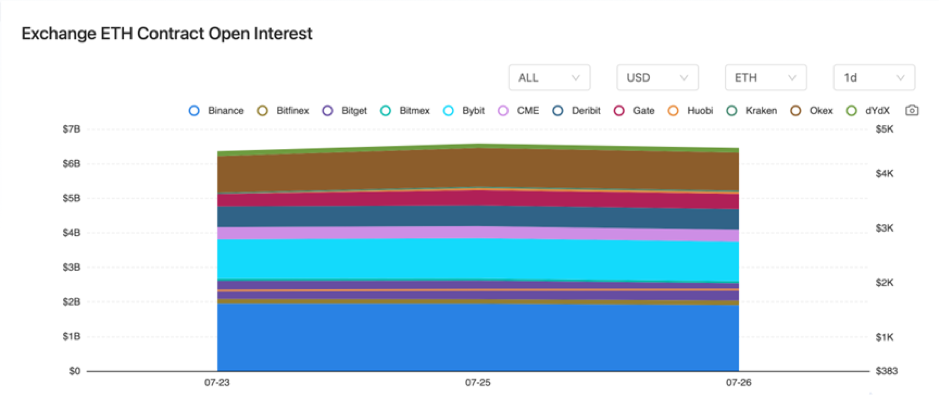

Between July 24 and July 26, the contract open interest of BTC and ETH almost remained unchanged from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On July 24, the Wordcoin protocol was launched on the OP mainnet.

2) On July 24, long-term holders of Bitcoin accumulated 14.52 million BTC, reaching a historical high.

3) On July 24, the Chinese Embassy in Japan issued a warning regarding self-proclaimed virtual currency investment gurus.

4) On July 25, the Prime Minister of Japan stated that Web3 is a part of the new capitalism.

5) On July 25, the official logo of Twitter was changed to “X”, and “Tweet” was renamed to “Xeet”.

6) On July 25, Japan hinted at introducing more policies to promote Web3.

7) On July 25, CZ (Changpeng Zhao) announced that Binance will begin providing comprehensive services on a new platform in Japan starting in August.

8) On July 26, Google Play Store announced that it will launch blockchain-based content policies.

9) On July 26, Binance withdrew its application for a cryptocurrency license in Germany.

10) On July 26, the joint investigation team for virtual asset crimes was officially established in South Korea.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.