Around $286 Billion Was Poured Into Money Market Funds in Two Weeks Due to the Banking Crisis Report

2023-03-27 15:07:40

Due to the financial crisis, a lot of investors have changed the investments in their portfolios during the last two weeks, pumping billions of dollars into US money market funds.

Source: www.marketwatch.com

According to statistics from Emerging Portfolio Fund Research (EPFR) acquired by the Financial Times, the financial crisis has caused many investors to shift their portfolio holdings over the last two weeks, pouring more than $286 billion into US money market funds.

In the data from, Goldman Sachs, JPMorgan Chase, and Fidelity shows that these banks are the biggest beneficiaries of the recent inflow of capital into U.S. money market funds. According to the Financial Times, JPMorgan's funds received over $46 billion in inflows, while Fidelity received close to $37 billion. Goldman Sachs' money funds received $52 billion, a 13% increase. Since the start of the Covid-19 outbreaks, the amount of inflows has increased more than any other time in a month.

Money market funds are a favorite choice for investors in tumultuous times since they frequently offer high liquidity and minimal risk. Since the U.S. Federal Reserve keeps boosting interest rates to combat inflation, these funds are currently providing their greatest returns in years.

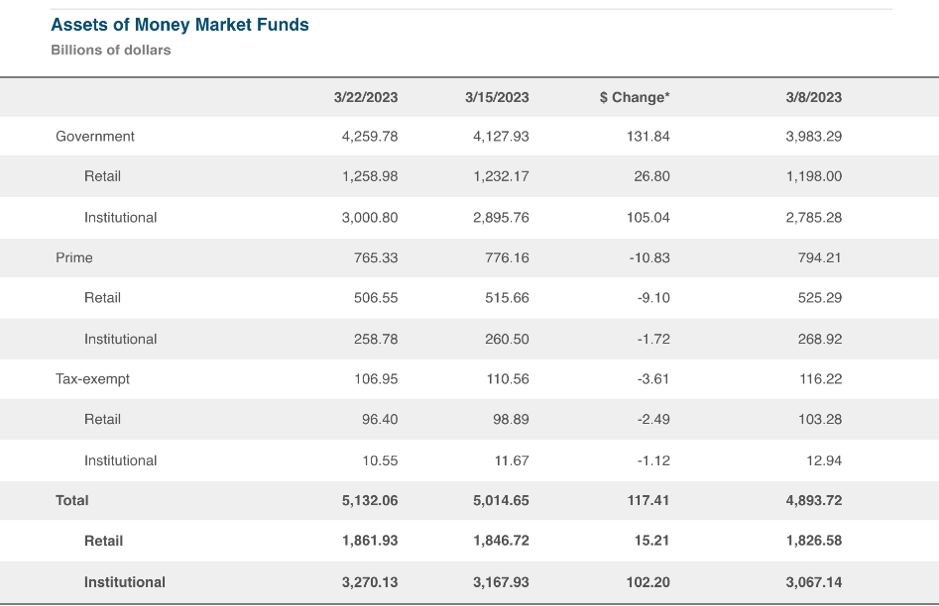

Assets of money market funds. Investment Company Institute as a source

A study from the Investment Business Institute claims that, the total value of money market fund assets climbed by $117.42 billion in the seven days leading up to March 22 to reach $5.13 trillion. Government money market funds had a rise of $131.84 billion, while prime funds saw a decline of $10.83 billion. Money market funds that are not taxed decreased by $3.61 billion.

Unstable Coins: Hazards of Depegging, Bank Runs, and More

Money market fund inflows are prompted by worries about the stability of the financial system as U.S. and European banks struggle with liquidity shortages as a result of tighter monetary policy.

Due to a rise in the cost of insurance against its possible default risk, Deutsche Bank's shares fell on March 24. According to Reuters, which quoted data from S&P Global Market Intelligence, the German bank's five-year credit default swaps, often known as CDS, increased 19 basis points (bps) from the previous day to close at 222 bps.

Although insurance on failure for financial services companies Charles Schwab and Capital One skyrocketed this week, with the most recent seeing credit default swaps climb over 80% to 103 bps as of March 20, worry still hangs over smaller banks in the United States.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.